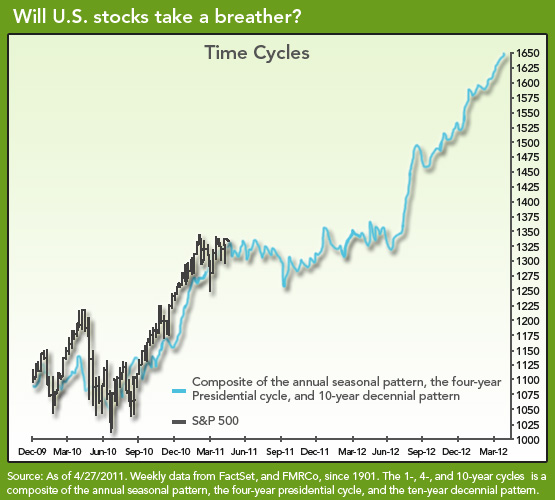

Here is an interesting expansion on the idea of Sell in May. Fidelity Investments elaborates by combining several time cycle indicators into one. The result – still Sell in May:

“On the negative side, it is coming to that point in the cycle where, seasonally, the market tends to take a pause, also known as Sell in May and Go Away.

Since, historically markets have tended to follow cyclical patterns such as this, I compiled the seasonal pattern, the four-year presidential cycle, and the 10-year decennial cycle into a composite performance index and projected the pattern. So far, the stock market has followed this roadmap very closely, so over the next two years. As you can see in the chart below, the market has closely tracked these historical cyclical patterns Since December 2009. Because of this, I think it bears watching. (Past performance is no guarantee of future results.)”

See the original article >>

No comments:

Post a Comment