by

Metals ETF’s have been moving as if they have no connection to each other. But they are a family. With each family member taking on a different role. The dominant first born. The middle child unafraid of authority pushing the boundaries. And old Uncle Jessie who has his ups and downs. Gold (ticker: $GLD) is like that first born child. Look at the weekly chart below.

In a steady up trend since making a low in November 2008 GLD just keeps plugging higher. Occasionally it visits the trend line around the 20 week Simple Moving Average (SMA) but there is no confusion about where this confident metal is heading. look for the pullbacks to the trend and 20 week SMA to buy or add to your position.

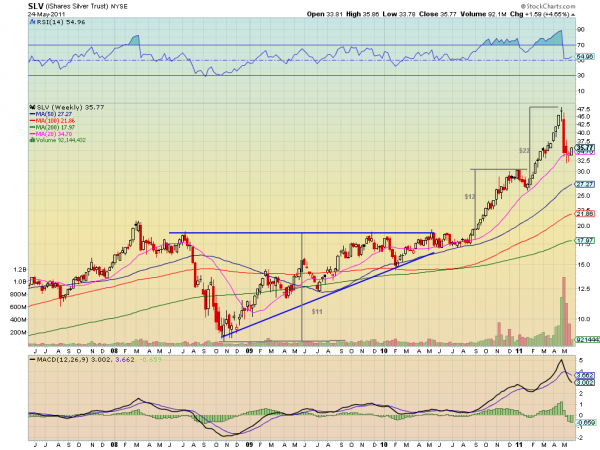

The Silver ETF (ticker: $SLV) is like the middle child. It heads forward in fits and starts and then occasionally runs away to test the boundaries, like when it culminated in a parabolic top 4 weeks ago. After being punished for that move it is trying to get back on track now with a bullish candle on the weekly chart through the first 2 days of this week, also off of support of the 20 week SMA. If it can get above 36.20 then it could be off to the races again.

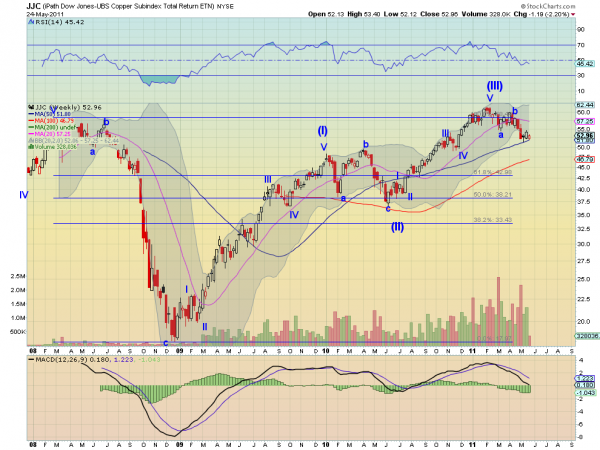

Old Uncle Jessie has put in a hard life working and has his good and bad times. The Copper ETF (ticker: $JJC) is the working man metal like Uncle Jessie. The weekly chart above shows the Elliott Wave count now in corrective Wave (IV) before moving higher. Elliott guidelines suggest that this pullback will end before it hits 50, and then start Wave (V) higher. The quick support of the 20 week SMA does not hold the same magic for JJC. The current bear flag on the 50 week SMA suggests a continuation lower to the 100 week SMA at 46.79 is likely. So how does Uncle Jessie feel? Looks like he woke up with a spring in his step today.

No comments:

Post a Comment