by Cullen Roche

We’re at an interesting point in the business cycle. There are signs that growth is waning, however, it doesn’t yet appear like a time to panic. The ISM index has been particularly notable. Last week’s ISM Services index showed a steep decline despite continued growth. As a diffusion index the ISM indices undergo cyclical patterns. The recent high readings are reassuring, but unlikely to sustain themselves.

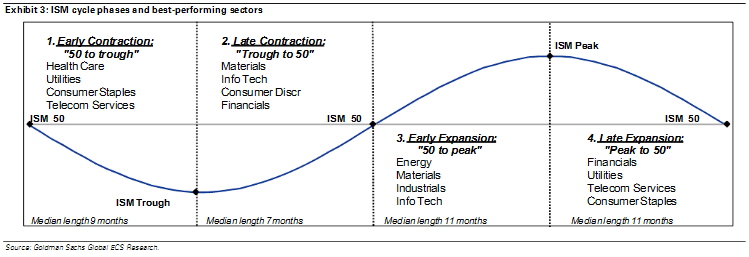

As growth peaks the investment cycle changes dramatically. Goldman Sachs has a very good note on this change. They see the ISM index as forecasting a slowing business cycle, but not a collapse in growth. This warrants a more defensive investment posture:

“A high level of growth favors cyclical parts of the equity market. A slowing rate of change signals a shift to become more defensive at the sector level. A transition points to significant turnover in 8 of 10 S&P sectors and 17 of 24 S&P industry groups.

ISM has remained above 50 for 20 straight months and above 60 for the past four months. However, the index may have peaked at 61.4 in February and is essentially unchanged over the past year so the business cycle signals are mixed. S&P 500 and most sectors pause around the ISM peak allowing time for investors to confirm a transition is underway and re-allocate portfolios into later cycle parts of the market. Around previous peaks S&P 500 has consolidated gains for about three months before resuming median positive returns of 13% as ISM falls from peak to 50. Every cycle is unique and return distributions are wide.”

No comments:

Post a Comment