By Rohan Clarke, Data Diary

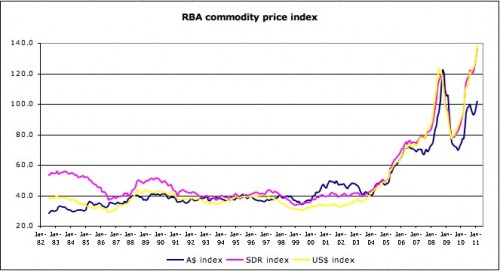

Another month rolls by (Feb report here) and commodities still power on – the RBA published it’s monthly commodity index (here):

The prices of Australia’s basket of commodity exports climbed higher against all comers.

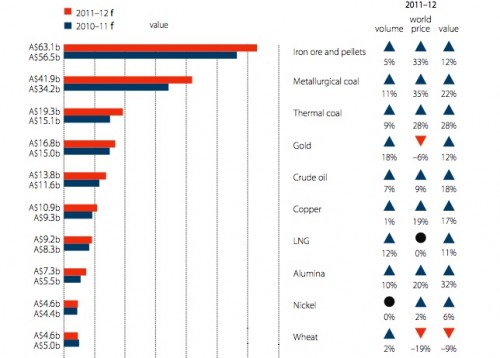

Preliminary estimates for February indicate that the index rose by 2.2 per cent (on a monthly average basis) in SDR terms, after rising by 5.3 per cent in January (revised). The largest contributors to the rise in February were increases in the estimated prices of iron ore and coal, reflecting some further adjustment towards the higher contract prices in the March quarter. Increases in the prices of crude oil and wheat also contributed to the rise, while beef & veal prices fell. In Australian dollar terms, the index rose by 1.9 per cent in February.

That is a pretty buoyant outlook for our commodities exporters, however you paint it – all those Chinese farmers moving into brand new apartments have to get a fridge, dishwasher and playstation from somewhere.

So how much are equity prices reflecting these types of expectations? Well, running through valuations for some of Australia’s major miners, it looks like both volume and price assumptions of this ilk are baked into prices. Consider BHP ostensibly trading at ~10.5 times 2011 forecast earnings and 9.0 times 2012. Looks reasonable – on the assumption that China demand growth continues apace – and therefore commodity prices at least hold around today’s levels.

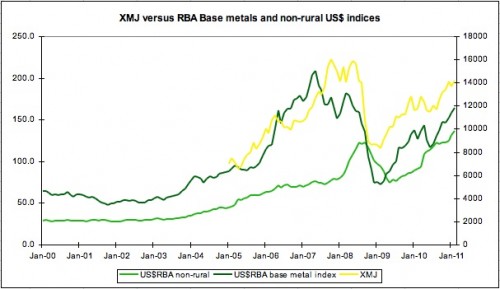

We can see the tight correlation between spot commodity prices and those of the commodity producers in the following chart that maps the RBA’s US$ base metal price index against the Australian materials index (XMJ). We’ve included the non-rural index to highlight the point – resource equities are a risk market that take their lead from the more visible and tradeable metals markets:

It is because resource equities have kept pace with spot price appreciation that the risk/reward is skewed against owning them. For equities to move higher from here, commodity prices need to climb further – something that is becoming progressively harder and harder to sustain.

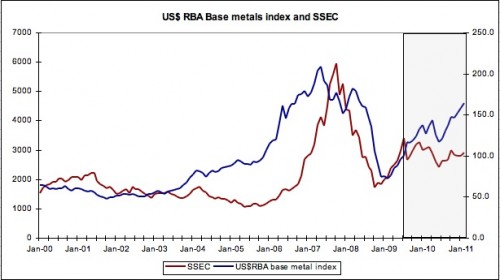

Which gets me to the thought that has been nagging away – will higher commodity prices create their own demand destruction? It’s an extension of Morgan Stanley’s point on oil prices (via Pragmatic Capitalism here). Not only are higher energy prices likely to undermine the economics of many a zinc, aluminum and copper refiner, the higher raw material prices are doubling up the total cost for the end user. Perhaps this is why Chinese equities have been underperforming commodity equities for some time now?

For a reality check on how Chinese demand might evolve in a tighter credit environment read this article from AsiaOne news “Chinese steel prices slip again as demand falters” (here). The following quote would have Minsky rolling his eyes in despair:

“The interest rate hike hasn’t been so awful for traders as long as the commodity prices are high, but the really painful thing is the credit crunch – steel traders cannot borrow money,”.

No comments:

Post a Comment