by Sober Look

In addition to property market challenges and the unexpected slowdown in manufacturing expansion, we continue to see markets signaling a significant loss of momentum in China's economic growth. Earlier in the year the country's economic trajectory was quite uncertain. This was followed by a strong pickup in manufacturing activity early this summer and economists suggested that the worst is over. But it seems that China is once again facing significant headwinds.

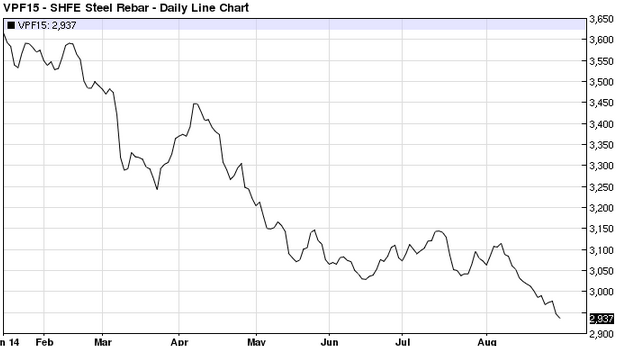

The nation's industrial commodities are hitting new lows, particularly iron ore and the Shanghai-traded steel rebar.

Iron Ore 62% Fe, CFR China; Jan-2015 contract (barchart)

SHFE Steel Rebar January 2015; Jan-2015 contract (barchart)

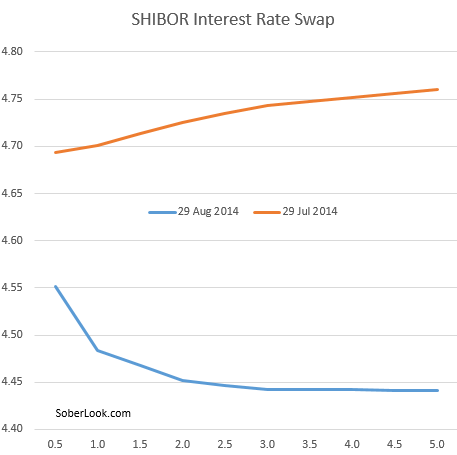

Other commodities linked to construction, such as fiberboard, have been declining as well. Moreover, the recent stock market rally has stalled. Perhaps the most telling sign of weakening fundamentals in China has been the nation's rates market. Rates implied by SHIBOR-based interest rate swaps have declined materially over the past month. More importantly the yield curve has become inverted.

Swap rates by maturity (yrs)

As discussed before, economic weakness in China is reverberating globally - from Australia to the Eurozone - and is in part responsible for the bond yield compression across developed economies. We are likely to see the central government step in with more stimulus in order to stabilize the situation. However, as Beijing is beginning to realize, limited new stimulus directed at boosting growth is becoming less effective. A much larger effort may be required.

No comments:

Post a Comment