By JJ Abodeely, CFA

As discussed in previous posts, the benefit of a normalized P/E ratio (and a historical perspective) is that it gives us cues on whether the current price of the market is cheap or expensive and thus whether future returns will be high or low.

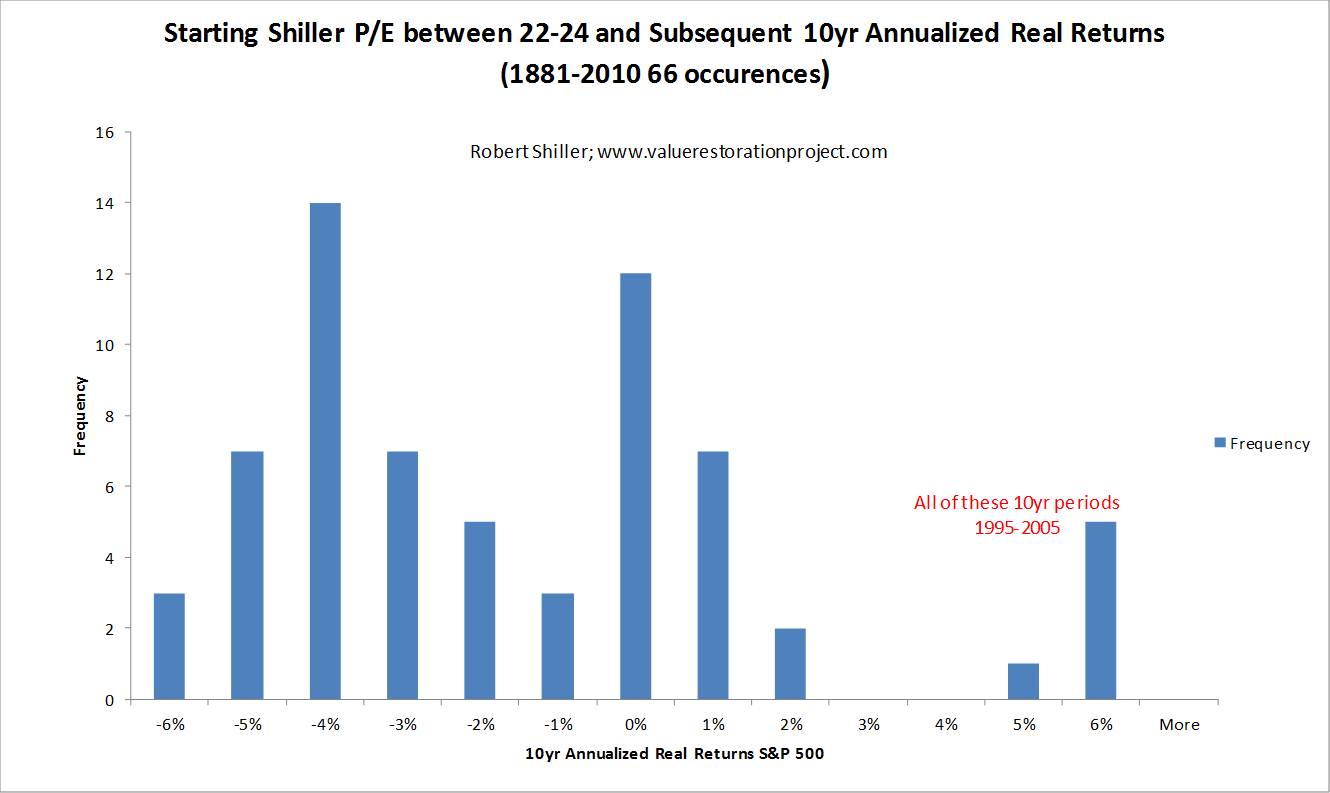

But just how disappointing are returns likely to be? I spent a few hours on Friday afternoon geeking out in excel. I found that when the cyclically adjusted P/E ratio is between 22 and 24 (as it is now) the average annual real returns (after inflation) for the subsequent 10 years is -2.6%! And as usual, the average doesn’t quite tell the whole story. In the 66 month ends since 1881 when the P/E was between 22 and 24 the distribution of subsequent returns looks like this:

The median return is -3.7% real. It seems exceedingly likely to me that long-term returns for the stock market from here will be negative. I don’t think most investors are prepared for these sort of outcomes over the next decade.

Several successful investors use the same concepts to drive actual estimates of future market returns.

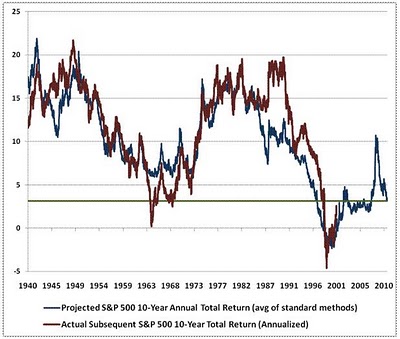

John Hussman, PhD uses this methodology to help drive decision making with his mutual funds. His recent work produces estimated NOMINAL returns over the next 10 years of 3.1% annualized which may be close to zero real returns depending on inflation.

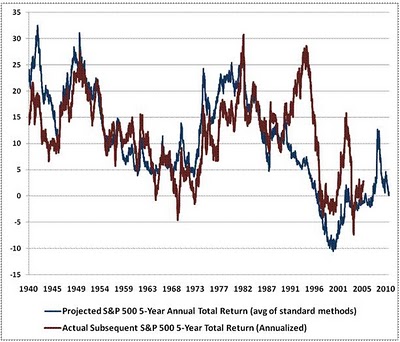

Using a 5 year time frame, the “probable outcomes” are even worse, with 0% projected nominal returns.

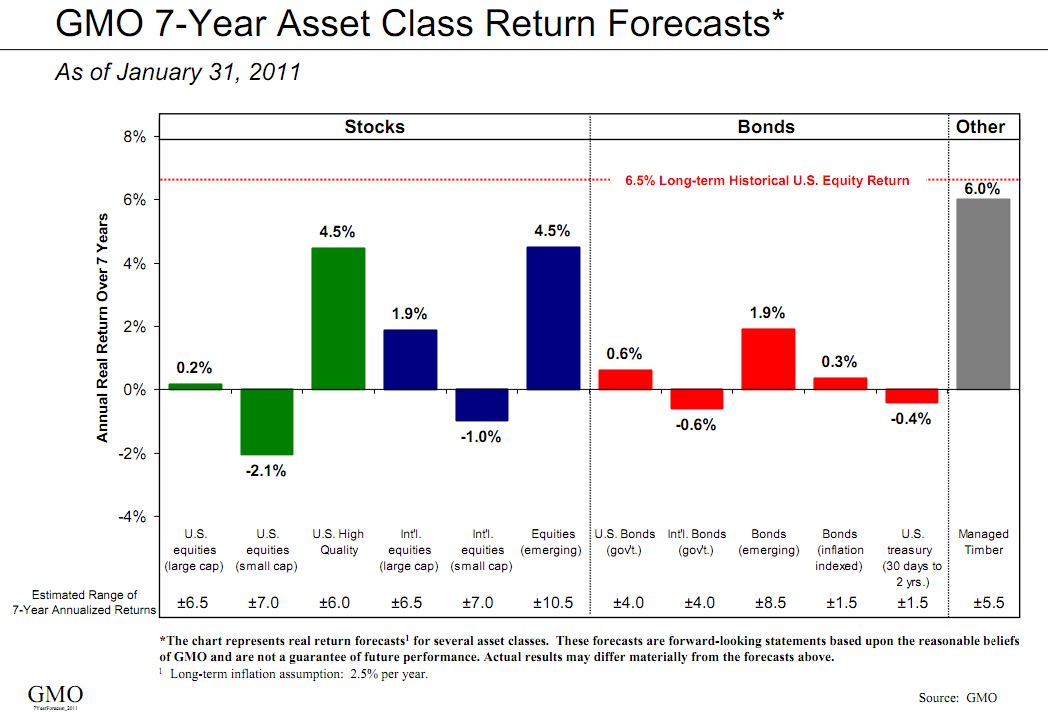

GMO does similar work with additional emphasis on where profit margins are relative to normal (and likely to revert towards) and does so across various asset classes and publishes their results monthly. These are also nominal returns and are certainly not high enough to warrant a buy and hold or long-only approach especially when one considers that this is just a range of estimates and the downside to low estimates is equally as likely as the upside.

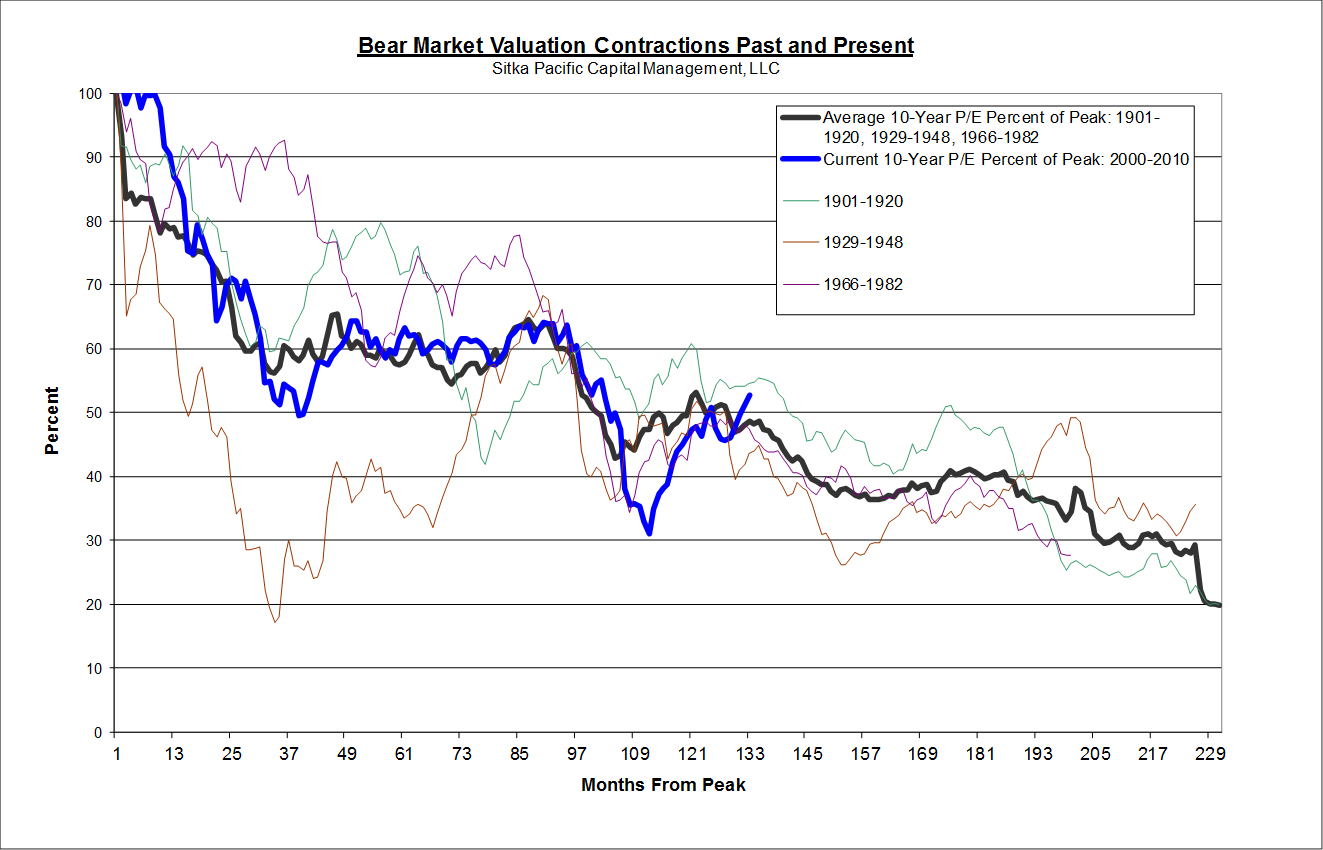

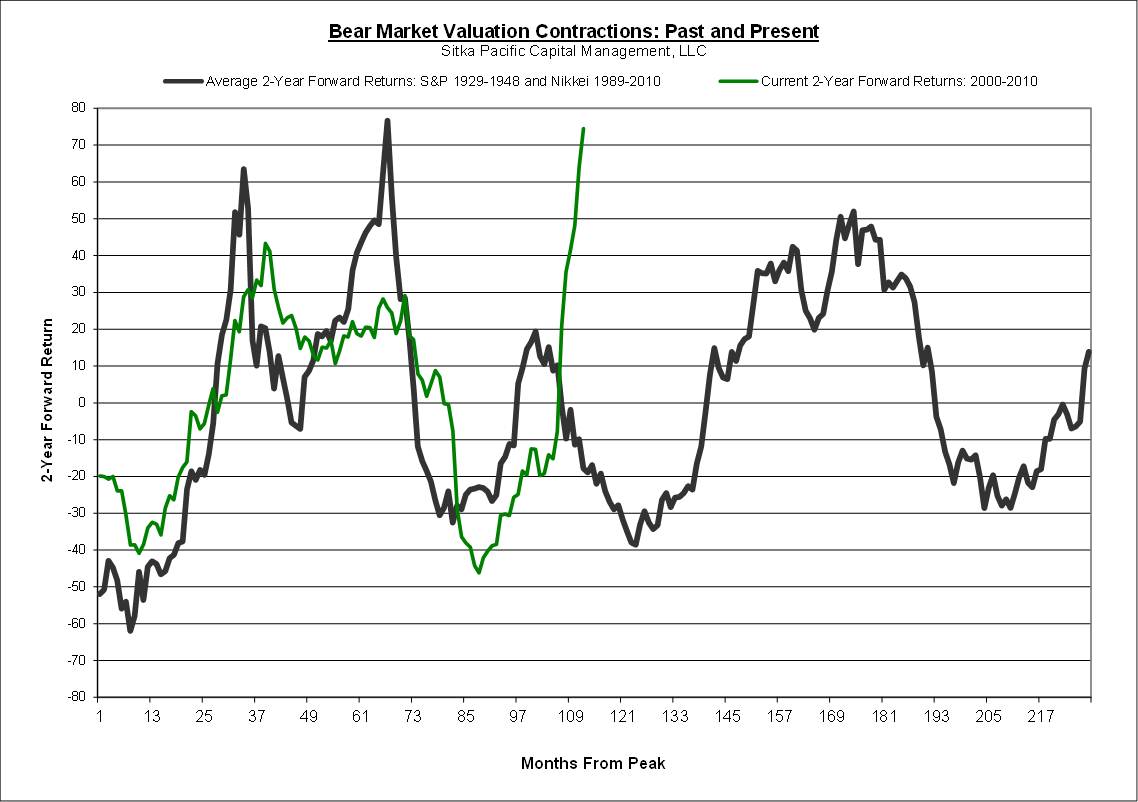

The fact is that what you pay matters and expensive markets today mean low or even negative prospective returns going forward. The value restoration project, which began with the peak of the stock market in 2000, is ongoing despite a 2 year cyclical rebound on the heels of unprecedented stimulus.

Read the Sitka Pacific Annual Review for more on the multitude of challenges facing investors.

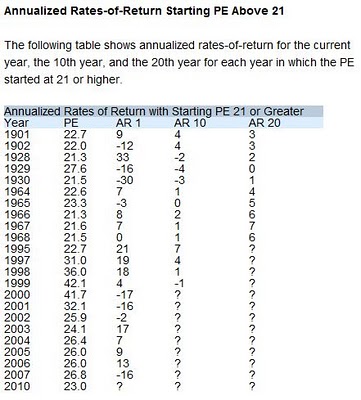

Of course, in the short term the market can get more expensive. Those calling for negative returns in 1997 or 1998 based on this sort of methodology were certainly frustrated over the course of the next 2 years as the market when from merely expensive to insanely bubblicious. My colleague Mish had a nice post looking at the returns over various time periods when you start with expensive markets. In the first year the returns ranged from -30% to +33%.

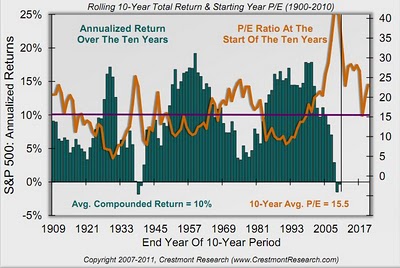

I believe this are nominal returns which means that all of those single digit 10 year returns starting in the late 60s were certainly negative after the effects of inflation.

Secular bear markets ALWAYS have powerful rallies which has nothing to do with the fact that bear markets NEVER end until the market is “not just interesting, but rather commandingly, and compellingly cheap.” I don’t portend to have a crystal ball, but it seems to me that our powerful bear market rally is getting rather long in the tooth.

No comments:

Post a Comment