by Cullen Roche

In a recent story David Beckworth described the balance sheet recession view as “inadequate”. He’s not the first one to do it. In fact, most of mainstream economics rejects the idea of the balance sheet recession (although Richard Koo and I are two of the only people who were calling this a household crisis in 2008 when Bernanke and other monetarists were pushing for bank focused rescue plans). Paul Krugman made similar comments a few weeks ago (right after Yves Smith and Bill Mitchell debunked his long standing “liquidity trap” theory). I believe this rejection of the balance sheet recession is based on several misconceptions.

Beckworth begins by arguing that the aggregate level of debt in the private sector doesn’t matter because there is a creditor for every debtor. He says:

“For every household debtor deleveraging there is a creditor getting more payments. Yes, household debtors have cut back on spending, but so have creditors. The creditors could in principle provide an increase in spending to offset the decrease in debtors’ spending. They aren’t and thus the economic recovery is stalled. In other words, the problem is as much or more about the build up of liquid assets by creditors as it is the deleveraging of debtors. The balance sheet recession view, however, sees the debtors deleveraging as the main problem. It completely ignores the creditors buildup of liquid assets and its implications for spending.”

Beckworth makes an egregious error in making these comments. He falsely assumes that all economic agents are somehow similar and that creditors necessarily contribute to economic growth in the same manner that debtors might.

What’s really happened in the US economy is that the driving engine of growth (household debtors – does anyone contest that households are the primary driver of US economic growth?) took on excessive amounts of debt. When the real estate bubble popped these consumers became savers as they were forced to pay down bubble era debts with post-bubble era cash flows. Bank transactions, however, net to zero. So, where did the money go that has been used to pay down these debts? Well, it went to the banks of course!*

Beckworth is right to note that there is a creditor for every debtor, but this implies that all creditors have an equally positive effect on the economy (the truth is that banks are not in any way equal to all other productive economic agents and instead serve as middlemen in the capitalist process). So, the real question that David Beckworth should be asking himself is whether banks are the engine of the economy (I have argued, emphatically, that they are not)? Are they truly productive economic agents or are they middlemen who “grease the engine of capitalism” (as I like to say). More importantly, Beckworth might want to research whether this growth in the financial sector has actually DETRACTED from US economic growth?

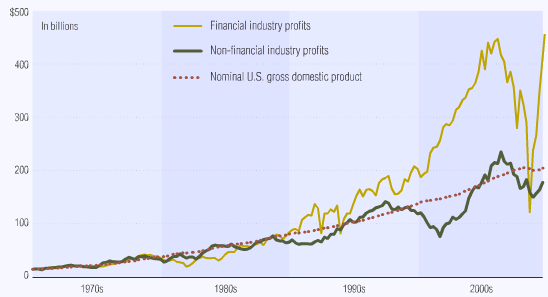

I think our Federal Reserve would agree with Beckworth that a healthy banking system is absolutely vital if we are to have a healthy economy. After all, this is why Fed policy has been mainly focused on saving the banking system. And they’ve largely succeeded. Banks are reporting an incredible v-shaped recovery (see figure 1). Profits are at all-time highs for these “creditors”. So why aren’t they ploughing all of this money back into the economy as any good capitalist entity should? The answer is quite obvious. First of all, banks don’t “plough” money back into the economy unless there is demand for loans. The Fed has bolstered bank balance sheets and injected the banks full of reserves with the assumption that this might lead to increased lending. But anyone who understands how a modern banking system works knows that banks are never reserve constrained. So, the only way that a bank could “plough” money back into the economy is if there is demand for loans (outside of their less productive normal business operations). Clearly, with low aggregate demand there remains very weak demand for loans. The weak demand for loans is a direct result of the fact that consumers have become savers, which has resulted in reduced domestic revenues for corporations and ultimately a reduction in lending.

(Image 1 – Financial Industry Profits)

Beckworth then goes onto claim that QE worked during the Great Depression and if implemented properly today, could work here:

“The balance sheet recession view cannot easily reconcile the large deleveraging by households and the rapid real economic growth that occurred between 1933 and 1936. What can explain it is a more nuanced view that acknowledges creditors with excess money demand were confronted by FDR’s original quantitative easing program. This QE program was far better than recent ones in that FDR clearly signaled a price level target and backed it up by devaluing the gold content of the dollar and allowing unsterilized gold inflows. In otherwords, FDR signaled that he was going to allow a significant and permanent increase in the monetary base and followed through on it. This change nominal expectations and caused creditors to start spending their money balances. The same could be done today with something like a nominal GDP level target.”

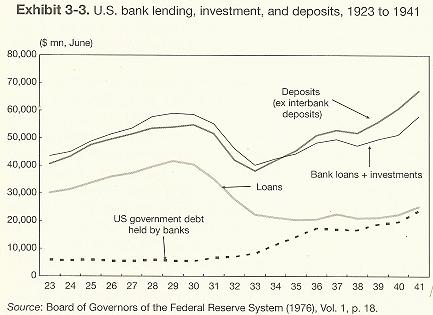

First of all, it’s widely agreed upon that the Great Depression did not end in 1936. It lasted a full 5 more years. Were there spurts of growth throughout the decade long malaise? Yes. Just as there are spurts of growth today. Datamining a period of growth, attributing it to a specific Fed policy and then concluding that it “worked” is misleading to say the least. The truth is that reserves did expand after 1933, deposits increased steadily, lending remained stagnant, the economy viciously double dipped in 1937 (something Beckworth conveniently doesn’t mention) and the Depression continued until the early 40′s. Can we really conclude that QE “worked” during this brief period of the Great Depression? That’s like claiming that QE worked in Japan in the early 2000′s because they had a spurt in growth, but not even the BOJ agrees with that idea. **

Beckworth is also on record stating that QE2 would “work” before it was implemented and was quick to cheerlead the program after inflation expectations showed some signs of spiking in late 2010 (see here and here). He now states that it wasn’t implemented properly as it’s become pretty obvious that the program did not result in real growth. I have consistently pointed to the exact specified transmission mechanisms that were supposed to result in recovery and debunked all of them in real-time. The David Beckworth’s of the world rely on this idea of altering expectations but cannot explain exactly how it works and have zero evidence proving that it has worked before (aside from the weak case of the Great Depression). The fact is, there is no transmission mechanism through which QE “works” during a time when demand for borrowing is weak. Of course, we’ve seen this in Japan and in the UK, but Beckworth doesn’t touch on those QE failures.

The broader flaw in this thinking is based on the common misconception that banks lend their reserves. That is simply not how modern banking works. As I’ve already stated, banks are never reserve constrained. When the Fed supplies banks with more reserves they are not giving them more fuel with which they can lend. Banks are capital constrained. They are never reserve constrained. So, the notion that more QE could “work” is simply not true in this sense. Giving banks more reserves isn’t going to force them to start building factories, lending more money, hiring more workers or generally “spending” (as Beckworth says). Just as their remarkable recovery in profits hasn’t resulted in any of the latter….

Furthermore, Mr. Beckworth’s colleague, Scott Sumner admits that QE is unlikely to be inflationary when the Fed is paying interest on reserve balances:

“If the new base money is interest-bearing reserves, I fully agree that OMOs may not be inflationary. That’s exchanging one type of debt for another.”

Could these operations alter expectations? Yes. I’ve consistently maintained that QE would result in altered expectations as people fear this idea of “money printing” and “debt monetization” (both of which are entirely wrong). After all, if nothing else, Fed policy is poorly understood by most people and known to cause severe economic disequilibrium. The evidence from QE2 shows that real GDP peaked as soon as the program began. All it did was contribute to commodity price speculation and cause a broad economic squeeze as cost push inflation increased and growth remained stagnant. The implication that we need more of this is misguided to say the least.

But most importantly, there are few people who have actually run a business who would contest the simple fact that they increase capital expenditures when they have more clients walking in the doors. And unfortunately, those clients aren’t walking in the door today because they are bogged down by bubble era debt levels. So, the recovery in bank profits and corporate profits in general might continue, but that doesn’t even begin to explain why aggregate demand is so low today. The answer, in my opinion, is simple – the US economy is suffering a balance sheet recession that is primarily caused by a collapse in household balance sheets. And while it is extreme to imply that monetary policy is entirely ineffective (I in fact said that QE1 would help stabilize the banks and market at the time it was implemented) during a balance sheet recession, it should be clear to most observers by now that the Fed’s policies have not done a great deal to help the US economy and cannot be relied upon as the balance sheet recession continues.

In sum, it’s clear that the mainstream continues to misdiagnose the true cause of this recession. The implication that banks and other creditors are somehow the engine of growth is just not an accurate portrayal of the US economy. And this idea that more bank reserves and altering expectations is a recipe for growth should be obviously inaccurate by now.

* Update – To clarify this comment, when banks create money by extending credit (loans create deposits), this occurs completely within the banking system and results in a liability for the bank (the deposit) and a corresponding asset (the loan). The customer has an asset (the deposit) and a corresponding liability (the loan). This nets to zero. The banks do however, accumulate wealth via interest payments.

** Richard Koo’s Holy Grail of Macroeconomics has an ENTIRE chapter debunking the Great Depression ideas espoused by David Beckworth

No comments:

Post a Comment