by

Ok, it makes some sense allegorically that the Euro or British Pound may pull back against the US Dollar if there is any strength associated with the greenback from US austerity. These currencies and their representative countries are in some deep doodoo. But the Swiss Franc, Australian Dollar or Canadian Dollar? The Swiss Franc is a bastion of strength, and Australia and Canada are the only resource rich countries that have their act together. So why are these currencies not just going straight up bucking the trend? Let’s take a look at the charts.

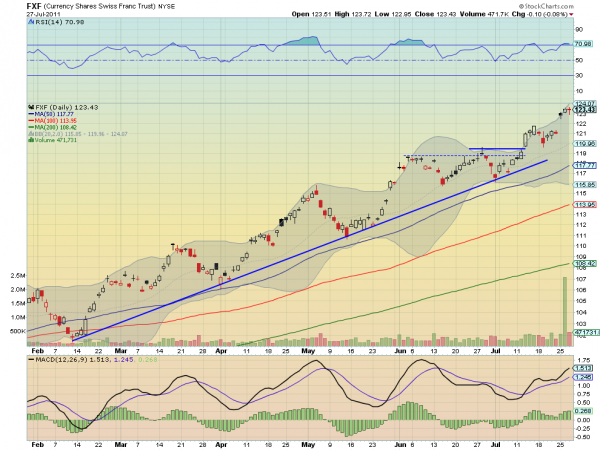

The Currency Shares Swiss Franc Trust, $FXF, is not really in a bad way. It has gapped higher and then paused holding the gap. But with the doji Wednesday and a Relative Strength Index (RSI) starting to roll and over 70 some are talking about a sell off to come. To that I say be ready to buy. This chart looks like it should, nothing but up. I am not calling for the gap at 121 to be filled but it is good support and if it does consider it a gift.

The Currency Shares Australian Dollar Trust, $FXA, has also gapped higher but printed a much more bearish Solid Black Candle on Wednesday. Many would look at that as a sign to short it back to the gap at 110 or 109 lower, but again this would be a gift. This country does not allow anyone to live in the middle because there are so many natural resources there. If it pulls back that is an excellent opportunity to enter at a lower price.

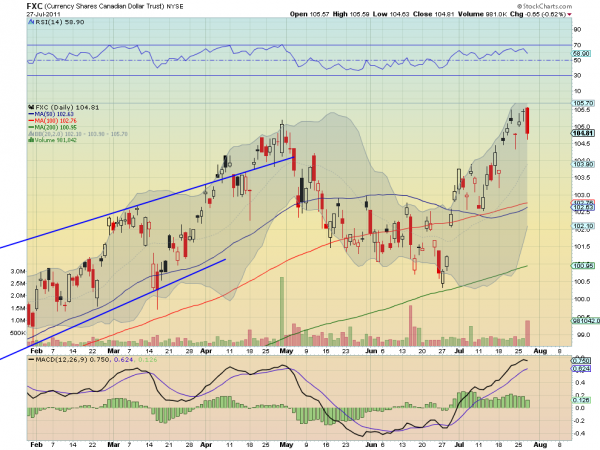

The Currency Shares Canadian Dollar Trust, $FXC, had a major pullback Wednesday confirming the Hanging Man candle From Tuesday. Canada is a major trading partner with the US so maybe this has some short term merit, but seriously have you been to Canada? They have Oil there, and there are allowed to drill for it. They have minerals there too. They will be a winner in the long run and their currency will benefit. Use this pullback as an entry. The technicals say it is in the support zone from 104.30 through 105. It may pullback to 104 below that.

No comments:

Post a Comment