by Cullen Roche

On March 3rd I asked “Who Will Buy The Bonds?” I wrote this piece in response to a letter by Bill Gross in which he asked:

“The Treasury issues bonds and the Fed buys them. What could be simpler, and who’s to worry? This Sammy Scheme as I’ve described it in recentOutlooks is as foolproof as Ponzi and Madoff until… until… well, until it isn’t. Because like at the end of a typical chain letter, the legitimate corollary question is – Who will buy Treasuries when the Fed doesn’t?

…I don’t know. Reserve surplus sovereigns are likely good for their standard $500 billion annually but the banks are now making loans instead of buying Treasuries, and bond funds are not receiving generous inflows like they were as late as November of 2010. Who’s left?”

I responded by explaining that the bond auctions will serve as their usual reserve drain. This meant that Treasury and Fed would continue to coordinate bond issuance in accordance with reserves in the system. And the Primary Dealers would execute the reserve drain once QE2 ended. Just like they always do. The auctions would move along just as they always have and the mysterious (non-existent) bond vigilantes would appear to be in a deep slumber again.

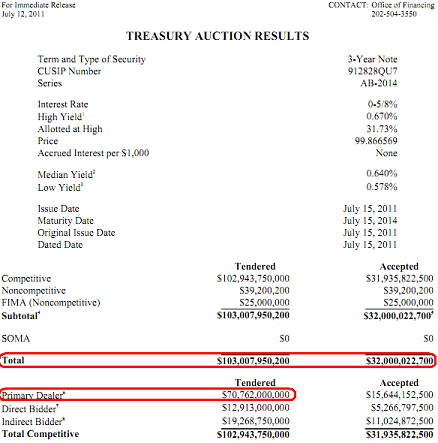

Well, today we got the first bond auction since the end of QE2. And what happened? It was as strong as ever. The bid to cover came in at 3.22 with the Primary Dealers submitting bids for 2X the entire auction. Of course, I pointed this same phenomenon out several times before and during QE2, but you still heard the same rumblings today from various skeptics who said that the auction was only strong because of QE3 rumors. Nonsense. The auction was strong for the same reason they always are – the reserves are tracked in the system and hoovered up in accordance with the scheme that the mainstream media calls the “funding of the USA”. Of course, funding is not the purpose of US bond issuance, but explaining a boring old reserve drain wouldn’t make for good TV or political theater.

See the original article >>

No comments:

Post a Comment