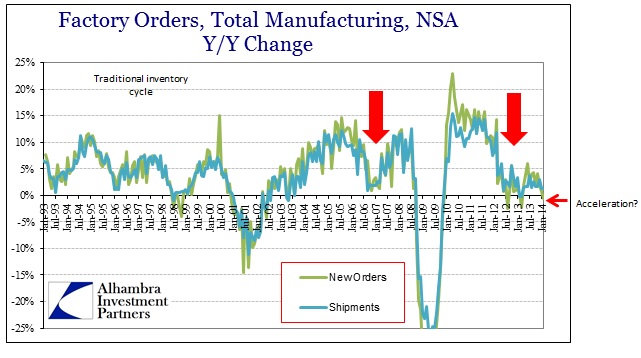

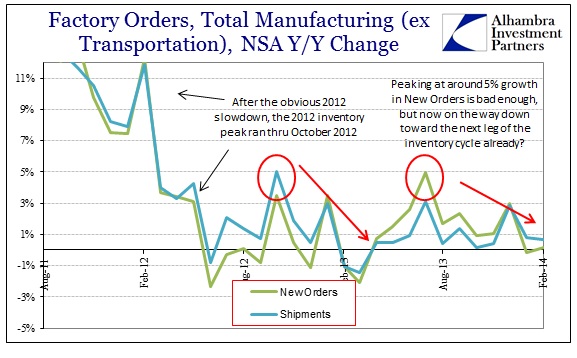

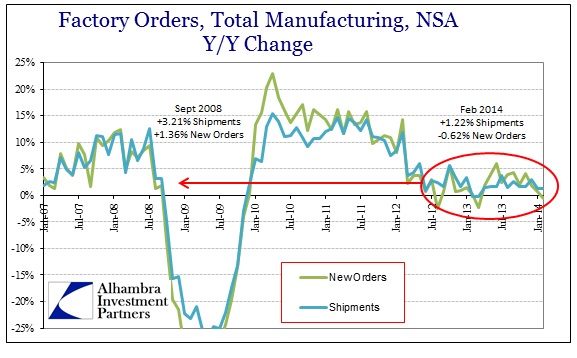

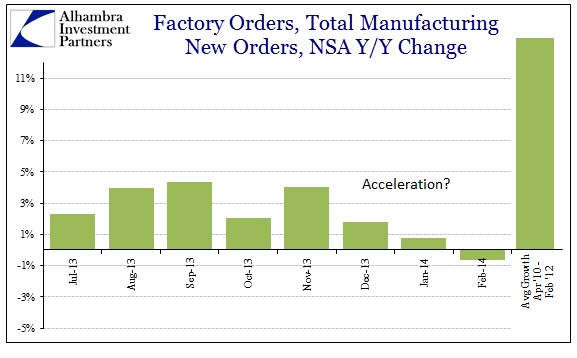

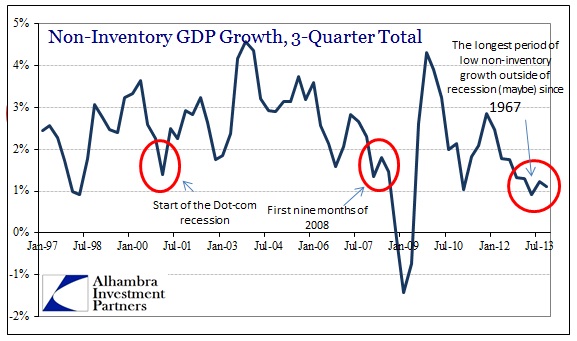

| Courtesy of James Pethokoukis of the AEI, today we learn that Joe LaVorgna, Chief Economist at Deutsche Bank, noticed, “Over the past year, the US economy has demonstrated a significant acceleration.” The reason for such cheeriness is the “private economy.” In other words, if you take out the “fiscal drag” of purported austerity, the indication of GDP is very encouraging. Summing up this optimism, Pethokoukis adds, “Actually, the increase in fiscal drag in 2013 was accompanied by faster private GDP growth. You can probably thank for the Fed for that.” I’m not sure acceleration is the word I would use to describe anything about the US economy right now, be it housing, consumer spending or the goods economy. If the economy is moving in the “right” direction, it should be easily observable in a broad range of accounts, including today’s release of factory orders. The factory orders estimates for February were among the worst of this “cycle”, matching closely the lows seen late in 2012 and early 2013. In other words, more of the inventory mini-cycle. Setting aside second derivatives for a moment, there is something particularly striking about what we have seen now for almost two years. The growth rate again exudes this kind of confused stasis, with almost no growth at all, to significantly underperform the first phase of the Great Recession. The recent trend in factory orders also belies any notion of acceleration, contradicting the apparent predictive capacity of non-fiscal GDP. Even if factory orders showed a positive growth rate and second derivative in February, it would hardly be something that would indicate sustainable growth. We have not seen anything above 5% in almost two years, compared to the average rate from April 2010 through February 2012 of 13.1%. It’s not even close. What LaVorgna and Pethokoukis are attempting amounts to a sleight of hand. By first looking at GDP by halves instead of quarters they can preserve the ordinal changes that look like acceleration. However, if you view GDP in the more normal quarterly fashion, the last two quarters and current estimates for Q1 2014, the trend looks noticeably similar to the data shown above: 4.1%, 2.6%, 1.8%; i.e., deceleration. That conforms to what we know of the inventory cycle as it has appeared throughout the economic accounts. We can include GDP itself, given that almost half of the 4.1% rate in Q3 was due to record inventory levels (that continued into Q4). So where they seek to view GDP ex-gov’t, I can counter with GDP ex-inventory. That is a far more consistent position in accordance with a broad array of data that shows exactly this constant deceleration, interrupted only slightly by an inventory mini-cycle most associated with the pattern of 2008. For his part, however, Joe LaVorgna, like almost every orthodox economist, has at least been consistent in his thesis regarding acceleration. In this morning’s relatively irrelevant ADP report, his expectation of +275k far exceeded the actual +191k. In early January, he actually increased his expectation for the December payroll report (Establishment Survey).

That month came in at +84k. In August 2012, LaVorgna was again optimistic:

The very next month that optimism apparently dissipated in the warm embrace of QE3.

One month the economy “needs to be left alone” without “training wheels”; the next there is serious concern about “traction.” This extends back a long way, including the following:

That was September 30, 2008. It took Lehman, AIG and Wachovia to slightly erode Mr. LaVorgna’s optimism enough to actually forecast just a small decline in GDP. I don’t mean to be overly harsh on one individual, only to point out what is common among the orthodox set. An economy that is actually accelerating will show it conclusively across numerous and disparate economic accounts and estimates. And it will be fully insulated from snow and winter. A real recovery will not be bothered or interrupted because of a Polar Vortex, though it does offer very convenient cover to what is an obvious and durable downslope. You can probably thank the Fed for that. |

Thursday, April 3, 2014

Memo To Deutsche Bank Chief Stock Tout Joe LaVorgna: Inventory Spurts Are Not Signs Of A Keynesian Boom

Subscribe to:

Post Comments (Atom)

No comments:

Post a Comment