by The Investment Insight

THE current financial climate is making it harder to decipher where investors are going to find returns. The rates on holding cash are low, bond yields in general have narrowed substantially and there is much uncertainty on the outlook for the stock market. In addition, with macro risks on our minds and the sovereign debt crisis raising concerns, risk aversion is on the rise. In this environment, investing in something tangible that could provide a potentially uncorrelated return is attractive. Nevertheless, there has been a vast difference in returns from various investments in this market. Therefore, it will pay to be particular.

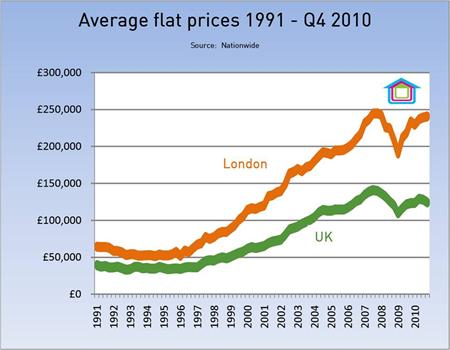

There has been a stark divergence of fortunes between property prices inside and outside of London. Location within or access to the city is a price-setter. Fundamentally, prime assets in attractive sectors should see a level of demand providing a floor on prices. Foreign investors have been quoted as spending £3.7bn per annum for London residences, due to the inviting exchange rate, national ties, as well as in some case the greater political stability that our city can offer. The emergence of an appetite for second homes has created demand in another segment of property investing, where the right location will again be crucial.

Students are another opportunity. Regional student housing is the UK’s best performing sector with around a 15 per cent ROI last year thanks to a shortage of suitable one-bed apartments. Broadly speaking, this is a “buy-to-let” approach. Rental rates are at all-time highs and the short-let market is booming. It is predicted that for the Olympics, rates will increase six-fold.

Therefore, depending on your strategy, timing may also be crucial. To play the school or student market, the run up to September is a key window of opportunity. The challenge is in finding the investments that fit your aspirations, and putting your plan into action at the right time. In a desired area, properties can attract multiple buyers, making this task tougher.

Nevertheless, with inflation one of the biggest threats to the market currently, implementing the right strategy and picking the right property will help provide some protection.

No comments:

Post a Comment