by Cullen Roche

This data from La Caixa will help put the magnitude of the “recovery” into perspective. Clearly, there’s something bigger going on underneath the surface than just a weak recovery. At some point, investors have to begin recognizing that this has never really been a recovery at all and has instead been one long balance sheet recession papered over by government spending (via La Caixa):

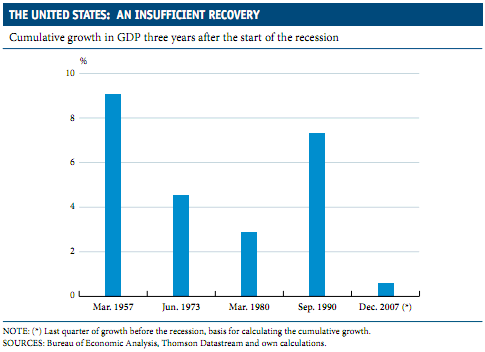

“The US economy is going through its most problematic recovery since 1945. The growth forecast for gross domestic product (GDP) for the whole of 2011 is a little above 2.5%, clearly below what was expected in April and utterly insufficient for significant improvement to be seen in the labour and housing market. The reason for this slowdown in activity is partly due to temporary factors such as rising oil prices and the interruption of supply chains in industry because of Japan’s earthquake. Now that oil is likely to fall in price and Japan to regain its industrial rhythm, activity should be expected to improve its performance somewhat during the second half of year.

However, the weakness of the recovery is not only due to temporary factors. Proof of this is the fact that the US economy has taken three years to regain its pre-recession level. GDP for the first quarter was 0.6% above the level of October-December 2007, the last quarter of positive growth prior to the recession. This cumulative growth three years after the start of the recession is higher than the rates of Western Europe and Japan but far behind the rate in the United States in the four previous recessions since the end of the

Second World War. The most comparable case is the 1982 recession, when unemployment also exceeded 10% but, nevertheless, the strength of the recovery meant that the cumulative growth three years after the start of the recession was 2.9%, much higher than today’s figure.”

See the original article >>

No comments:

Post a Comment