On June 30, 2011, the Federal Reserve’s second round of Treasury bond buying, informally known as quantitative easing, or QE2 ended. With a QE3 program unlikely to occur, this marks the completion of an eight-month window in which the Federal Reserve purchased $600 billion worth of assets in an attempt to add liquidity to the market, and thus, stimulate the U.S. economy.

After two rounds of bond buying, public confidence in the future of the economy has weakened and the effectiveness of QE2 is being questioned. Meanwhile, as pessimism continues to grow among Americans over concerns of a double dip, if not continuation of the recession into perhaps a depression, many are left to wonder if the Fed has any monetary tools remaining to spark the economy, after devaluing the U.S. Dollar so drastically. So, the question arises: was quantitative easing worth it?

In November 2010, the Fed announced the need to commence a second round of bond-buying to lower long term interest rates to boost the economy. With $600 billion stated to be purchased, the primary goals of QE2 were: decrease the unemployment rate; and ensure that the inflation rate remains close to 2.0 percent. Eight months later, although QE2 contributed to a rebound in the equities market, on a nominal basis, and boosted inflationary pressures slightly, the long-term outlook for the U.S. economy remains bleak as the Federal Reserve still faces low price pressures and a stubbornly high unemployment rate.

Some have argued that the United States has benefited from a weaker U.S. dollar, with many countries, including China, noting that they are being affected by Dollar weakness, seeing a decline in competitiveness; a weaker dollar makes U.S. goods more attractive to foreign investors. In fact, since late August, when Federal Reserve Chairman Ben Bernanke announced the possibility of a second round of monetary easing, the U.S. Dollar has been down against every other major currency, falling the most against the Swiss Franc (-20.93%), the Australian Dollar ( -17.67%) and the New Zealand Dollar (-16.33%).

While most signals pointing to an unsuccessful implementation of the $600 billion bond purchases, there are indications that QE2 met several of its objectives. The Fed maintained low interest rates on Treasuries. Commodities and equities were well supported by the program. All the major indexes enjoyed formidable gains dating from the fourth quarter of 2010 to the second quarter of 2011.

At its most recent conference on June 22, 2011, the Fed announced that its bond-buying program will not continue. However, the Fed expects to maintain its interest rate at 0.25 percent for “an extended period,” which Chairman Bernanke has noted would be for atleast two or three more meetings.

So, what are the implications from a trading perspective?

Prepared by Jamie Saettele, CMT

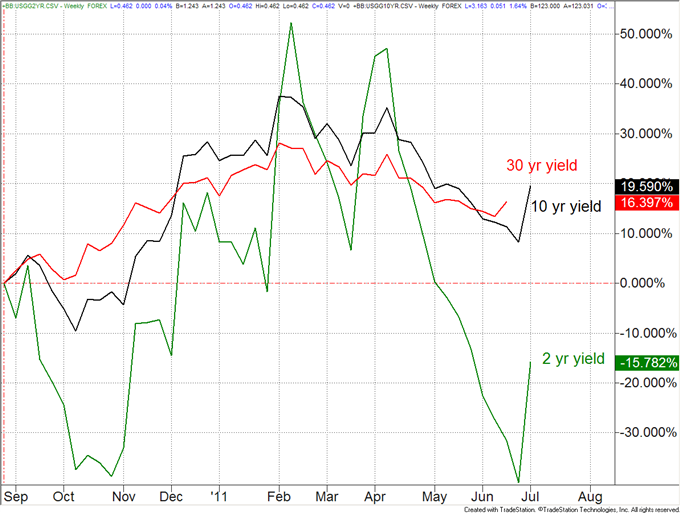

2 yr Treasury yields ended the quarter down about 16% (from .5481 to .4616) from when the Fed announced the bond purchasing program in late August of 2010. Just last week the yield on 2 yr Treasuries was down 40% (at .3290). However, in February, 2 yr yields were up over 50% from the time of the bond purchasing announcement. As such, hailing the Fed’s actions as the reason for the decline in 2 yr yields is dubious.

If the Fed’s program exerted so much control over short term credit, then why didn’t yields consistently decline throughout the period of bond purchases? The bottom line is that 2 yr yields have been under pressure since April (which is when the Yen crosses topped…not a coincidence) but the sharp turn from last week’s low gives scope a double bottom with the October low. If 2 yr yields continue higher, then look to the USDJPY as a way of expressing your opinion (next chart). By the way, 10 yr and 30 yr treasury yields increased roughly 16% and 20% on a net basis. In general, longer dated maturities are less affected by Fed policy and more indicative of inflation expectations.

Prepared by Jamie Saettele, CMT

The relationship between the USDJPY and 2 year Treasury-JGB differential is clear. If the interest rate differential has found a low (triple bottom), then the USDJPY is most likely headed higher as well.

No comments:

Post a Comment