by Cullen Roche

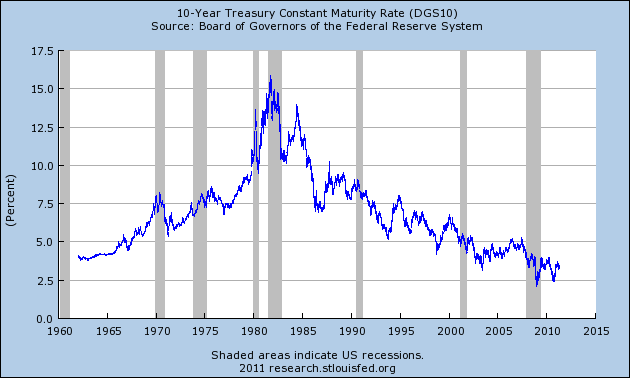

The US Treasury bubble continues to collapse HIGHER….If you bought long bonds exactly 12 months ago you have achieved a total return of ~5.5%. That’s not world beating, but it’s certainly not bad. What’s been so interesting about the US Treasury market, however, is that yields simply refuse to surge higher. Supposedly, there is high inflation. Supposedly, there are bond vigilantes just waiting to take out the USA on a slab and dump her in the ocean of default. Supposedly, we have a fiscal problem that will render us the next Greece. Supposedly, we are “running out of money”. Of course, none of this is really accurate and the US Treasury market is reflecting that reality.

In a death march similar to Japanese Government Bonds in the 90′s, US bond investors continue to try to call the US Treasury market a “bubble”. Some readers might think I spend most of my time trying to slay bubbles (given the recent surge in hate mail regarding my silver bubble call), but I have spent quite a bit of time trying to quell fears in the US Treasury market as well. After all, this bubble talk in treasuries has been going on for the better part of the past 5 years+ and an odd thing keeps happening – the bubble callers keep looking back in awe as yields simply refuse to surge as so many have predicted.

Of course, anyone with a sound understanding of our monetary system (see here for a guide) can see that there is no such thing as bond vigilantes for a nation that is the sovereign issuer of its currency in a floating exchange rate system. You also understand that it is nonsensical to argue that the USA is remotely similar to Greece, a household or a business (all of whom are currency USERS). And most importantly, you see that bonds have no relationship to the nation’s financing operations. The only reason yields would surge is if the country were in fact suffering high inflation or at risk of hyperinflation. The treasury market is sending a loud message, however – those calling for hyperinflation, default or even high inflation are dead wrong. The JGB death march (now the UST death march) continues…..

No comments:

Post a Comment