by

Last week’s review of the macro market indicators looked for the move higher in Gold and Crude Oil to continue. The US Dollar Index and US Treasuries conversely are set up to move lower, with a chance of Treasuries just running in place. The Shanghai Composite and Emerging Markets look as though they may test the top of their consolidation ranges. Volatility appears to remain muted and allow for the Equity Indexes SPY, IWM and QQQ to continue to test higher and perhaps break their consolidation ranges, with the QQQ already making a new high.

The week began with Gold gapping higher and rising through the week while Crude Oil fell modestly. The US Dollar Index consolidated in a lower range while US Treasuries remained stable until a big move Friday. The Shanghai Composite fell Monday and then consolidated while Emerging Markets remained in their range. The Volatility Index climbed slowly all week finishing at its highs just at the top of the range pushing Equity Indexes SPY, IWM and QQQ lower on the week and back towards the middle of their ranges. What does this mean for the coming week? Let’s look at some charts.

As always you can see details of individual charts and more on my StockTwits feed and on chartly.)

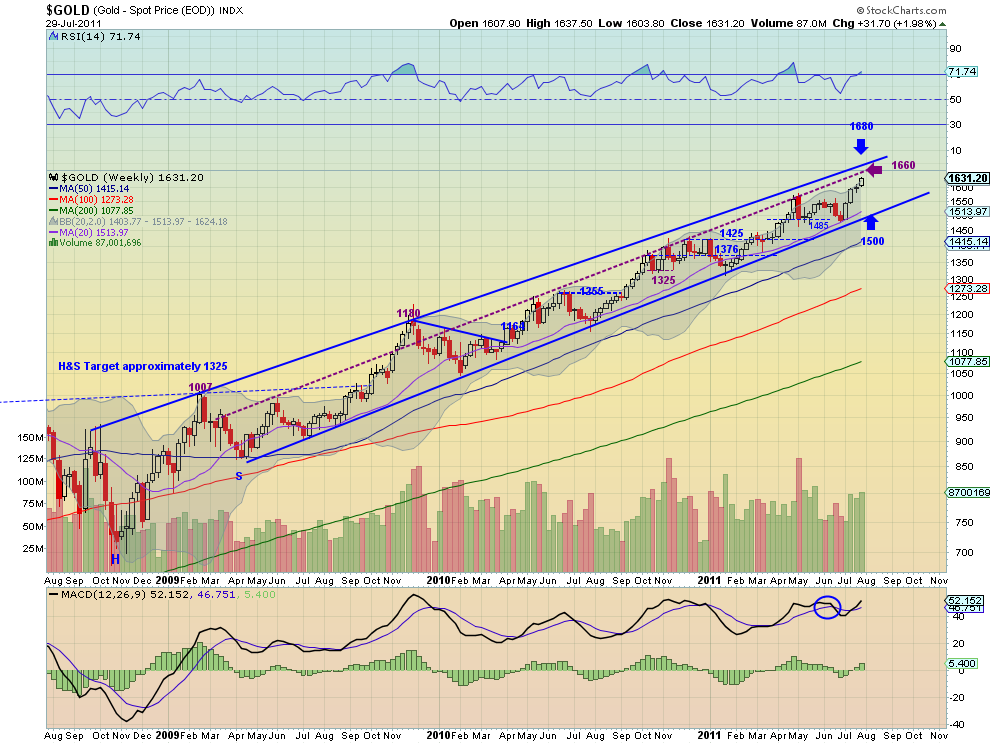

Gold Weekly, $GC_F

Gold jumped to start the week and then consolidated until a move higher again on Friday. The daily chart shows the Relative Strength Index (RSI) level around the 70 level and the Moving Average Convergence Divergence (MACD) indicator leveling in positive territory after a pullback. All of the Simple Moving Averages (SMA) are sloping higher as well. The weekly chart shows the break higher from the doji last week with rising RSI and increasing MACD. This chart looks like money. The bias for Gold remains to the upside next week with targets on Measured Moves (MM) to 1645, 1665 and then 1720. Any pullback should be contained by support at 1580-1600 consolidation area or the strong support at 1560 below that.

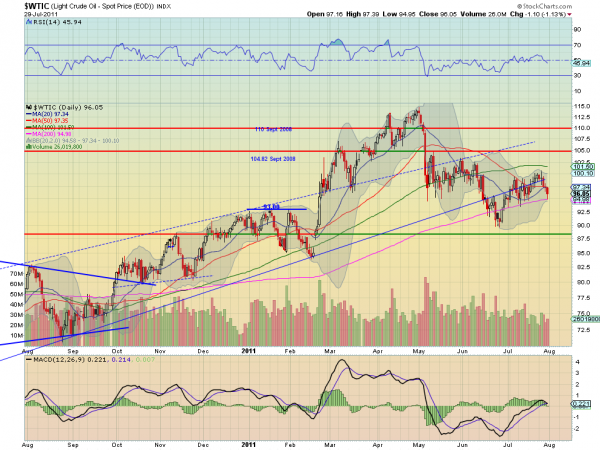

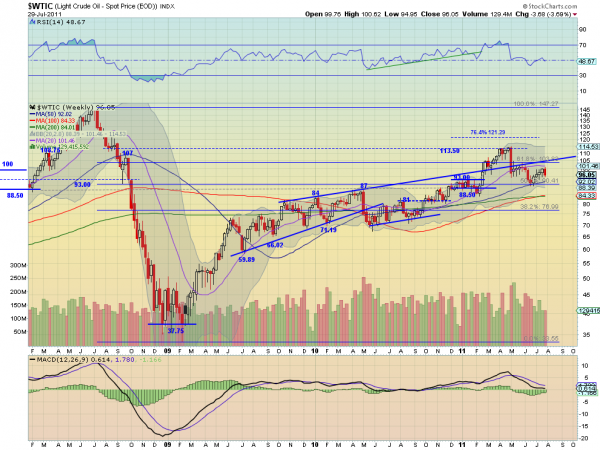

West Texas Intermediate Crude Weekly, $CL_F

Crude Oil started the week with a doji, signaling the rise had ended and then fell for the rest of the week finding the 200 day SMA on Friday as support. But the RSI on the daily chart is rolling lower ad the MACD is crossed negative, suggesting more downside. The weekly chart shows the bearish engulfing candle taking hold as the RSI rejects at the mid line. Also notice that all of the SMA’s on both time frames are now flat to rolling lower. Crude Oil is poised to continue lower next week now with support at 93 and then the 90.41 Fibonacci level followed by stronger support at 88. Any rise should meet resistance at 100 and a major spike at 104.82.

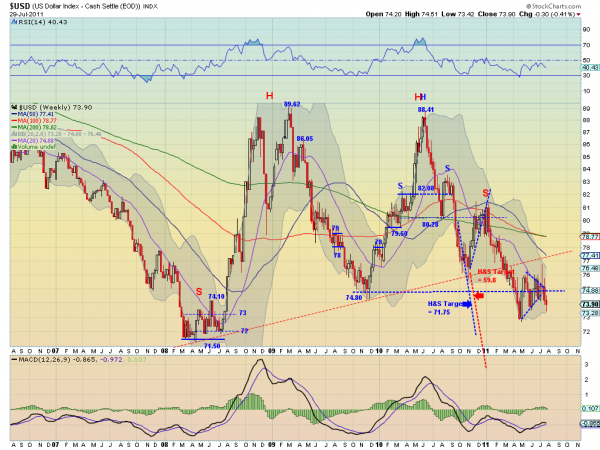

US Dollar Index Weekly, $DX_F

The US Dollar Index continued to fly a bear flag lower this week between 73.50 and 74.50 after falling out of the symmetrical triangle but below all of the SMA’s. The RSI on the daily chart is pointing lower while the MACD is diverging, improving, suggesting that the flag may continue. The weekly chart shows the move lower and the RSI and MACD suggesting more downside. Expect this continue to trend lower with any upside surprise to find resistance at 74.80 or on a super spike at 77.3, the neckline of the three year uptrend. Support comes at 73 and 72 before testing the all time low and then Head and Shoulders and MM targets of 63 and 59.8 kick in. Ugly set up.

iShares Barclays 20+ Yr Treasury Bond Fund Weekly, $TLT

US Treasuries, as measured by the ETF TLT, continued their consolidated most of the week before rocketing higher on Friday. The daily chart show a rising RSI and a MACD that crossed positive, suggesting more upside, on heavy volume Friday. The weekly chart shows that the move finally pushed it through the middle range of the symmetrical triangle, from 95.50-97.30. It also shows the increasing volume as the RSI and MACD point higher. Look for US Treasuries to continue higher, if they hold the 97.30 break, and a test of 100 and then the top rail at 102.50. Losing the break should see support in the 95.50 area.

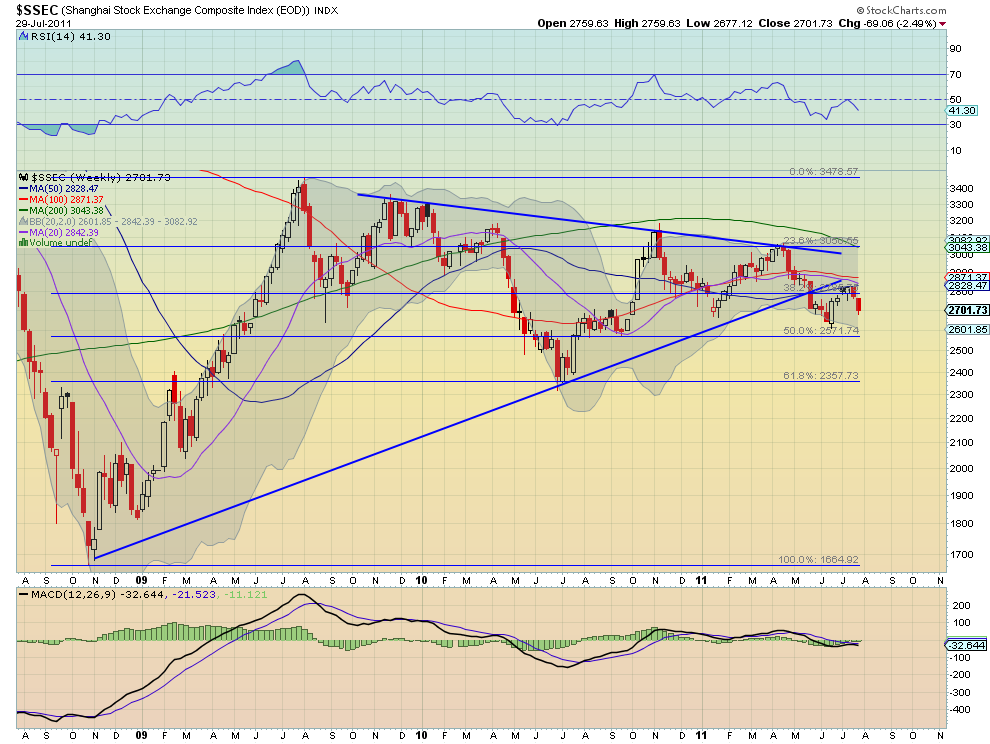

Shanghai Stock Exchange Composite Weekly, $SSEC

The Shanghai Composite jolted lower on Monday and then consolidated there for the week in a bear flag. This marks the 7th consecutive lower high. The RSI on the daily timeframe combined with the negative MACD suggest there my be more downside. The weekly timeframe shows that the fall is also a rejection at the falling SMA’s. The RSI on this timeframe also suggests lower. Look for the Shanghai Composite to continue to operate in a narrow range between 2695 and 2800 with any short term spikes limited to 2590 lower and 2900 above in the coming week.

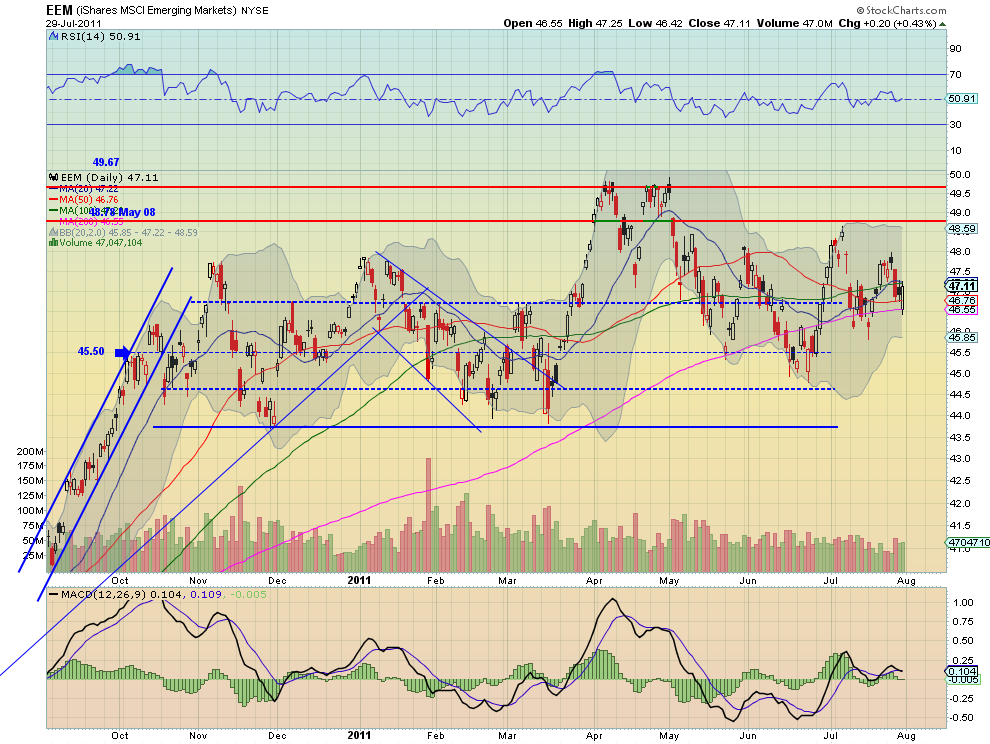

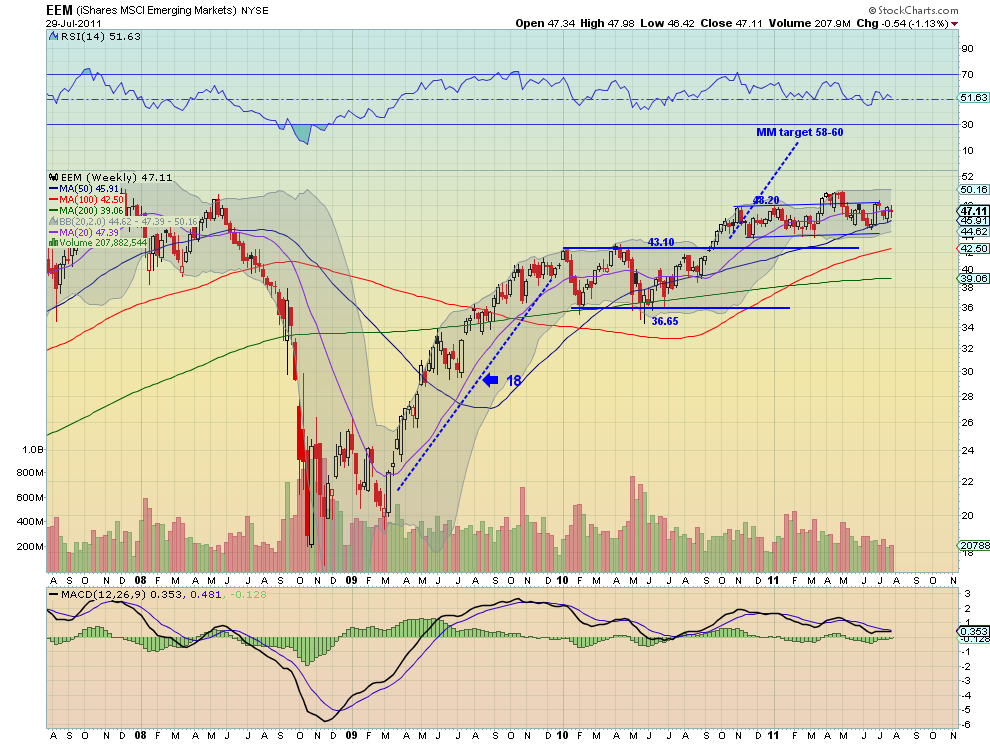

iShares MSCI Emerging Markets Index Weekly, $EEM

Emerging Markets, as measured by the ETF EEM, held in the upper end of the range for the week. The daily chart shows the RSI continues to meander around the mid line and the MACD around the zero level. On the weekly timeframe the broad range from the daily chart is put in perspective. More consolidation is shown on this chart as well as the RSI and MACD offer no guidance in this time frame. Continued consolidation in the range bounded by 45.50 below to 48.78 above is expected for the coming week.

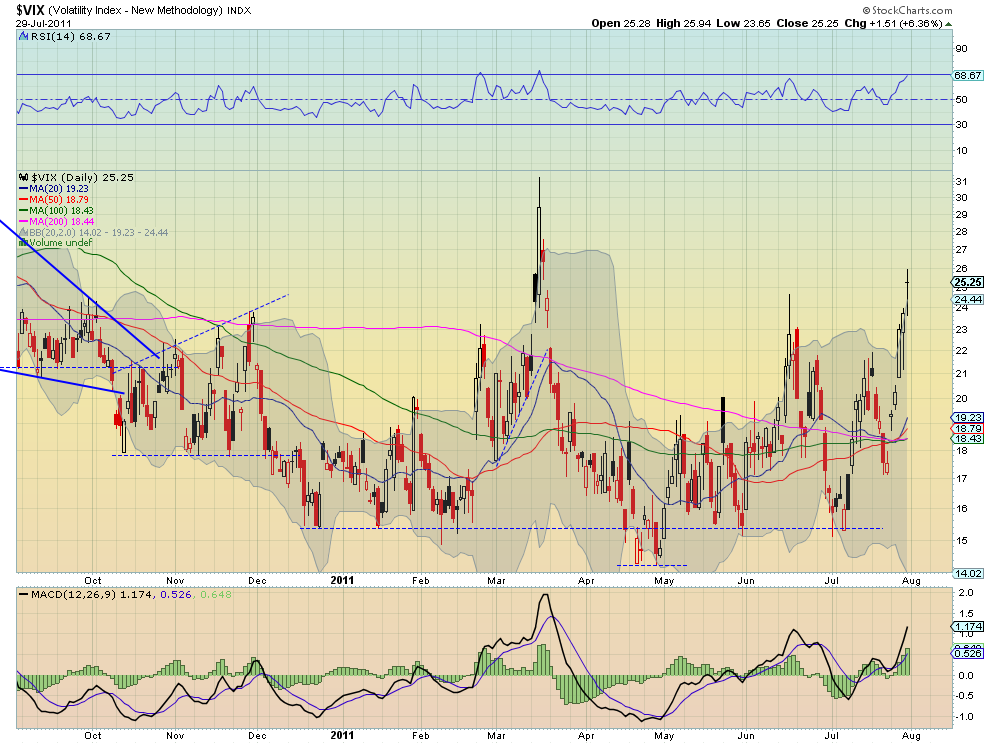

VIX Weekly, $VIX

The Volatility Index marched higher throughout the week ending at its highest closing level since March out of the Bollinger bands. The daily chart shows that the RSI is touching 70 and the MACD is growing suggesting more upside, despite the long legged doji, signaling indecision. The weekly chart shows that is peeking above the recent range but still has resistance above at 28-30 before the 12 month range can be declared broken. Both the RSI and MACD on this timeframe suggest that a test higher is coming. Should it fail then there is support at 24 and 21.25 before 18 lower.

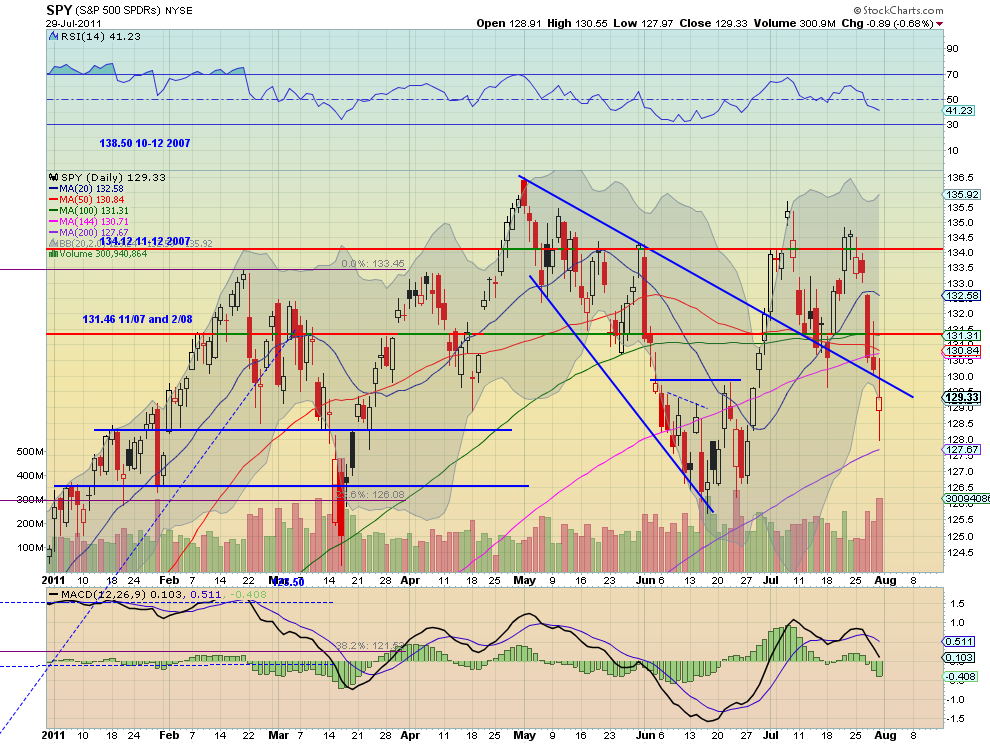

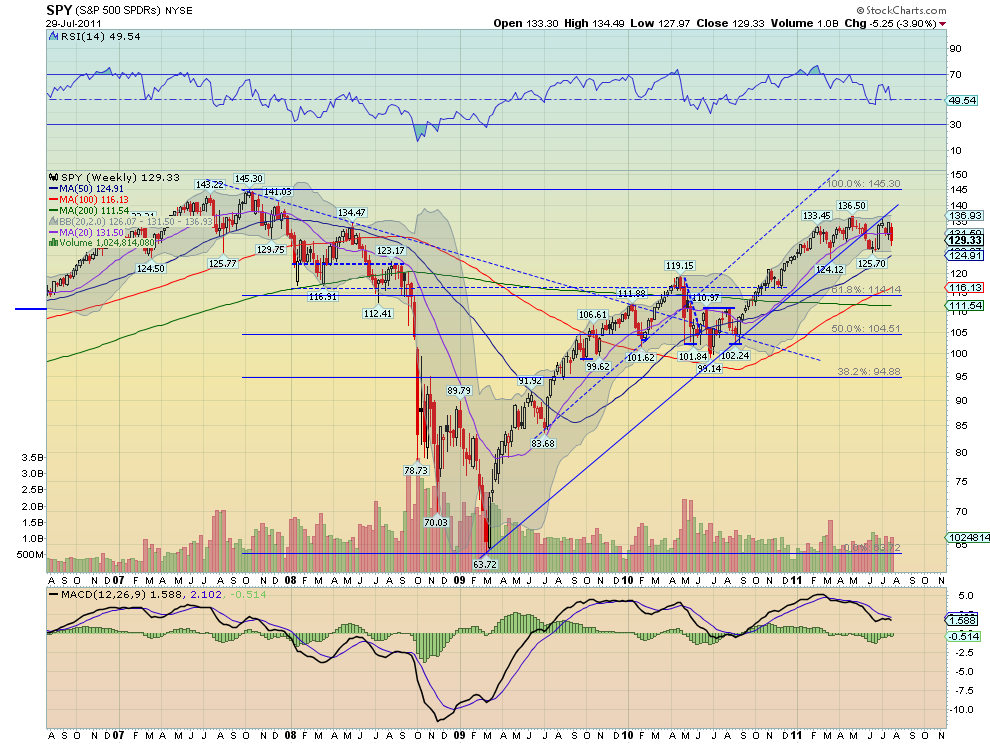

SPY Weekly, $SPY

The SPY began the week in consolidation mode before beginning a plunge on Wednesday through the support of the previous downtrend line. Friday’s candle with long shadows signals some indecision. The RSI pointing lower and the MACD growing more negative on the daily timeframe suggest resolution of the indecision to the downside. The weekly chart is not so clear as it remains in the 126-136.50 range from the past six months. The RSI on this timeframe suggests lower but the MACD is improving. Look for a bias to the downside in the coming week but within the range above 126. A confirmation higher, by a move above 130 would suggest more range bound trading in the coming week. The upside resistance at 131.46 and then 134.12 should halt any rallies.

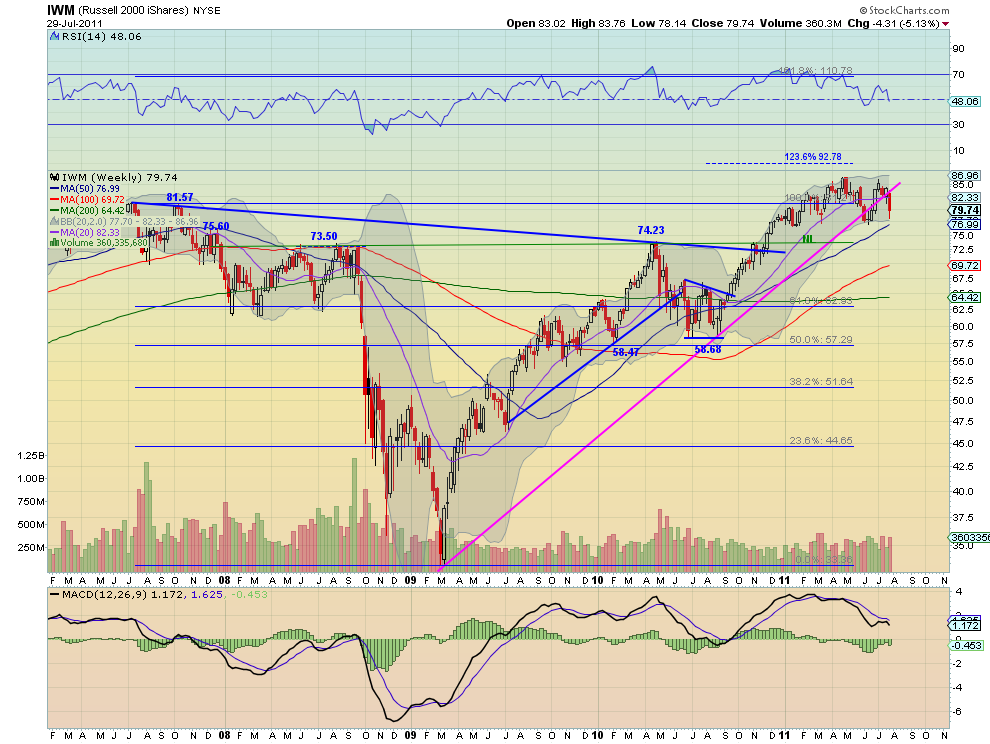

IWM Weekly, $IWM

The IWM on the other hand began the week falling and then plunged further from Wednesday onward through the support of the previous downtrend line. Friday’s long hollow red candle though showed very positive upside intraday action. The RSI is pointing lower but leveling and the MACD is growing more negative on the daily timeframe though, suggesting more downside or consolidation. The weekly chart remains in the 76.5-86 range from the past six months. The RSI on this timeframe suggests lower but is leveling and the MACD is pointing lower. Look for a bias to the downside in the coming week but within the range above 76.5. A move higher above 80.50 would suggest more range bound trading in the coming week. The upside resistance at 81.57 and then 84 should halt any rallies.

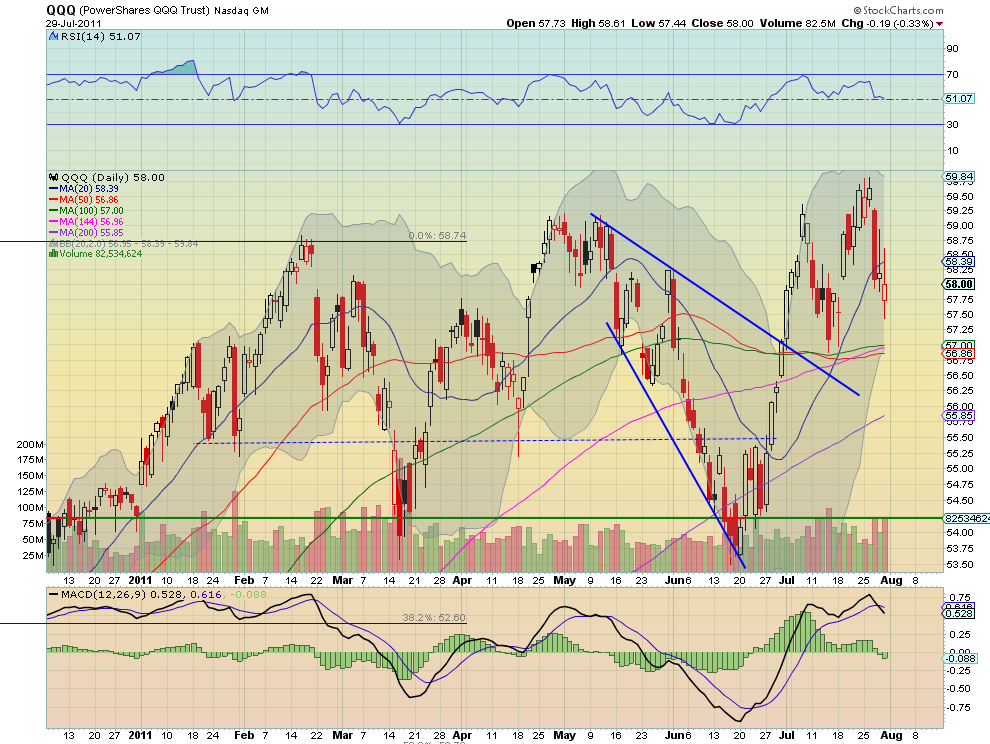

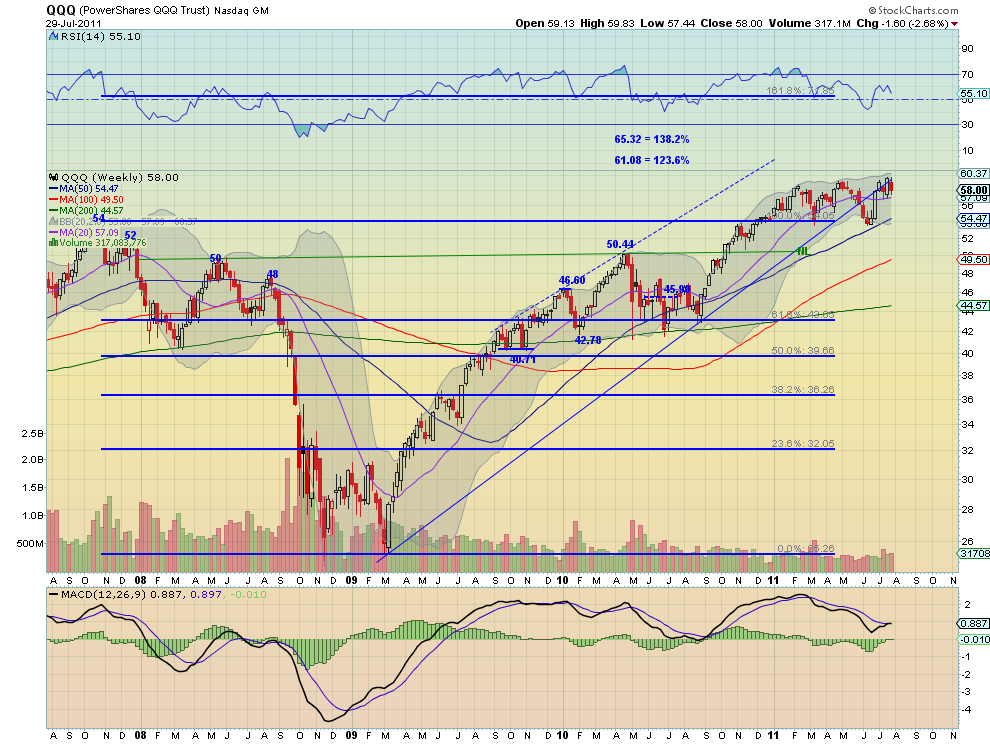

QQQ Weekly, $QQQ

The QQQ began the week much like the SPY in consolidation mode and actually making new highs before beginning a plunge on Wednesday that continued for the rest of the week. Friday’s candle with long shadows signals some indecision, but Hollow red candle also shows there was positive intraday action. The RSI flat lining and the MACD growing more negative on the daily timeframe suggest resolution of the indecision to the downside, although consolidation is possible at this level. The weekly chart remains in the 54.26-60 range from the past six months. The RSI on this timeframe suggests lower but the MACD is improving to a potential cross up. Look for a bias to the downside in the coming week with support at 57 and then 55.50 lower, but unlike the SPY and IWM well above the bottom of the range at 54.26. A confirmation higher, by a move above 58.50 would suggest another test of the top of the range at 60 in the coming week.

Gold and US Treasuries look to continue their moves higher in the coming week, with Crude Oil and the US Dollar Index continuing lower. The Shanghai composite looks to consolidate further in the middle of its range while Emerging Markets do the same at the upper end of their range. Volatility looks biased to the upside contributing to the view that Equity Indexes, SPY IWM and QQQ will continue lower. All look to remain within their ranges with the QQQ remaining the strongest much higher in its range. News driven breaks to the upside should be contained in the range with the possible exception of the QQQ’s. Use this information to understand the major trend and how it may be influenced as you prepare for the coming week ahead. Trade’m well.

No comments:

Post a Comment