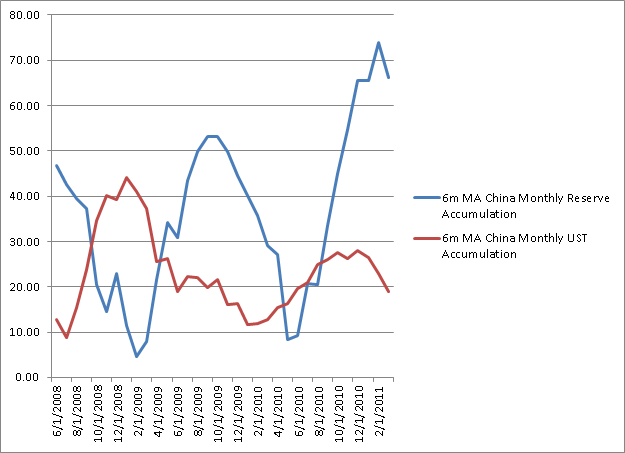

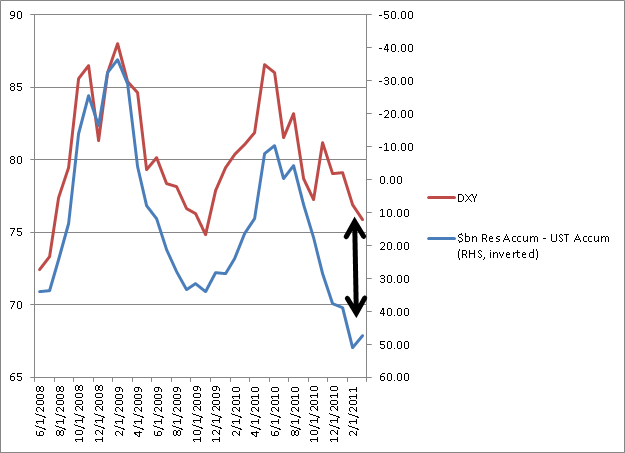

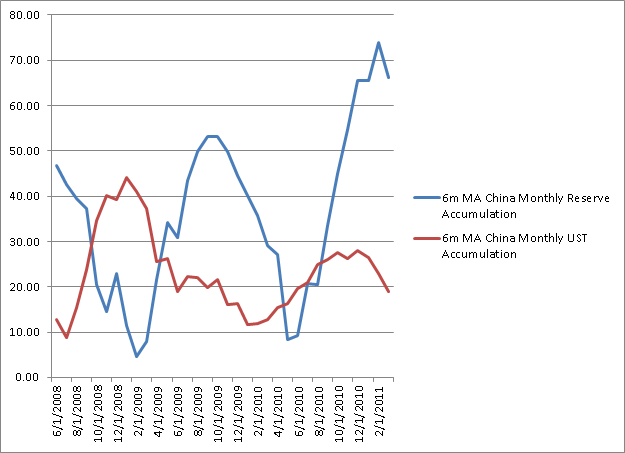

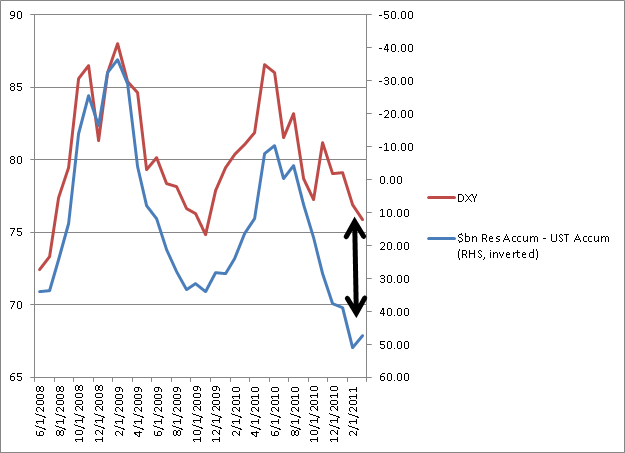

So it looks like QE2 indeed managed to scare China out of the dollar. This is the portfolio shifting previously discussed that’s been dragging down the dollar even though, fundamentally sound, as Fed Chairman Bernanke correctly stated. When China (and Japan) offered to buy Spanish and other euro zone national government debt to ‘help out’, the euro zone fell for that one, watching their currency rise against their better judgment with regards to their euro wide exports.

Maybe Fed Chairman Bernanke is aware of this, and has assured China he does favor a strong dollar as per his latest public statements, and let them know that QE3 is unlikely, and has ‘won them back’? No way to tell except by watching the market prices. And with most everyone out of paradigm with regards to monetary operations, there’s no telling what they all might actually do next. What we know is that the world fiscal balance is tight enough to be slowing things down, and looking to keep getting tighter.

QE/lower overall term structure of rates removes interest income from the economy, and shifts income from savers to bank net interest margins. If China’s growth is going to slow dramatically, it’s most likely to happen in the second half as they tend to front load their state lending and deficit spending each year. And all the while our own pension funds continue to allocate to passive commodity strategies, distorting those markets and sending out price signals that continue to bring out increasing levels of supply that are filling up already overflowing storage bins.

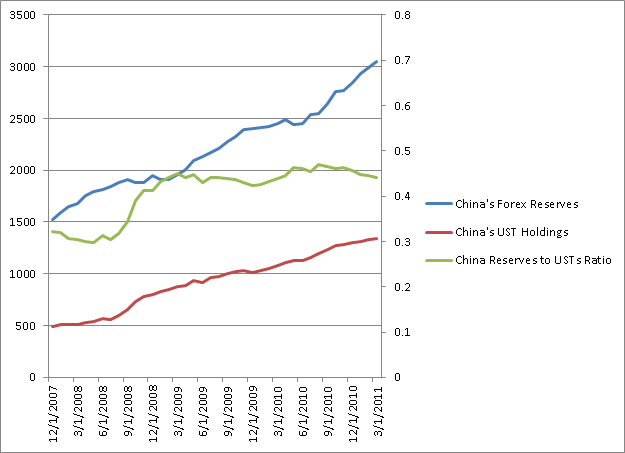

Note in particular that reserve accumulation has been high and rising recently, though UST accumulation has been moderate.

No comments:

Post a Comment