By Phil of Phil's Stock World

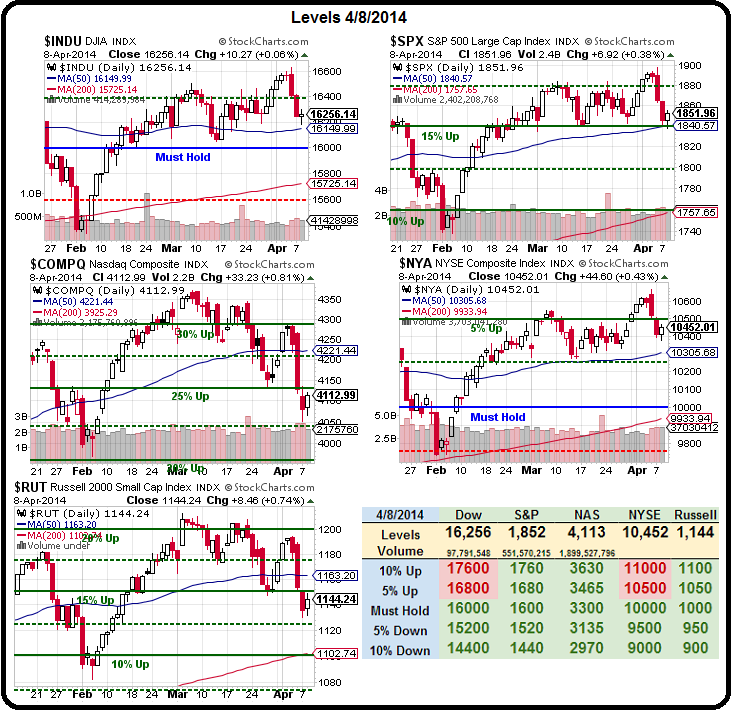

| As nasty as our Big Chart looks at the moment, we only have two Vomiting Cobra Patterns (Nasdaq and Russell) while the other three indexes are still forming Spitting Cobras, which are only LIKELY to head lower.

Forget the Ukraine, there's an all-out Global currency war being waged as we speak and yesterday the Dollar was the clear winner by losing 1% of its value in a single day. With over 250 days left until the end of the year, that extrapolates out to -150% by Christmas, which means you'd better start shopping now, before your next IPhone costs $1,000 (if you can afford the gas to get to the store, that is).

A weak currency may not be good for those with JOBS, who get paid in Dollars, or those with small businesses, who buy more and more expensive raw materials and then have to accept Dollars from customers. But for our Corporate Citizens, it could not be better. They sell 50% of their goods overseas so a weak Dollar is great for sales and it lowers the relative wages they pay US workers and, of course, it makes Dollar debt so much cheaper to pay back. That is how the Interests of our Corporate Citizens and the Government align. Our Government also has a lot of debt to pay back, but they have to pay it back in Dollars and, the less the Dollar is worth, the cheaper it is to pay it back. USUALLY, when your currency is weak, interest rates rise to compensate – so there's a check and balance to the system but the Fed has destroyed those checks and balances, allowing us to devalue our currency with NO CONSEQUENCES – EVER!!!

Well, maybe not "ever," as other countries (cough, Japan! cough, cough) also have mountains of debt that they would like to print their way out of too. China wants a weak currency so they can sell their goods overseas and Germany wants a weak Euro for the same reason. So it's a global race to the bottom and Corporations love it as it even boosts their earnings since they sell the same stuff now for $40 that they used to sell for $20 10 years ago. It makes every CEO look like a genius. He boosts the "earnings" of his company and justifies his bonus – which keeps him miles ahead of inflation and, after all, as long as the top 0.01% are winning – don't we all win?

The other 10,989,000 families in the top 10% shared the rest of the $350Bn; it's enough for them to each get $31,000 but, of course, the top 0.1% (110,000 families) grabbed $635,000 for themselves and that added up to $70Bn and the next 440,000 families in the top 0.5% (not including those above) gave themselves $125,000 raises for another $55Bn, which left just $225Bn to go to the other 10.5M families in the top 10%, which worked out to just $21,500 in raises over 10 years for the top 10% – no wonder they want to steal more money from the bottom 90% – they barely got any in this round!

What's missing from this chart? Wealth creation. There simply wasn't any! No new wealth was created at all outside of capital gains (which were a lot!) in America in the past 10 years. Money was taken from the wages of the bottom 90% and transferred to the top 10%, but mostly the top 0.01%.

Imagine what it's like to only earn $34,000 and, 10 years later, being paid $30,400 for the same job. That's the income for the ENTIRE family, not per person. That's how the bottom 90% of America is living and that is why we're short XRT (see – it does relate to the markets), because most people simply have no disposable income. That's also why we short oil at $102.50 (there this morning) – because, no matter how rich the top 1% get, they can only fly one jet at a time and only use one limo at a time. So things like oil and gasoline, which must be consumed in mass quantities, are simply unaffordable over a certain price. This again is great for rich people as the lack of demand from poor people keeps prices low when they gas up the Range Rover. This is unacceptable, to reasonable people, and can't last. It wouldn't last if the Fed didn't make it all possible by artificially manipulating the money supply and the interest rates to mask over what is becoming a plantation-style economy, where the great mass of workers barely make enough while the masters live in blissful luxury in the big house. For now, the Corporate Media keeps the masses in line but can we really expect another 10 years of this to continue without some blow-back? |

No comments:

Post a Comment