by Ben Carlson

Every time I write about commodities being a poor investment option over the long-term, I get a few comments such as this one:

Yeah, but what about the 1970s?

The 1970s were probably one of the most difficult decades for investors in the traditional asset classes. Stocks and bonds posted positive returns, but those returns were completey consumed by the sky high inflation which reached as high as 13% a year by 1979. Short-term T-bills even outperformed both stocks and bonds because of the rising interest rates environment. Basically the entire decade was a mess. Except for commodities, that is.

The S&P Goldman Sachs Commodity Index (GSCI) does actually go back to 1970. And the returns in the 1970s were impressive – up 21% annually. These returns should be put into context, though. The price of oil was up 870% from the OPEC oil embargo. Once the price of gold became unpegged in 1973 it rose nearly 1,000% for the remainder of the decade.

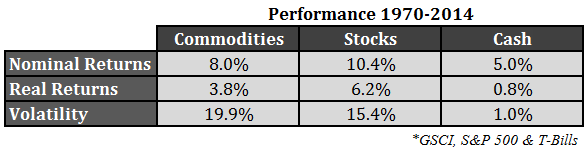

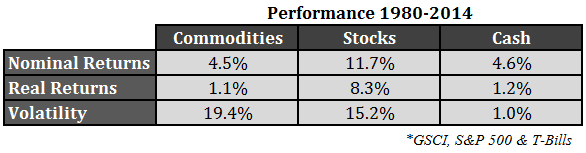

Regardless, the 1970s did happen, caveats and all. If you look at the data on the GSCI starting in 1970 through 2014, commodities look like a pretty decent long-term asset class:

Eight percent annual returns with little-to-no correlation to U.S. stocks (0.09 to be exact. What’s not to like? Sounds like the perfect portfolio diversifier. Now take a look at the returns from 1980 on:

Commodities had nearly identical volatility characteristics in both periods, but after 1980 they returned less than ultra-safe cash equivalents. Cash-like returns with stock-like volatility for 35 years does not make for a very compelling long-term asset class.

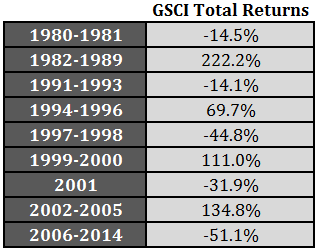

That’s not to say that commodities won’t have huge gains at times. In fact, the sentiment is so heavily skewed towards deflation, low growth and low interest rates forever right now that an unexpected rise in inflation in the coming years could lead to great returns in commodities for a time. You can see the volatility in commodities throughout the years by looking at the large gains and losses since 1980:

There are obvious supply and demand issues to consider, but I think the real reason they’re so volatile is because they’re basically in constant competition with technology. This is why I always say that commodities are trading vehicle, not a long-term investing vehicle. There’s a huge difference. If you’re truly worried about a 1970s-style price shock, then commodities will probably be your best bet. The question is: Can you wait that long for a low probability event that may never happen?

I think it makes sense to plan for a wide range of possible outcomes with any portfolio. But I’m not sure banking on 1970s-style inflation at all times is one of them. I’m not saying it’s not possible. Anything is possible. I’m just not sure you want to carve out a huge piece of your portfolio for a single situation like that which is unique historically. Almost 45% of the entire gains for the GSCI during the 45 year period from 1970-2014 were earned in the 1970s.

Also, oil currently makes up around 47% of the GSCI index, with the remaining allocation spread fairly evenly among agriculture-based commodities and metals (gold is actually only 2% or so of the index). That’s a fairly big bet on the energy sector.

There are alternatives that can protect investors from future inflation that are less volatile (TIPS) or offer a better return profile (REITs and even high quality dividend stocks) than commodities.

No comments:

Post a Comment