By Data Diary

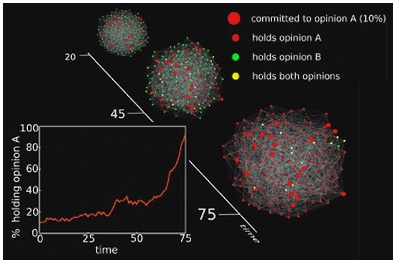

Apparently it only takes 10% of the population to be true believers for the rest of us lemmings to follow suit. (From the Rensellear Institute via History Squared – please note that the research was funded by the Armed Services).

This really does explain a lot. For example, ever wondered how bell-bottoms took over the world? (Though what else would you wear with lamb-chop sideburns.)

Part of the fun of investing is trying to discern the next fashion. The real challenge is being able to translate that view into an attractive risk/reward investment. Too often it seems I get caught looking the wrong way.

For example, back in May, we noted the dark mutterings of a learned few about the US debt ceiling debate and suggested that there was a fair degree of complacency about the process to its resolution (“Chicken Little says the ceiling is fine”). While the note touched on the risk to the US dollar, the conclusion focussed on US Treasuries. Looking back across the two months, the clear winning strategy was to short the US$ against ‘real’ currencies and gold. Treasuries remain caught in swirling cross-currents that are just too difficult to untangle.

So what are the likely trends from here?

As the ‘sell USD’ meme has gone mainstream, the risk/reward probably favours a counter-trend move. Certainly, ‘safe haven’ sentiment is at extremes (here), capital flows are becoming concentrated in fewer stocks (here andhere), and the climbing interest in protecting the downside even as volatility remains subdued (here), all suggest that the weak side is one where the USD rallies hard.

On the assumption then that the market is vulnerable to a USD rally – whether it is the result of a ‘resolution’ or not – what are the trades to consider?

1) Short gold – When I look at the relative underperformance of the gold miners versus the metal, I get the feeling that the ‘alternative money’ is due for a nasty sell-off. Note that the gold miners (HUI – blue line) have failed to make a new high while gold (black line) has pushed on through. This view is number 1 for good reason.

2) Short ‘safe haven’ currencies – we’ve been positive on the CHF since the start of the year (“Trends you can trust“), but with the most recent move it has got just plain ridiculous. While the Swiss central bank may have given up fighting the trend, the current mood leaves USDCHF particularly vulnerable to a sharp correction.

3) Neutral Risk assets – If we take the defensive posturing of money managers as a guide, the argument could be made that there are willing buyers for risk assets (equities and/or lower grade bonds) on resolution of the debt ceiling. While I’m not a buyer down the risk curve from a longer run valuation perspective, it’s unclear to me as to which way these asset classes can run in the shorter term.

4) Neutral Commodities – On the face of it, a stronger USD should hang heavily on the commodity sector. Still, commodities are more inclined to follow the breezes coming out of China, so the sector may not be as susceptible to movements in the big dollar.

No comments:

Post a Comment