by

Last week’s review of the macro market indicators looked for more upside for Gold and a drift higher for Crude Oil. The US Dollar Index looked headed to test the recent lows while US Treasuries continue higher. The Shanghai Composite looked to continue lower after falling out of the symmetrical triangle while Emerging Markets head higher toward resistance. With continued stable and low Volatility the Equity Index ETF’s are diverging, with the IWM looking better to the upside while the SPY and QQQ need to break resistance to join it and so are looking better to the downside. This divergence should resolve soon but could also lead to more sideways action.

The short week unfolded as the charts laid out for Gold and Crude Oil. The US Dollar Index and Treasuries also moved as suggested but with Treasuries reversing mid week. The Shanghai Composite and Emerging Markets flew flags for the week and with Volatility rebounding but not much. The Equity Index ETF’s resolved their divergence issue by weeks end, Wednesday and proceeded lower. What does this all mean for the coming week? Let’s look at some charts.

As always you can see details of individual charts and more on my StockTwits feed and on chartly.)

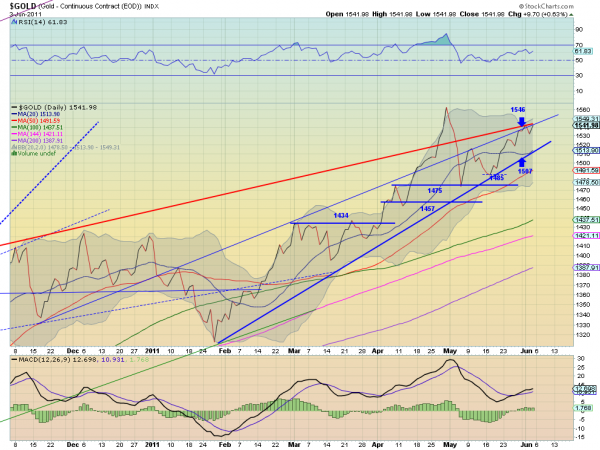

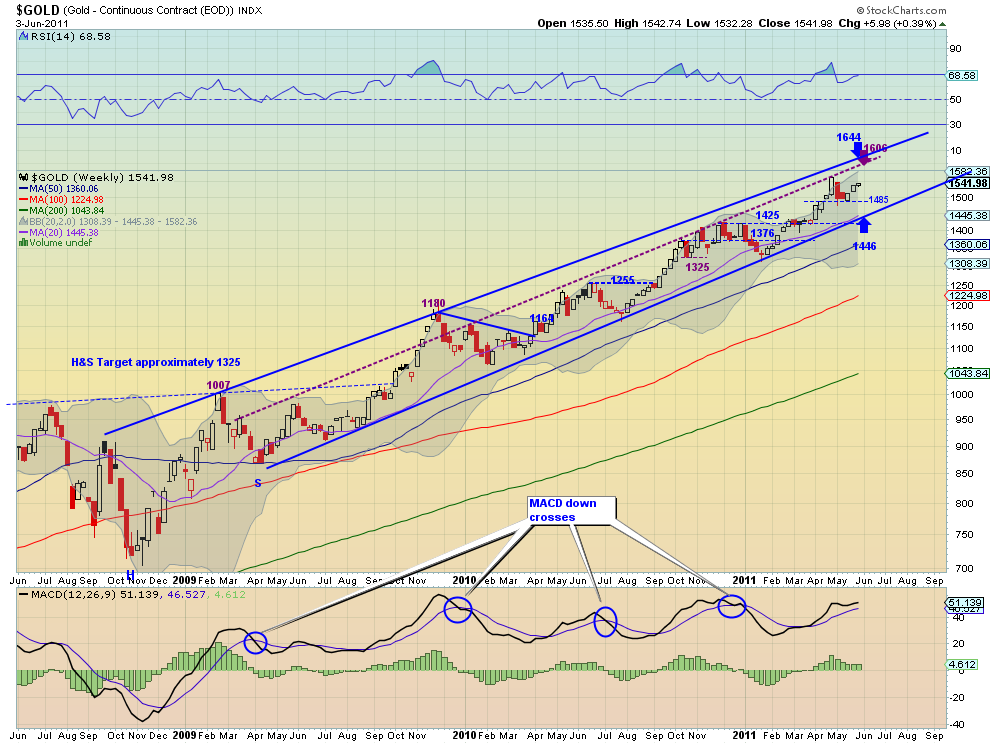

Gold Weekly,$GC_F

Gold remained in contact with resistance of the rising trend line on the daily chart for the entire week. The Relative Strength Index (RSI) shows a slight trend upward and the Moving Average Convergence Divergence (MACD) a gradual increase. Both support a run higher either through the trend resistance or along it. The weekly chart shows Gold in the clear and rising with a rising RSI and a MACD that is starting to grow slowly again. Both timeframes suggest more upside in the coming week. If it gets above the 1546 resistance area the previous high at 1563.20 is the next resistance and then 1600. Look for pullbacks to find support at 1517 and 1510.

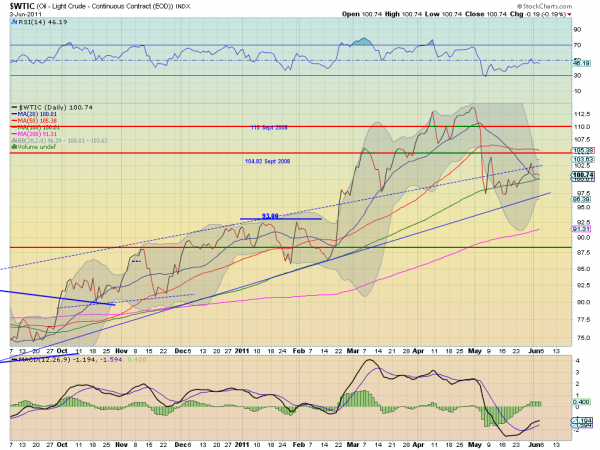

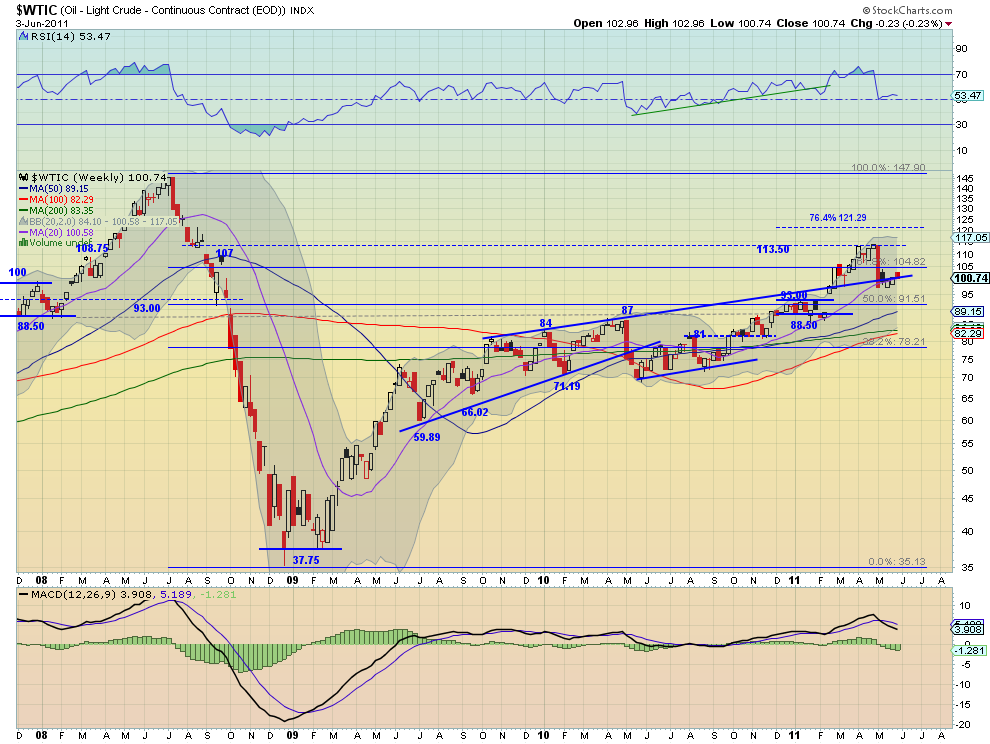

West Texas Intermediate Crude Weekly,$CL_F

Crude Oil spent the week bouncing off of the 100 day Simple Moving Average (SMA) and the slowly rising trend line resistance, currently at 102.45. The RSI has been flirting with the mid line on the daily chart as the MACD levels. Also the SMA have started to flatten as the Bollinger bands (BB) are tightening. Consolidation before a move. The weekly chart shows a drift higher alternating around the extension of the resistance line from 2008 and the 20 week SMA. The RSI on this timeframe is holding in bullish territory but the MACD is diverging lower. This suggests a bias for the BB tightness to resolve lower. Look for next week to continue a sideways to slightly upward drift with a break of 104.82 to the upside or 97 to the downside signalling a next trend direction.

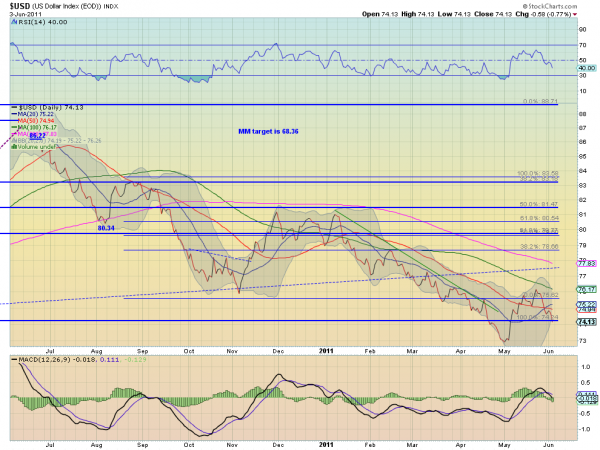

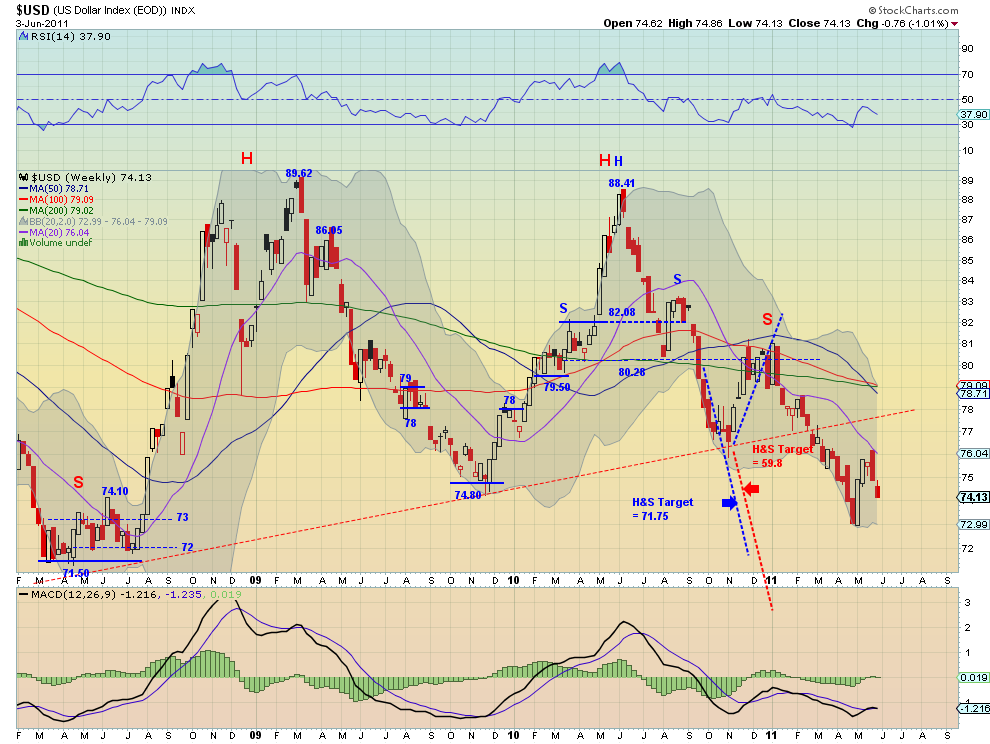

US Dollar Index Weekly,$DX_F

The US Dollar Index moved lower for the week and looks to continue that in the coming week. The daily chart shows it breaking below the 2009 lows again at 74.24 and resting just above previous support at 74.10 from 2008 and slightly outside of the lower BB. But with the RSI looking sharply lower and the MACD crossing negative this week the slight break of the BB on the daily chart should not stop it. The weekly chart shows a continuation off of the Marubozu from last week, with a falling RSI and a flat MACD. Support comes next at 73 with only 72 and 71.50 lower keeping it from making new all time lows. Targets get ugly down there, but for the time being look for it to continue disintegrating next week.

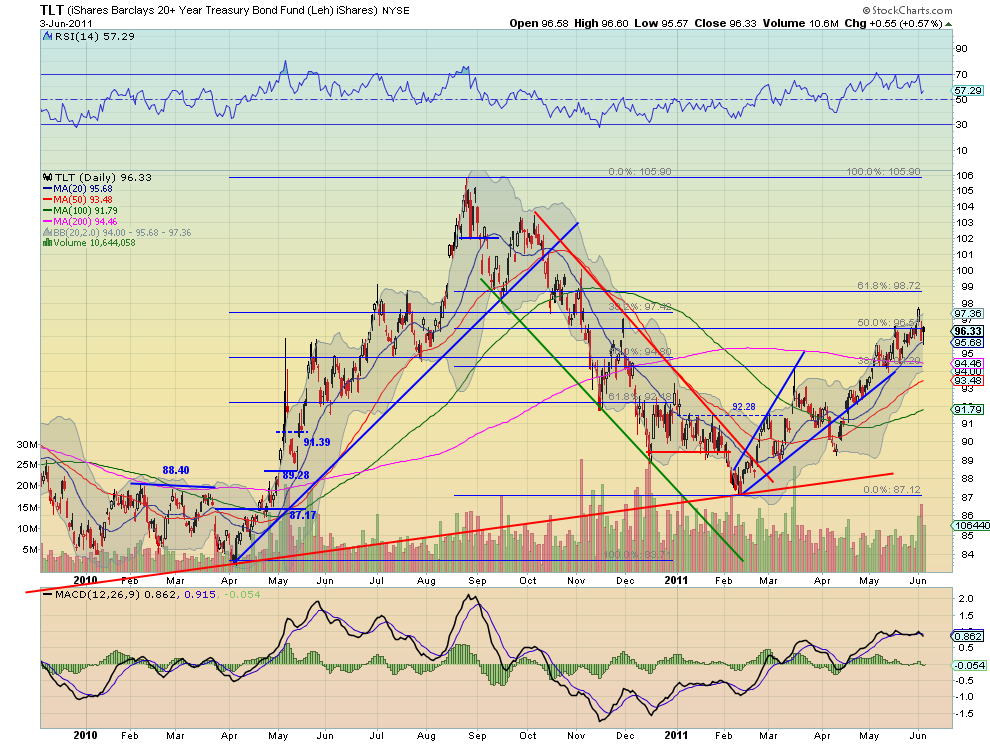

iShares Barclays 20+ Yr Treasury Bond Fund Weekly,$TLT

Treasuries, as measured by the TLT ETF, probed higher before falling back to support of the 20 day SMA at 95.68 and bouncing back to the 96.51 Fibonacci level. These are now short term resistance and support. The daily chart shows the RSI may be ready to turn higher again, but the MACD is crossed lower, but relatively flat. It could go either way from this chart. The weekly chart shows that indecision by way of long upper shadowed doji printed, nearly touching the 97.80 resistance and reaching just under the 96 support. The RSI on the weekly chart is rising, but flattening, as is the MACD, suggesting more upside, and that agrees with the trend since February. But add that together with the declining volume and the doji and the picture says there may have been a top set. A move below 94.20 would confirm more downside. If it gets over 97.8 then I like the upside to continue to test 100. Remain with the uptrend for next week until proven other wise.

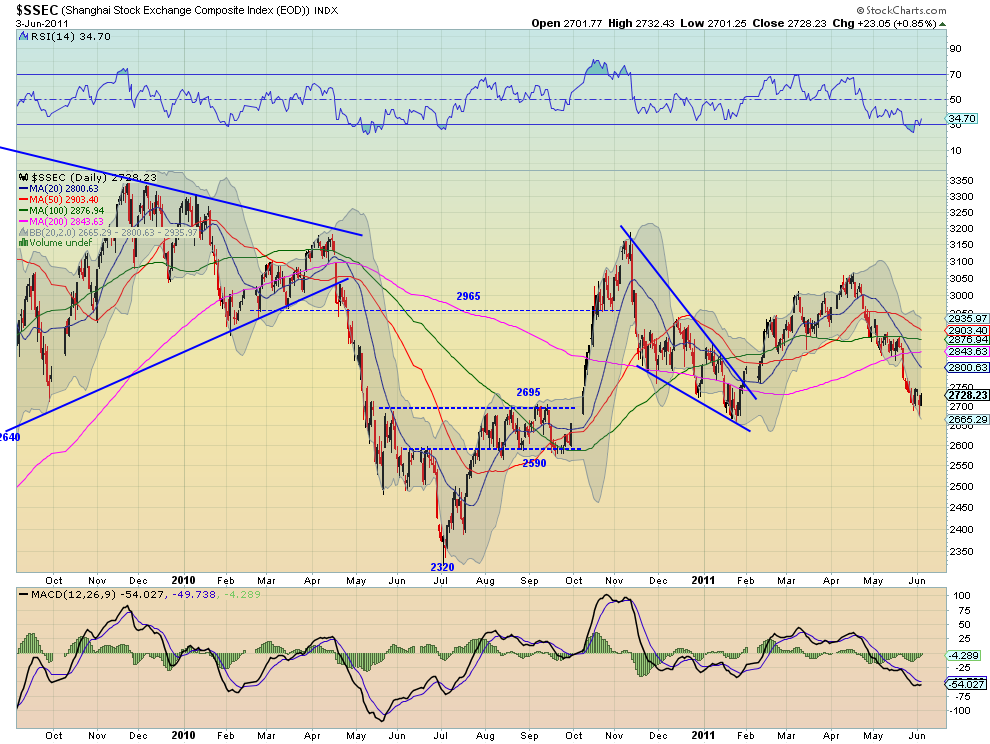

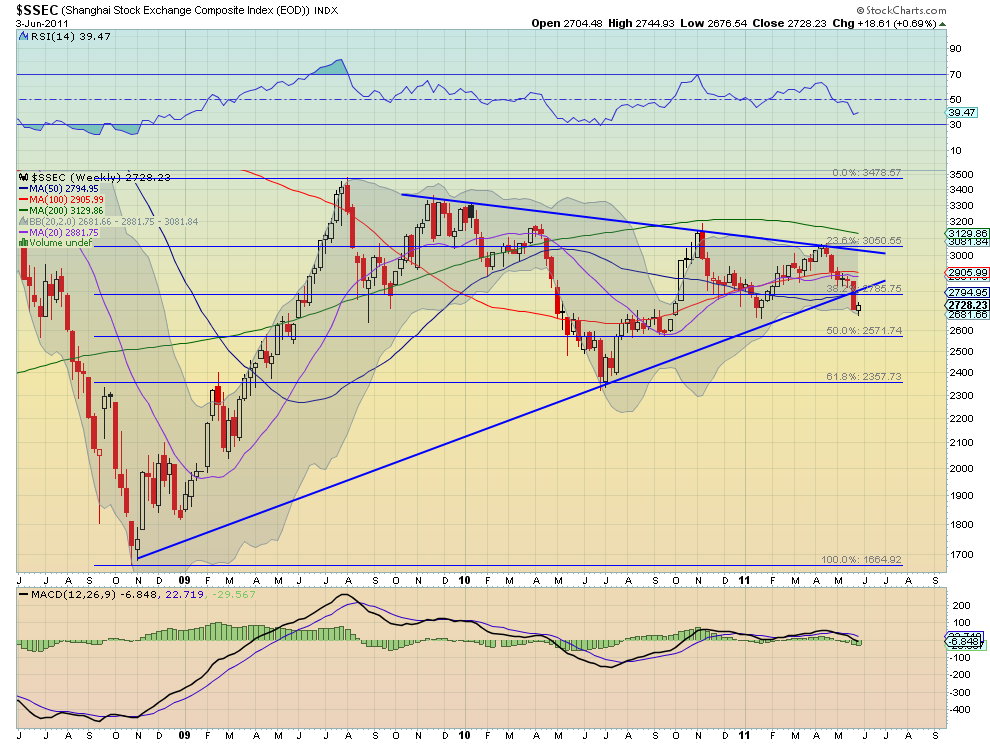

Shanghai Stock Exchange Composite Weekly,$SSEC

The Shanghai Composite consolidated in a bear flag at support 2695-2700 this week after a big fall last week. This allowed the RSI to work off the slightly oversold condition and the MACD to work back to level. The SMA’s turning lower suggest more downside. The weekly chart concurs with a falling RSI and a MACD growing more negative. Look for more downside short term but maybe more consolidation first with upside resistance at 2800 and a move above that changing the trend. A Measured Move (MM) lower would take it to the bottom of the support channel at 2590.

iShares MSCI Emerging Markets Index Weekly,$EEM

iShares MSCI Emerging Markets Index Weekly,$EEM

Emerging Markets, as measured by the EEM ETF, consolidated in their own flag of sorts over the 20 day SMA at 47.54 and below long term support/resistance at 48.78. The RSI on the daily chart shows this indecision resting on the mid line, but the MACD is diverging higher suggesting more upside. The weekly chart shows a solid black candle for the week holding over the 20 week SMA, and just under resistance. The flat RSI and MACD give little guidance for the next move. Look for a move above 48.78 to trigger another run to 50.17 but failure at 48.20 to lead to further consolidation in the channel above 44.30. So flat with a slight bias higher for the coming week.

VIX Weekly,$VIX

The Volatility Index tested both ends of the recent range again at 15 and 20 before settling in the middle. The SMA, RSI and MACD on both the daily and weekly charts are all still very flat and give little clue as to where the next move will be. Look for a continued tight range at relatively low levels within that range with upside possible up to 21.25 before any worries of increasing volatility.

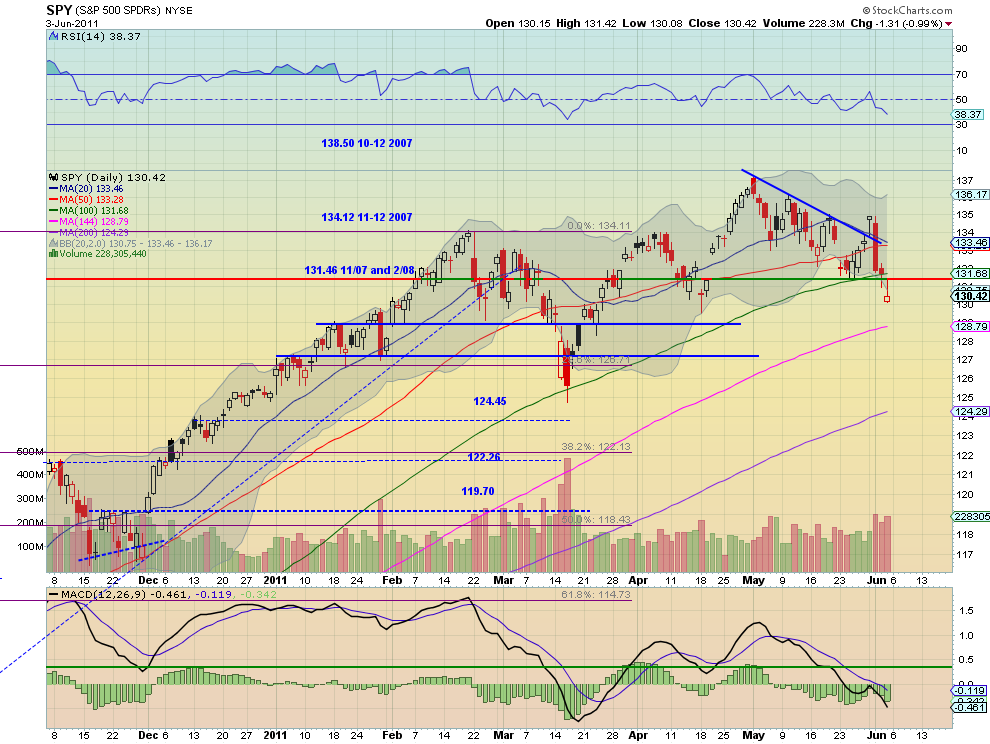

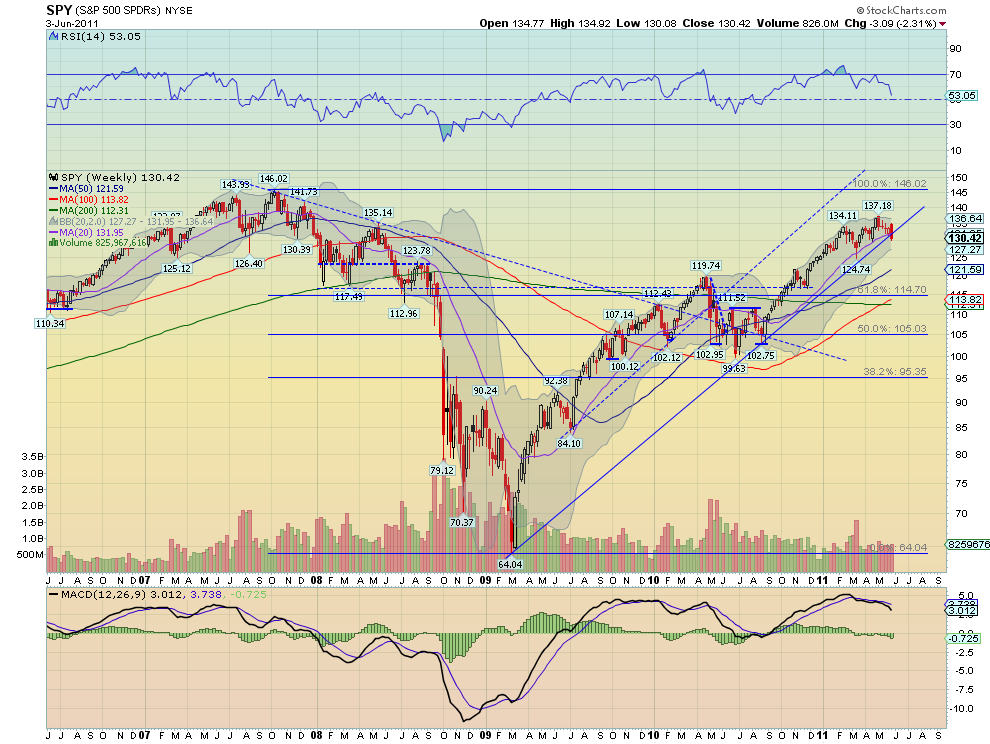

SPY Weekly,$SPY

The SPY popped to a higher high on Tuesday over the downtrend resistance only to fall back and continue lower the rest of the week closing with a Hollow Red Inverted Hammer Friday near support at 130 and a lower low. A possible reversal signal after a hard move lower. It also closed under the 100 day SMA for the first time since September, when the rally began. The RSI and MACD suggest that there is more downside to come and the elevated volume confirms that. The weekly chart shows a bearish engulfing candle through the uptrend support line and the 20 week SMA. The RSI is heading sharply lower and the MACD is increasing negative. Look for next week to bring more downside, minding the inverted hammer, with support next at the 129 area near the 144 day SMA and then 127.

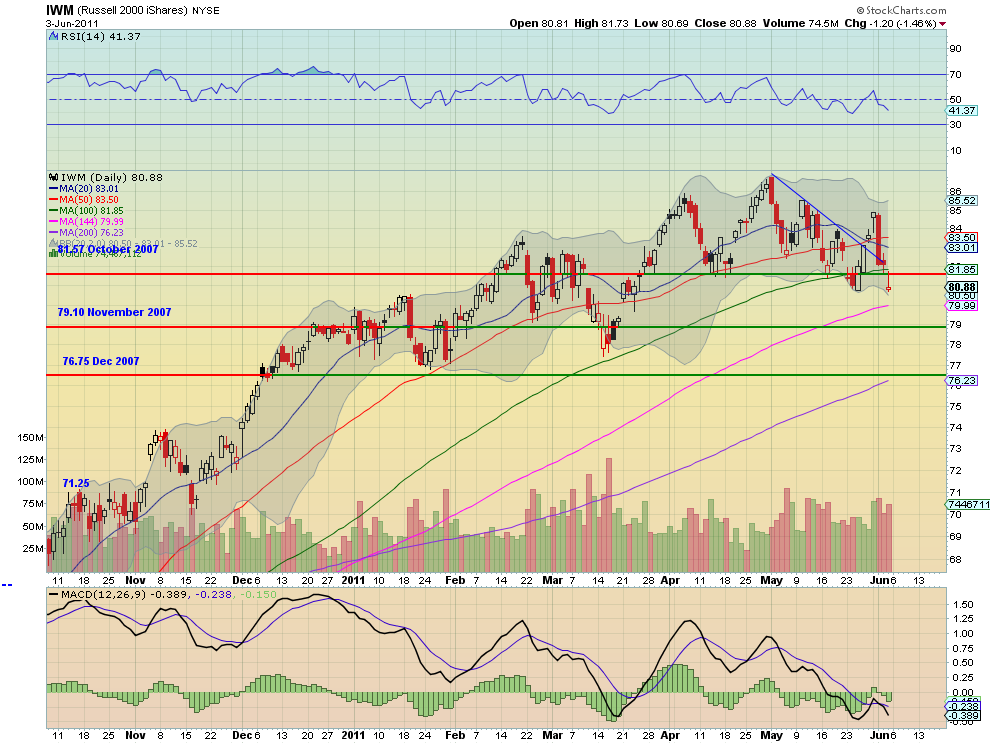

IWM Weekly,$IWM

The IWM also popped to a higher high on Tuesday over the downtrend resistance only to fall back and continue lower the rest of the week closing with a Hollow Red Inverted Hammer Friday near support at 80.60 and a lower low. It also closed under the 100 day SMA for just the third time since September, the other two being last week. The RSI and MACD suggest that there is more downside to come. The weekly chart shows a bearish engulfing candle just above the uptrend support line and under the 20 week SMA. The RSI is heading sharply lower and the MACD is increasing negative. Look for next week to bring more downside, minding the inverted hammer again, with support next at the trend at 80 near the 144 day SMA and then 79.10 and 77.

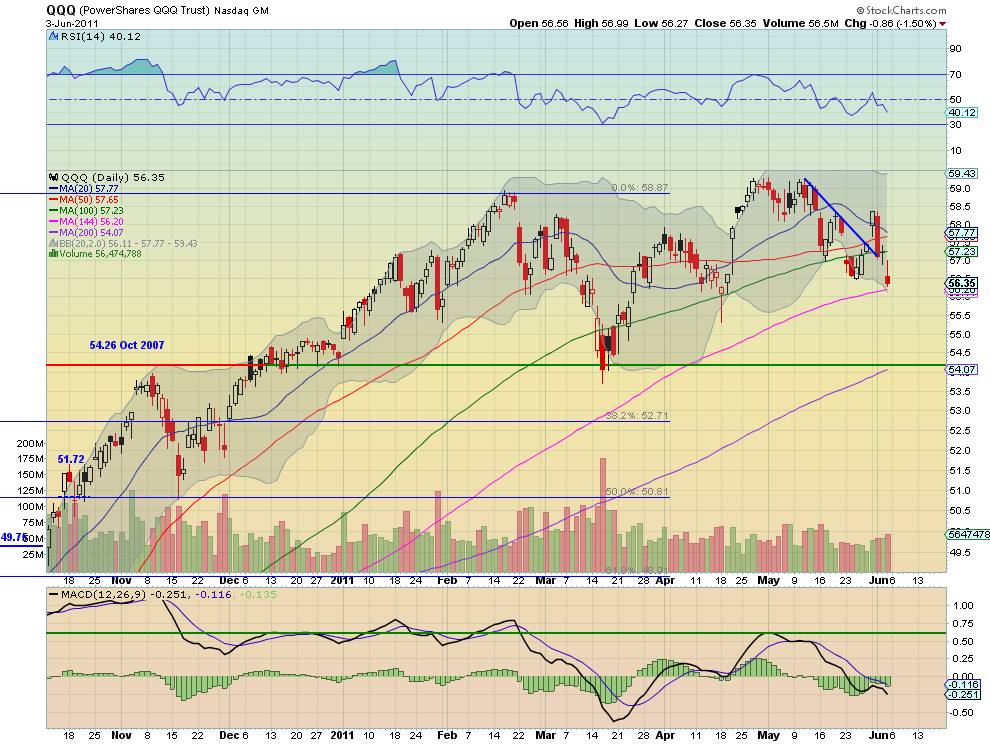

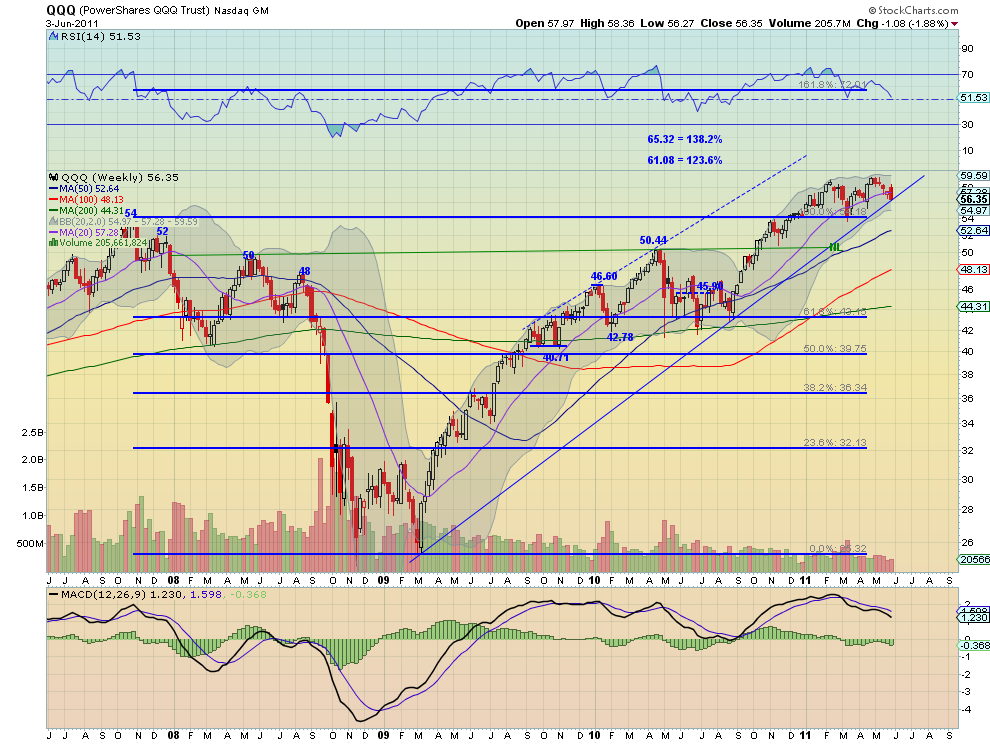

QQQ Weekly,$QQQ

The QQQ followed suit also popping to a higher high on Tuesday over the downtrend resistance only to fall back and continue lower the rest of the week closing with an Inverted Hammer Friday near support at 56.20, and a lower low. The RSI and MACD suggest that there is more downside to come. The weekly chart shows a bearish engulfing candle at the uptrend support line and under the 20 week SMA. The RSI is heading sharply lower and the MACD is increasing negative though only slightly. Look for next week to bring more downside, minding the inverted hammer again, with support next at 56.20 near the 144 day SMA and then 55.50 and 54.26.

The coming week look to continue the trend higher for Gold with Crude Oil drifting sideways to slightly higher. The US Dollar Index should continue lower while US Treasuries remain in an uptrend but with a potential reversal looming. The Shanghai Composite could continue its flag or head lower while Emerging Markets continue their flag or head higher. Volatility should remain subdued but start to watch for a break of 21.25 to change that. The Equity Index ETF’s, SPY, IWM and QQQ are all on the same page again and look lower. Use this information to understand the major trend and how it may be influenced as you prepare for the coming week ahead. Trade’m well.

Editorial Note: My service provider is no longer providing open-hi-lo, but only close data for Gold, Crude Oil and the US Dollar Index. I will be making a decision about substituting ETF’s for the going forward vs using close only data. If you have a preference please leave your thoughts in the comments.

No comments:

Post a Comment