by Cullen Roche

With earnings season largely finished we are beginning to generate some solid conclusions. One persistent trend this earnings season has been margin compression across many companies as costs surge. Danske Bank recently offered some good commentary on why this is setting off some red flags for them:

“…But beware – most companies are guiding down for Q2

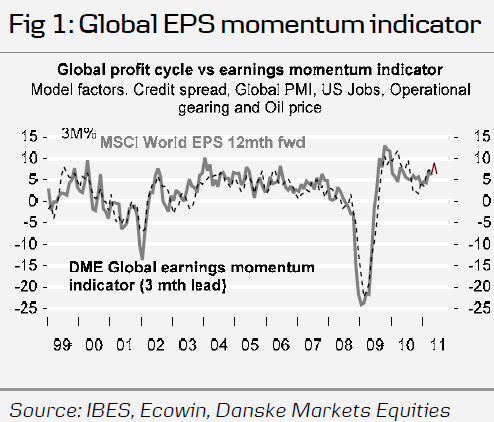

That we nevertheless urge caution going into Q2 is due to the challenges that we perceive for corporate earnings going forward. Companies have already felt the pinch from sharply rising input costs in Q1. Commodity prices have broadly speaking risen by some 70% on average since mid-2010, and this is being reflected in spiralling prices. Hence companies are already seeing their margins squeezed and this will intensify in Q2. This is also why twice as many US companies are now cutting their expectations for Q2 as raising them. On the positive side, the figures suggest that growth is merely being postponed to late 2011 and 2012, when there are more upward than downward outlook revisions. We further see a risk to company earnings in Q2 from a temporary slowdown in the global economy. Our concerns stem from the monetary policy tightening currently under way in the developing economies and Europe (ECB) and also the fiscal cutbacks that are being enacted in the EU and that are so obviously needed in the US. Both factors will shift the focus from growth to tightening, which all else being equal will undermine companies’ ability to pass along input cost increases to output prices and softening sales volumes. This will be further reinforced – especially in the US – by the effect on consumption of the soaring energy prices.”

No comments:

Post a Comment