by Cullen Roche

The Euro has been particularly kind to one nation in particular. Germany. While many Germans have been quick to blame the periphery for the problems, the truth is that the core played a vital role in helping to lend to the profligate periphery. It’s because of this interconnectedness via the banking system that the core is hesitant to allow any defaults on the periphery. The ripple effect in the core could be extremely damaging. So, not only does the core have an incentive to stop any potential banking crisis via periphery banking crises, but they’ve also benefited enormously from the construction of the Euro. Germany, for instance, is experiencing a 19 year low in unemployment and has continued to see strong relative economic growth during the crisis.

Germany’s stock market has been no exception to these benefits. And in a recent research piece Credit Suisse cited 4 reasons why this outperformance is likely to continue:

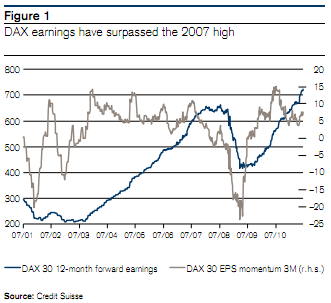

“This week, we feature Germany, which we have been recommending to overweight over the past few months and which we continued to do. We have four main reasons for being positive on Germany. First, we think German companies are likely to be able to pass on wage increases to their customers, and capacity utilization implies scope for price increases. Second, robust earnings growth and waning risk aversion opens scope for multiple expansion. Third, its has a high degree of cyclicality and export orientation, as the country is benefiting from large exposure to exports and emerging markets, as well as from a competitive level of the EUR. Germany strongly profits from global demand as its export share amounts to around 40% of GDP. And fourth, undemanding valuation in terms of traditional valuation multiples, especially in terms of market-implied valuations. If P/E ratios for the DAX were to revert to their historic average of 15 times 12-month forward earnings, the DAX would quote above 10,000 on current earnings, which are now above the 2007 highs (see Figure 1). We like Adidas, Allianz, BASF, BMW, Daimler, Deutsche Post, Fresenius Medical Care, Henkel pref., Infineon, SAP, Siemens and Volkswagen.”

No comments:

Post a Comment