by Cullen Roche

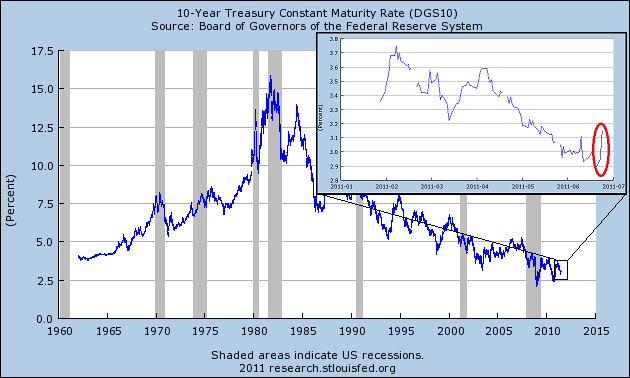

The “surge” in yields this week has many pointing to the end of QE2 as the beginning of the awakening of the bond vigilantes or even the beginning of the collapse of the mythical “bond bubble”. But I went to find this “surge” in yields or “collapse” in the bond market and I had to pull out the trusty magnifying glass again. As you can see below, Treasury yields are surging so much that you have to magnify the move by 10X just to see it on a long-term chart.

More hilarious is the fact that yields aren’t surging due to some bond vigilantes or fears that we are Greece as some fret over the debt ceiling. Yields are surging at the same time equities surge, the risk on trade re-emerges and investors realize that the end of QE2 doesn’t mean the end of the world (most hyperinflationists still have no idea why this is even hilarious).

Just one week ago I said this was no time to panic about Greece, debt ceilings or even the macro picture (yet):

“Personally, I don’t think we need to panic just yet. The China slow-down is far from overshooting to the downside and the Europeans simply can’t afford to let the situation spiral out of control. There is too much to lose. The European politicians have invested too much time and money into this Euro project to allow it to just crumble now. China is a much bigger question mark. Their economy is a black box of central planning and irrational government intervention. One thing is certain – inflation almost always resolves itself in the form of recession.

The question now is how deep will the Chinese economy slide and how much will it hurt US corporations? I think buy and hold investors are silly to wait around and find out. In the meantime, I think the markets look more attractive than they did in May when I said we should all be hedging risk and/or selling.

…So, while I was bearish a few weeks ago I have moved towards a more bullish posture now. So, just to be clear, I am not long-term bullish, but I am short-term bullish.”

Investors were overreacting to all the bad news and becoming excessively negative. This week’s very tiny move in yields is not a sign of the end of days. It’s just a sign that too many big ____ swingin’ bond traders got caught flat footed. So put that magnifying glass away and wipe off your forehead. This is as much a non-event as the end of QE2.

No comments:

Post a Comment