It’s all about the debt-ceiling debate right now, and mounting fears have caused technical damage that will take time to resolve. Use any short-lived rally as a chance for selective selling.

It was a rough week for the markets this past week, and the week ahead may be no better. Last week, Senator John McCain used the word “bizzaro” in his description of how the debt crisis was being handled. It is nice to have one politician who is not afraid to speak his mind. Comic book fans will remember that Bizarro World was a fictional, cube-shaped planet from DC Comics (how appropriate!).

It would be nice if last week’s action in the financial markets and in Washington, DC was fictitious, but unfortunately, it was not. The debt crisis weighed on the markets from the start of last week, and the selling pressure picked up steam as the week progressed. This week may be just as treacherous.

Another vote is scheduled for late Friday, but I am not optimistic that it will mean much. In all likelihood, we will wake up on Monday and still be without a deal. Investors definitely have started to run scared, as they removed $13.6 billion from stock mutual funds and ETFs in the first four days of last week.

Institutions are also nervous, as very short-term T-bill rates have spiked, therefore causing the yield curve to flatten out. Historically, a flat yield curve is negative for the economy. Yields on the ten-year T-note dropped to new lows for the year, as they seem to be the safest haven, after gold.

Though a deal will eventually be done, what we can’t determine is whether the confidence in the markets and economic recovery has suffered a fatal hit. A contraction in credit at this fragile time in the economic recovery could have serious implications.

There has been some technical damage to the stock market as well, and while the analysis of the Advance/Decline (A/D) line still suggests that a major top is not complete, some time is likely needed to repair the damage.

The negative short-term analysis allows for more selling, and the S&P 500 could drop back to the March lows, which are more than 3% below Friday’s close.

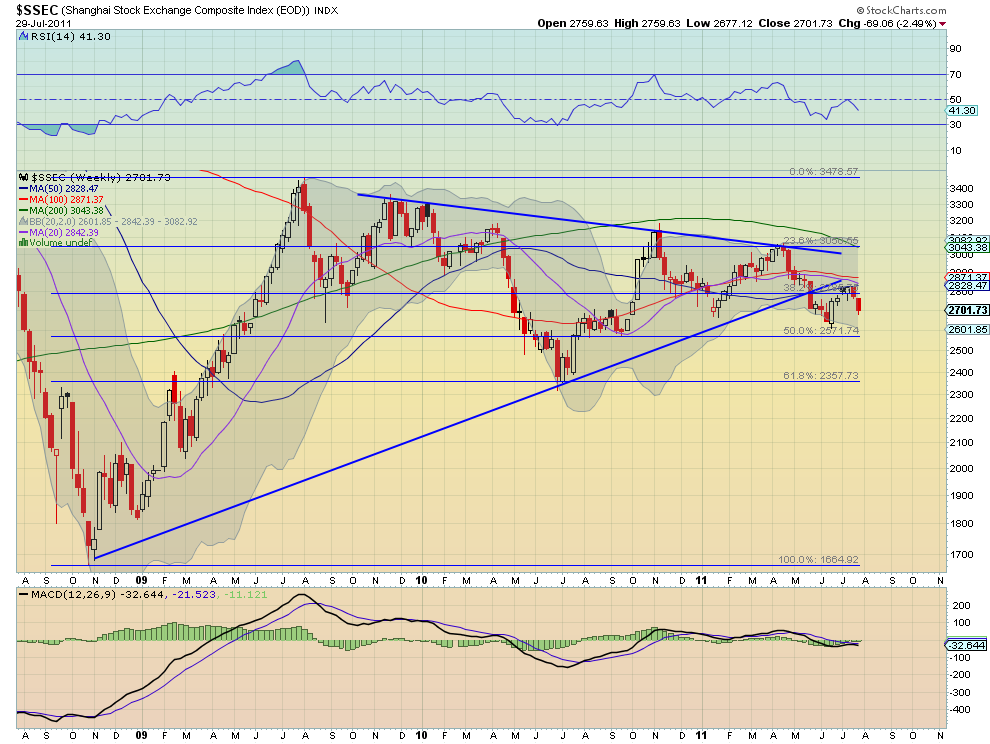

Click to Enlarge

Click to Enlarge

A surprise decline in claims for unemployment insurance was one of the few positives last week. The much weaker GDP numbers, especially the big downward revision in the first quarter numbers, hit stocks hard early Friday.

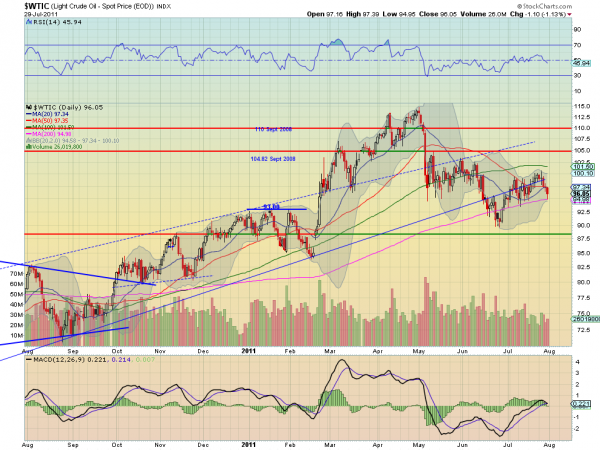

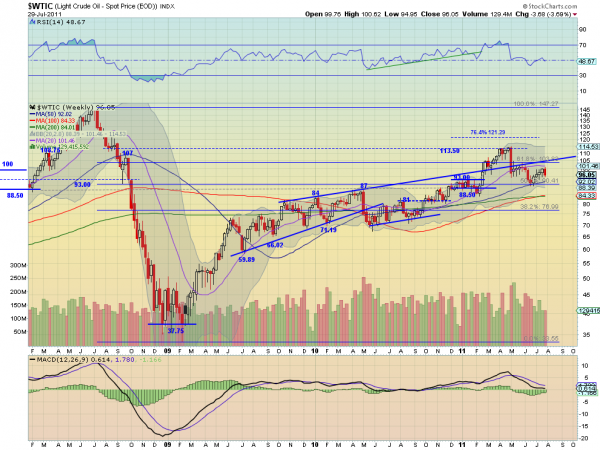

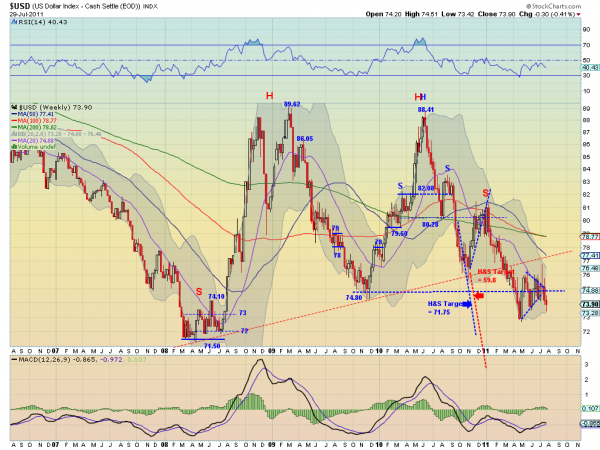

These numbers did not help make the dollar more attractive, as the dollar index violated support (line a) on July 21. Though it is possible that the dollar is forming a double bottom, a more likely interpretation is that it will break below the recent lows, which will cause heavier selling.

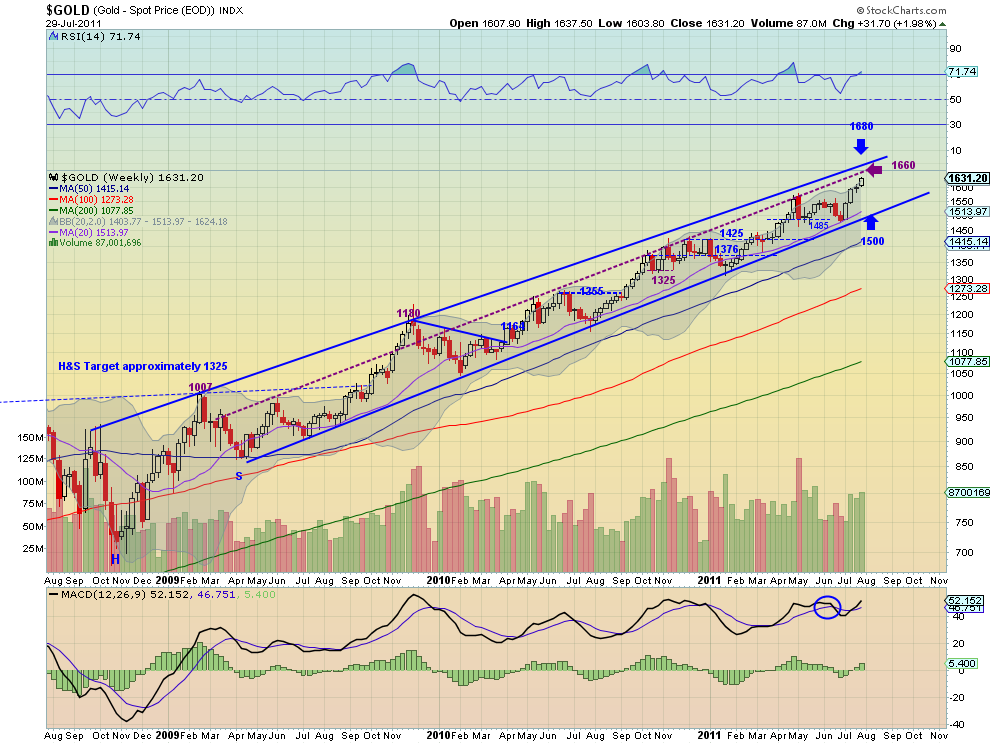

Gold was the big winner last week, and after completing its flag formation (lines c and d) on July 12, the

Spyder Gold Trust (

GLD) has accelerated to the upside. It is still below the upside targets from the flag formation, which are in the $160-$162 area.

Platinum prices have been lagging gold, as platinum is just $155 more expensive than gold. In January, one ounce cost $525 more, and the

long-term chart of the platinum/gold spread is quite interesting.

The week ahead is a big one for economic reports with the main focus being on jobs. The ADP Employment report is due out Wednesday, with jobless claims due Thursday, and the key monthly jobs report scheduled for Friday.

There are some other reports as well, with the ISM Manufacturing Index and Construction Spending set for release on Monday. On Tuesday, we’ll get the Personal Income report, while the ISM Non-Manufacturing Index and Factory Orders will be released on Wednesday.

What to Watch

Last Thursday,

I identified some key levels for ETFs that represent the major stock indexes. Those levels were decisively broken in the

Spyder Trust (

SPY) and

SPDR Diamonds Trust (

DIA). Technology has been the strongest sector recently, and the tech-heavy

PowerShares QQQ Trust (

QQQ) is so far holding well above its key support.

Stocks made their lows on the opening last Friday, and despite much-worse-than-expected economic numbers, S&P futures closed almost ten points above the early lows. Though this does possibly mark a short-term low, a rally this week will have to be watched closely.

My concern is that we will see a sharp reflex rally once a deal on the debt ceiling is made, but that rally won’t last more than a day.

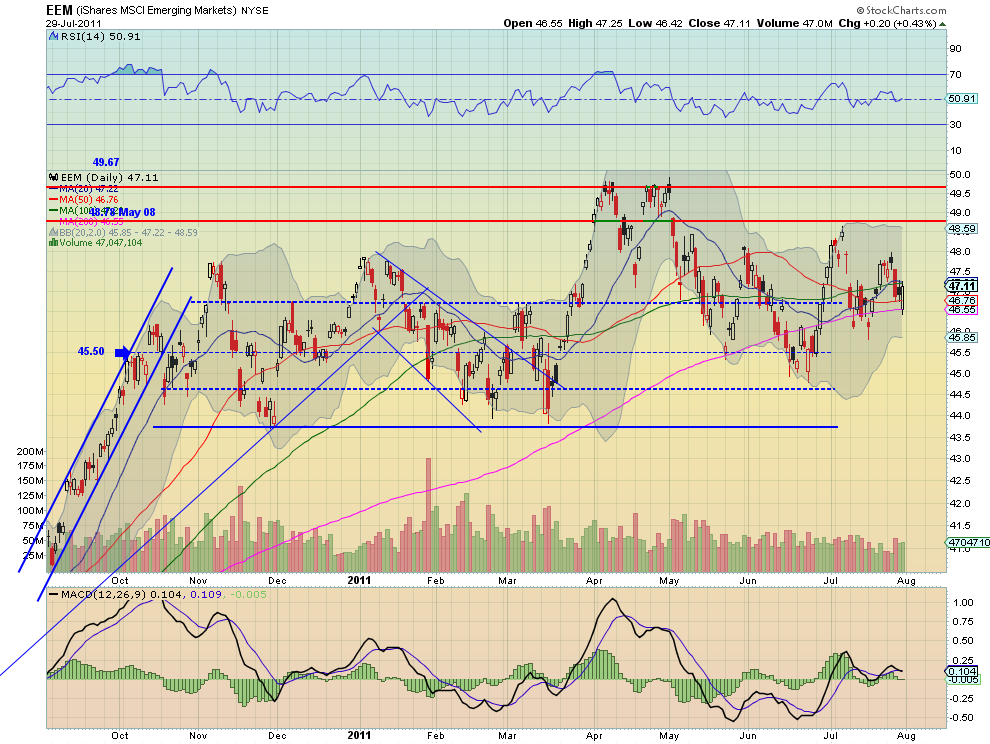

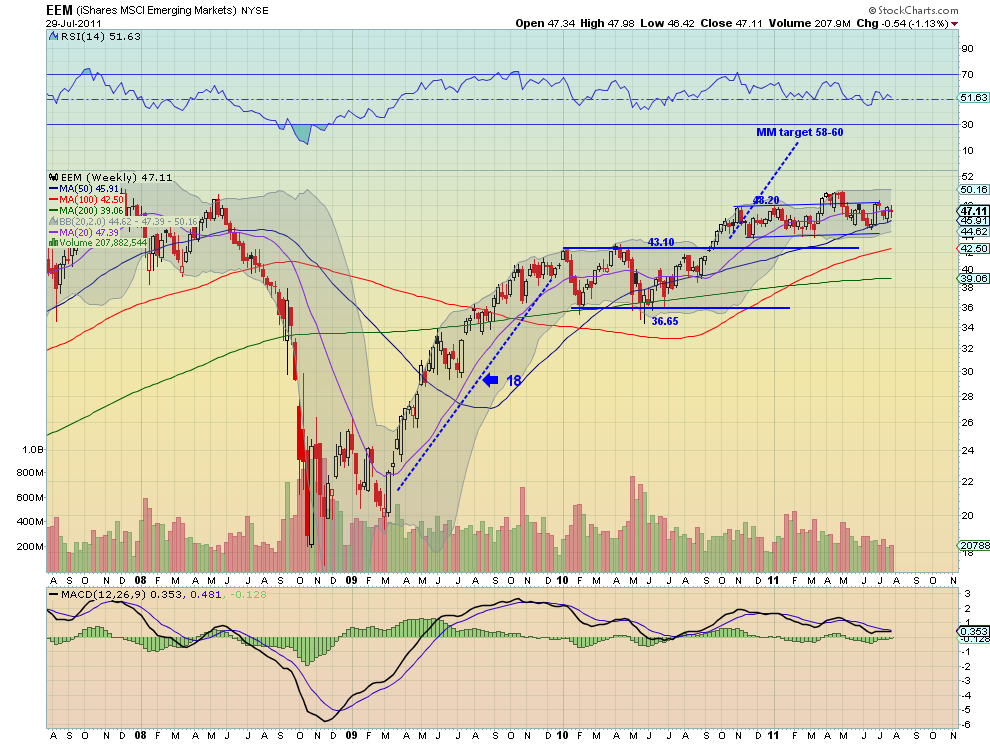

Click to Enlarge

Click to Enlarge

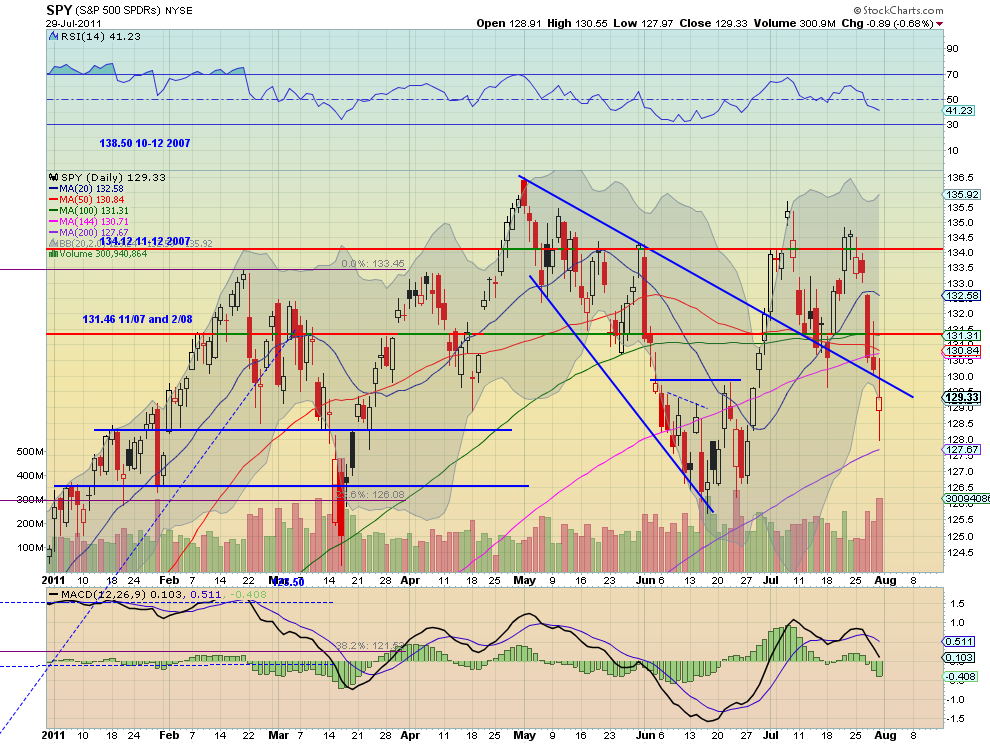

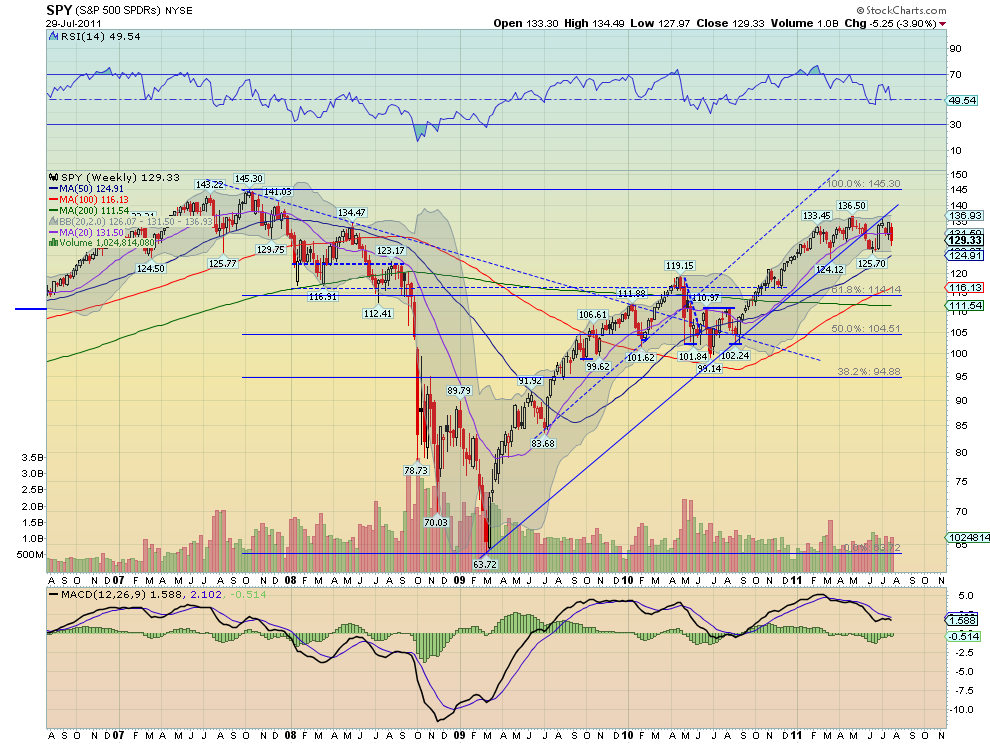

S&P 500

The monthly chart of the

Spyder Trust (

SPY) shows that it has closed lower for the past three months. It is currently not far above the monthly uptrend, line a, at $127. There is further support from the April 2010 highs at $122.

The 200-day moving average (MA) (not shown) is still rising but was violated last Friday.

Once below Friday’s low at $127.97, the next key chart support is at $126.19 and the June lows. SPY made a low in March at $125.28 during the panic selloff.

The S&P 500 A/D line has broken the uptrend from the June lows and now shows a pattern of lower highs and lower lows. The June lows now represent important support.

There is initial resistance for SPY at $130.40-$131 with much stronger resistance at $132.63.

Dow Industrials

The

SPDR Diamonds Trust (

DIA) was hit hard last week, falling as low as $120.64 last Friday. One can make a case from the weekly chart that a weekly head-and-shoulders top is forming. The neckline (line b) is just above the $119 level with the June lows at $118.54.

A decisive close below both of these levels on a weekly basis would clearly be serious. The weekly OBV did confirm the highs in May, but it remains below its weighted moving average (WMA) and has broken its uptrend, line c.

The Dow Industrials’ A/D line has reversed sharply, breaking the long-term uptrend, but it is still above the June lows. If those lows are broken, a more serious decline could occur.

There is significant resistance for DIA at $122.50-$123 and more important resistance now at $123.80 to $124.39.

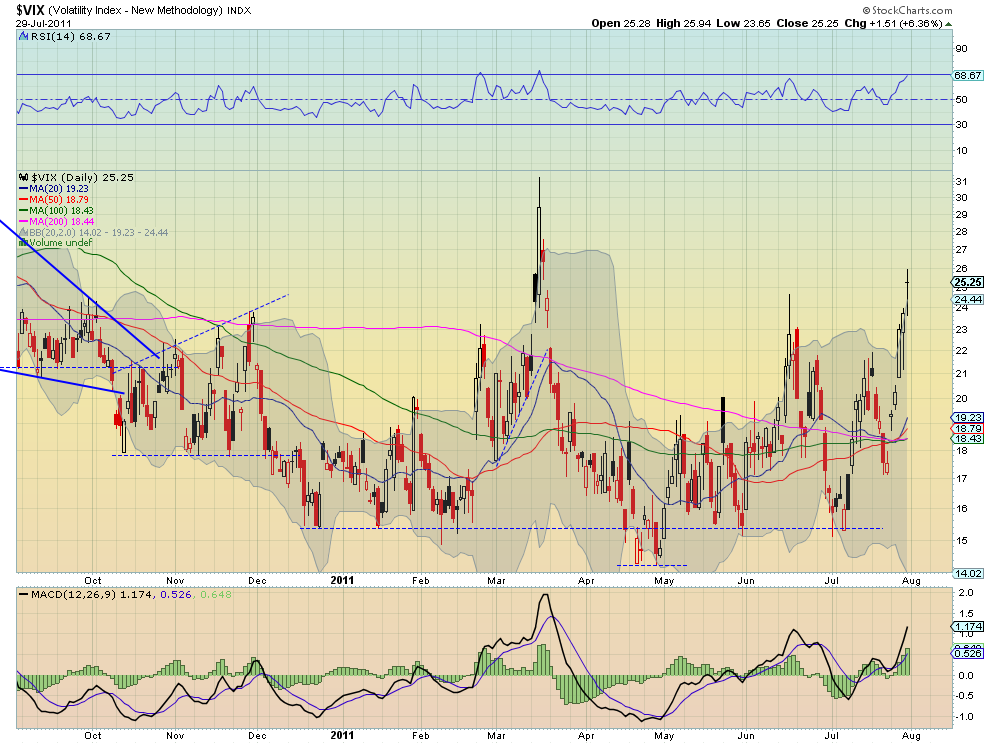

Click to Enlarge

Click to Enlarge

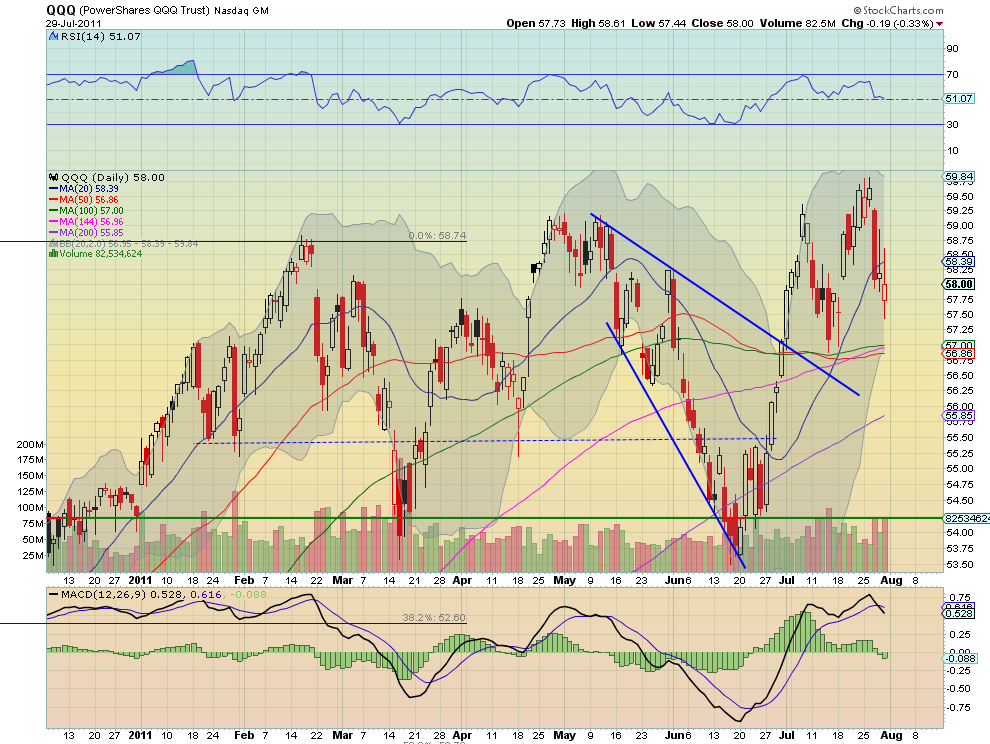

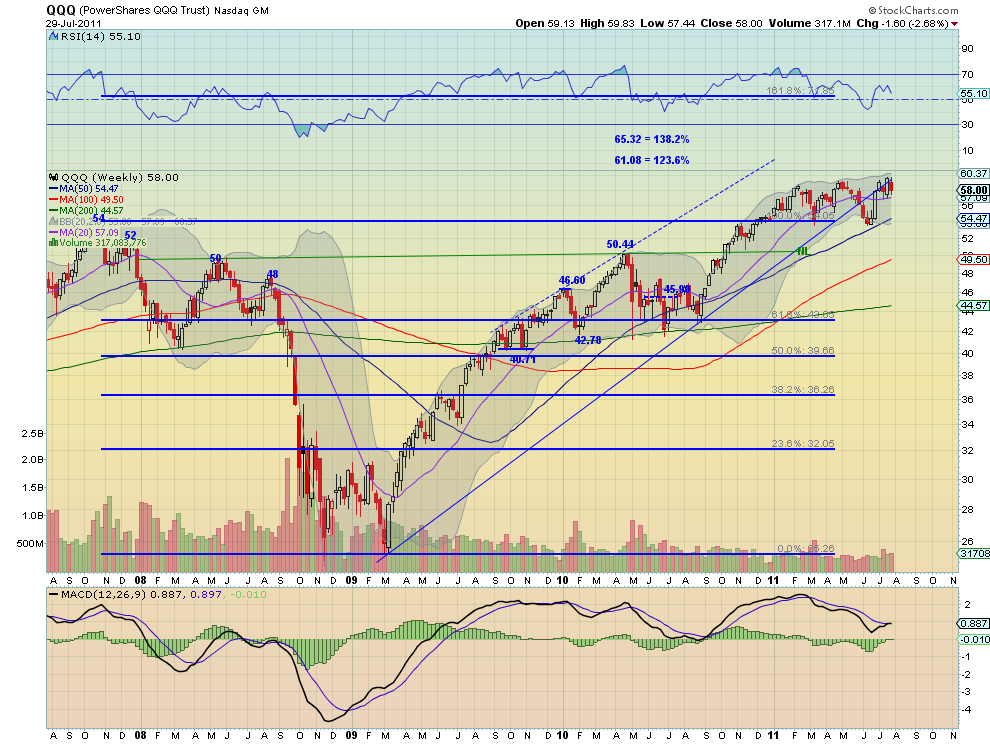

Nasdaq 100

The tech sector was the strongest last week, as the

PowerShares QQQ Trust (

QQQ) held above key support at $56.87-$56.98. Friday’s low was $57.44.

The better relative performance, or RS analysis, is evident on the %Change chart, as QQQ shows higher lows while SPY shows lower lows.

The Nasdaq 100 A/D line did not confirm the recent highs and this divergence is now more of a concern. A break of longer-term support will confirm the divergence.

There is initial resistance at $58.80-$59.30.

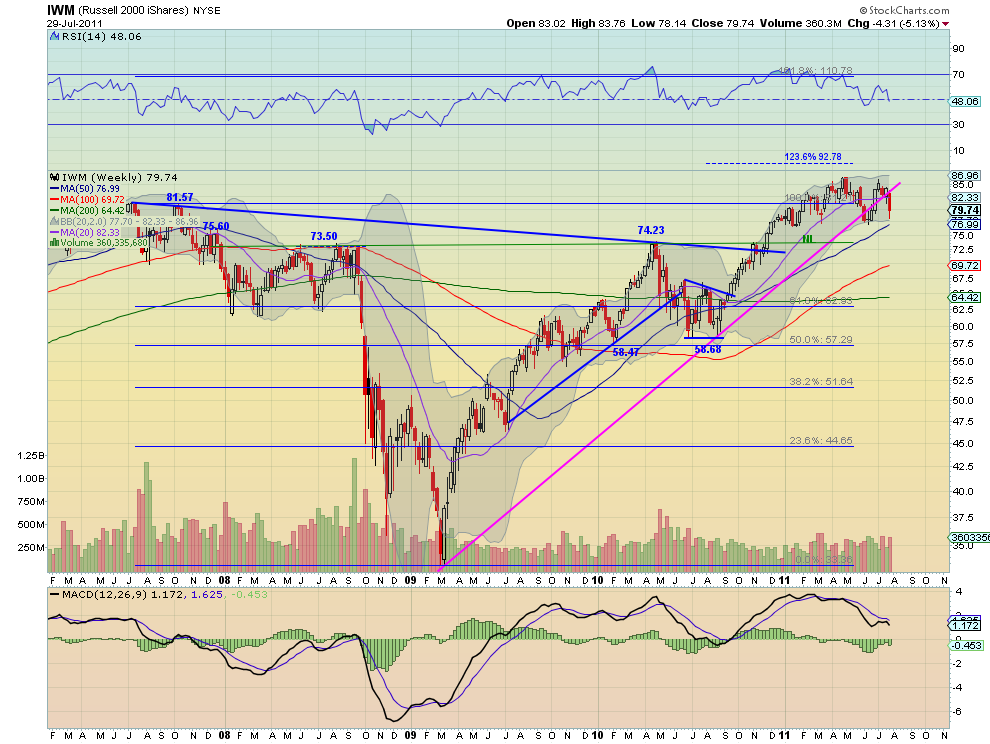

Russell 2000

The

iShares Russell 2000 Index Fund (

IWM) was hit hard last week, down over 5%, and it is already close to the June lows at $77.23, having reached $78.24 on Friday.

If the June lows are broken, the major 38.2% support is at $76.11.

The Russell 2000 A/D line is declining, but it is still holding above major support.

See the original article >>