| There was considerable attention given to Janet Yellen’s appeal toward “optimal control” language in prior speeches and toward her confirmation. The idea is such that the newly committed 2% inflation target does not need to be a “rule.” Under optimal control, the FOMC may tolerate an inflation rate above that target if it allowed unemployment to decline at a quicker pace. In other words, optimal control is a modeled concept whereby the FOMC can assume the best parts of the dual mandate, with a focus so far only on that narrow set of potential circumstances far afield of what we see now. At his press conference in March 2013, then-Chairman Bernanke tried to address some minor criticism about the pace of recovery, particularly as it related to optimal control concepts.

In a speech delivered in June 2012, Janet Yellen predisposed of some of the same issues.

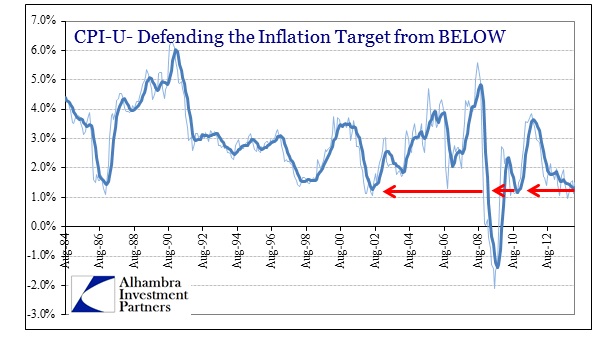

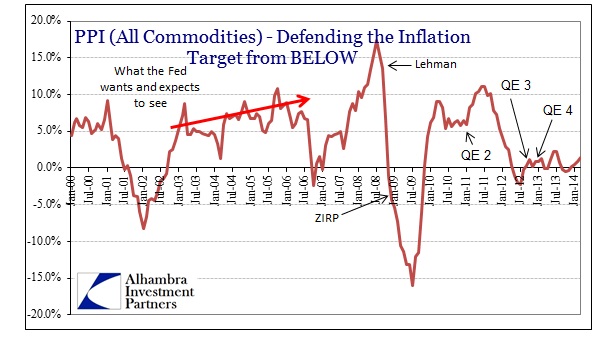

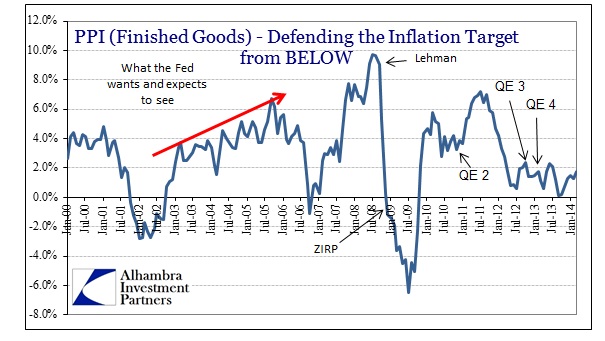

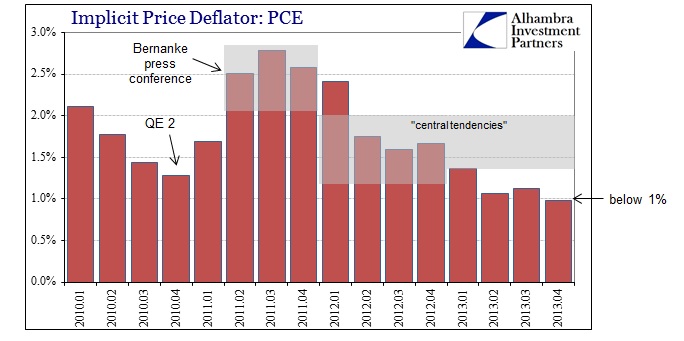

In other words (pardon the lengthy quotation), the Fed continues to get it wrong. Even by early 2011 the Fed was expecting the first rate hike to come in mid-2013. And in her last sentence of the first paragraph above, the “modest acceleration” has failed to materialize at any point in either 2012 or 2013. They keep getting their forecasts completely wrong. Bernanke asserted that was due to “as good as we can get with the monetary tools we have.” The latest inflation figures also track closely to this idea that the Fed is ultimately powerless. Bernanke had long been a proponent of inflation targeting, finally getting his wish in January 2012. One prime rationale is that 2% inflation realizes enough cushion for the FOMC to maintain a margin for future “stimulus.” Bernanke himself addressed that exact inquiry in the same March 2013 press conference (as part of the same line of questioning).

That raises the issue about current conditions as it relates to this orthodox arrangement, particularly “optimal control” theory. The idea is that the Fed must be able to “do something” at the onset of recession (because recessions are apparently the incarnation of pure evil and as such hold no beneficial resource re-allocation processes) so low inflation and low interest rates remove nearly every tool in the kit. Current inflation readings for March have come out slightly higher than recent months, but that only moves them a little closer to the 2% target. Inflation, by these official definitions, remains nowhere near such a comfort level. Though we won’t have an update for March on the Fed’s preferred inflation measure, the PCE deflator, until the end of this month, the last reading was actually under 1% and far below expectations. If you put all these various pieces together it might suggest another rationale for taper. By now the FOMC members are at least aware of their consistent over-optimism about economic growth, and it has to at least remain a factor in considerations for policy. Given what Bernanke admitted about the desire to be at the inflation target, you have to believe that at some point policymakers might actually grow concerned about a forming recession in the face of QE already and persistently at such high levels. In other words, what would they do, or at least think they might, if a recession became a greater likelihood while still going at full QE pace? It would be as Bernanke described, no room for additional “accommodation” in policy; a worst case. If a recession began to appear and they had not tapered, what would they be left with? If that is correct, taper is unrelated to the economy as it is now, but rather focused on restoring room to “do something.” I still think it likely that the primary focus of taper is the mortgage market and the absolute decimation in issuance. That includes not just taper but the adjustment of POMO operations toward the 10-year maturity. However, even given that, I have to wonder if this set of circumstances has not been discussed at length. Again, they know their over-optimism is, at this point, systemic (that doesn’t mean they don’t still believe or hope on some level growth will return as predicted, only that they have to be more than aware of the last seven years) added to the obvious deceleration in the economy (which has been acknowledged on several occasions). Might they not taper now so that they have at least the option of restoring QE should conditions grow worse? I think there is also the added “bonus” of rational expectations theory here, at least in this oversimplified orthodox world, where they can proclaim, against all observation, that the economy is doing well enough on its own to countenance taper in the hope that such a course convinces enough people to act according to that policy stance. In the “optimal control” paradigm, a central bank already at high capacity of “stimulus” is unable to address further and worsening changes in economic direction – they have nothing left. Optimal control in such a case would demand exactly this course of action. In terms of psychology, restarting QE would probably have much more impact (in their minds, if nothing else) than simply increasing the levels of what would clearly be ineffectual bond buying. Given what we know of rational expectations theory and the over-emphasis on psychology and “stimulus” potential, it certainly would be consistent. I don’t know if that is actually the case now with taper or not, but I find it plausible enough to present it. |

Wednesday, April 16, 2014

Essence Of The Eccles Building: A Ship Of Paint-By-The-Numbers Fools Who Inherently Get It Wrong

Subscribe to:

Post Comments (Atom)

No comments:

Post a Comment