There are, in my opinion, few things that threaten the sustainability of economic growth more than market disequilibrium. As I’ve discussed in recent months it is not mere coincidence that the Fed’s increasing involvement in the economy has coincided with the increase in market bubbles in recent decades. The Fed has helped exacerbate the financialization of the US economy and this has helped directly contribute to our current predicament. The result has been an appearance of stability inside an increasingly unstable system that is characterized by high valuations, more frequent recessions, deeper recessions and a growing discrepancy in the quality of life across the country.

This evolution has been fairly simple in my opinion. The highly flawed economic theory of the 60′s & 70′s led policymakers to believe that markets were self regulating systems that could be largely controlled so long as the money supply was managed adequately. These flawed theories resulted in mass de-regulation, placed a specific emphasis on monetary policy and gave the Fed an increasingly important role in markets. Because the Fed can only intervene in markets via the banking system it was only natural that the Fed’s increased role in markets resulted in an increasingly important role by the banks themselves. This resulted in what is now an obvious financialization of the US economy. The effect of this financialization has become apparent in recent years as the banking system nearly brought the entire system to its knees in 2008. But this financialization is far from over. Since no reforms were implemented following the recent crisis (and the Fed and banks grew MORE powerful) it’s not incorrect to assume that this cycle of booms, busts and bubbles is not over. And we’re already seeing signs that the problems are only growing again.

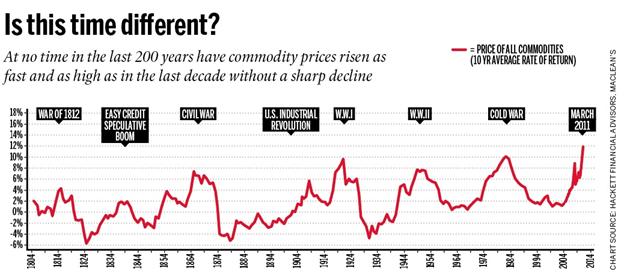

As I’ve discussed in recent months the latest victim of the Fed’s intervention appears to be the commodity markets. And I’m not the only one who has noticed this disequilibrium. In his latest missive John Hussman discusses the recent rise of the bubbly commodity market:

“On that note, it’s clear to me that we’re seeing classic bubbles in a variety of commodities. It is very unlikely that this is due to global demand growth. Even with an exhaustible resource, it is a well-known economic result (Hotelling’s rule) that the optimal extraction rule is one where the price rises at a rate not much different from the interest rate. What we’ve seen lately is commodity hoarding, predictably resulting from negative real interest rates provoked by the Fed’s policy of quantitative easing.”“Fortunately for the world’s poor, the speculative dynamic that has created a massive surge in commodity prices appears very close to running its course, as we see very similar “microdynamics” in agricultural commodities as we saw with oil in 2008. That’s not to say that we have a good idea of precisely how high prices will move over the short term. The blowoff phase of a bubble tends to be steep, but so short-lived that it affords little opportunity to exit. As prices advance in an uncorrected parabola, the one-sided nature of the speculation typically gives way to a frantic effort of speculators to exit simultaneously. Crashes are always a reflection of illiquidity in two-sided trading – the inability of sellers to find eager buyers at nearby prices.”

There’s no telling when a bubble ends and it’s impossible to quantify its impact. Oliver Wyman Group thinks this commodity bubble could be far from its climax, but they are clear about its impact:

“Western central banks pumping cheap money into the financial system was seen by many as having the dual purposes of kick-starting Western economies and pressing China to appreciate its currency. Strict capital controls initially enabled the Chinese authorities to resist pressure on their currency. Yet the dramatic rises in commodities prices resulting from loose Western monetary policies eventually caused rampant inflation in China. China was forced to raise interest rates and appreciate its currency to bring inflation under control. The Western central banks had been granted their wish of an appreciating Chinese currency but with the unwanted side effect of a slowing Chinese economy and the reduction in global demand that came with it.Once the Chinese economy began to slow, investors quickly realized that the demand for commodities was unsustainable. Combined with the massive oversupply that had built up during the boom, this led to a collapse of commodities prices. Having borrowed to finance expensive development projects, the commodities-rich countries in Latin America and Africa and some of the world’s leading mining companies were suddenly the focus of a new debt crisis. In the same way that the sub-prime crisis led to a plethora of half-completed real estate development projects in the US, Ireland and Spain, the commodities crisis of 2013 left many expensive commodity exploration projects unfinished.

Western banks and insurers did not escape the consequences of the commodities crisis. Some, such as the Spanish banks, had built up direct exposure by financing Latin American development projects. Others, such as US insurers, had amassed indirect exposures through investments in infrastructure funds and bank debt. Inflation pressure in the US and UK during the commodities boom had forced the Bank of England and Fed to push through a series of interest rate hikes that forced many Western debtors that had been holding on since the subprime crisis, to finally to default on their debts. With growth in both developed and emerging markets suppressed, the world once again fell into recession.”

I am not so certain that the end of this bubble is far off. As I said above, booms and busts appear to be becoming more frequent. In “The Bernanke Put and the Fed’s Trilemma” I discussed how the current environment is not dissimilar to a very obese man who suffers a series of heart attacks, but because he never resolves his inherent problems, his health problems only continue to deteriorate:

“What I fear most about the current cycle is that we have not allowed the markets to sufficiently clear. If that is the case you can think of the global economy like an obese man who fights to lose weight in an effort to fend off what is an almost certain heart attack. After a multi decade binge he suffers a massive heart attack (think LTCM circa 1998). The doctors save him by intervening, but they don’t actually help the man fix his inherent problems (dying internal organs and lack of discipline). In the case of the economy this is global imbalances, structural flaws in the banking system and a lack of regulation. The man vows to lose 50% of his total body weight, but after losing 20% of his total body weight he decides the process is too grueling and is taking too long. A fast food restaurant opens up next door (hello government bailouts!). He once again feels the need to stimulate his lust for food. So, he binges again (think Greenspan 2001). A new boom occurs before he ever becomes fully healthy. Over the ensuing 7 years his body weight doubles. He’s now 60% heavier than he was in 1998! Of course, this is unsustainable. His body begins to breakdown. Before you know it he is suffering a total system failure (think Lehman brothers). But again, thanks to modern medicine (or incessant Fed intervention) the man is once again saved. Over the following year he loses 25% of his body weight. It’s an arduous process and certainly not enjoyable, but it must be done. The good news is he’s 25% lighter. The bad news is he’s 20% heavier than he was in 1998 when he had his first setback. Nothing has changed inherently. He has the same failing internal organs and the same failing disciplines. But his next binge begins from a weaker starting point and a more dangerous level. You can imagine how this story ends.”

We are indeed the obese man who simply refuses to accept that he has a very real problem that requires dramatic lifestyle changes. It’s clear that policymakers have no interest in accepting the facts. But as investors we can calculate the risks and attempt to sidestep the Fed’s landmines. Forewarned is forearmed. As Mr. Hussman says, “The blowoff phase of a bubble tends to be steep, but so short-lived that it affords little opportunity to exit.” With the exception of gold (which will serve as a fear hedge), commodity prices look increasingly unstable….

No comments:

Post a Comment