The Dow Jones FXCM Dollar Index (ticker: USDollar) continues to rise early in the European session as euro weakness continues to dominate proceedings as contagion risks grips the market. The Eurogroup meeting later today is going to be closely watched by market participants, the officials are under mounting pressure to soothe market fears that the EU debt crisis can be controlled. So far, however, comments by officials have fallen on deaf ears and the flight to safety has helped lift the dollar index back above 9700.

As Italy, the EMU’s third largest economy, moves to center stage and concerns mount about not only its solvency but also its governments ability to work together to tackle its deficit; differences between the PM and FinMin are very public knowledge. With the EMU debt crisis back under the spotlight and the ability of the ECB/EU/IMF to act quickly to quell mounting problems severely mitigated due to their current commitments to Greece, Portugal and Ireland.

Coupled by the fact that Italy is simply too large an economy to bailout, we see the potential for a serious topside breakout move in the dollar index with the euro on the brink of collapsing back toward the 1.3500 region. We agree with the analysis of a friend and colleague from investment site Seeking Alpha who said that market moves look ominously “like moves we saw during the financial crisis, basically panic”.

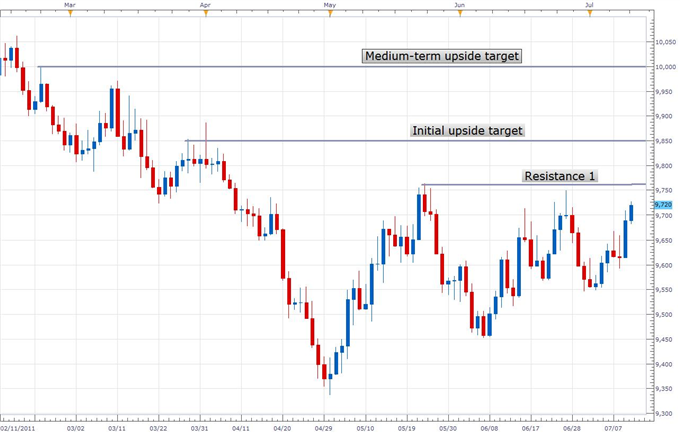

Our outlook for the dollar index is therefore highly constructive, assuming it can break out of its recent trend of posting lower tops with some weak resistance at 9750, but the real resistance level by the May highs at 9770. We forecast that the index will break through these with relative ease, assuming the market doesn’t reverse, which will then open our initial upside target and medium-term upside target as potentials.

No comments:

Post a Comment