By: Dan_Stinson

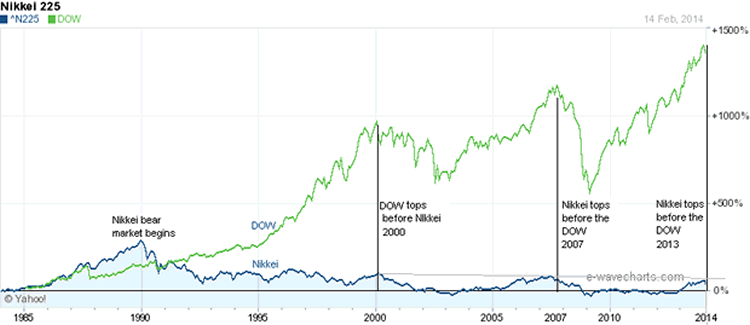

Nikkei top and relationship with the DOW - UPDATE - DOW wave (5) top and Nikkei wave (2) topWe issued a newsletter on Feb 17th discussing the possible relationship between the Nikkei and the DOW. The newsletter included charts to illustrate this relationship and suggested that we would see a DOW top while the Nikkei completes wave (2) up. This appears to have occurred on Apr 3 2014 for the Nikkei and on Apr 4 2014 for the DOW. Some of the charts below are from the Feb 17th newsletter. The DOW appears to have completed wave (5) up while the Nikkei completed wave (2) up. The overlay chart below illustrates that the Nikkei and the DOW have topped out together since 1990. DOW and Nikkei Tops

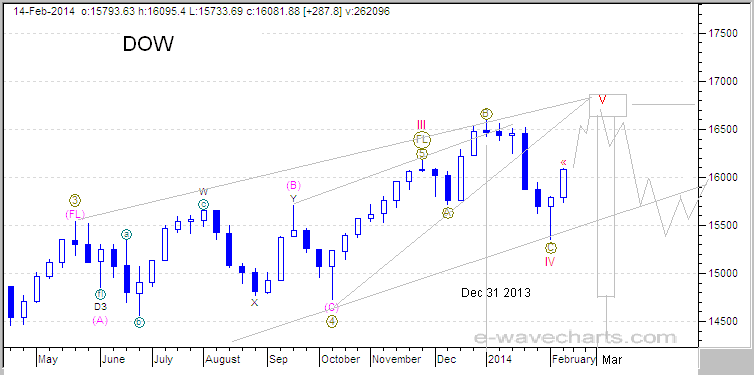

We saw this relationship in 2007 where the DOW made a brief new high while the Nikkei completed wave (2) up. The 2007 charts can be viewed on the Feb 17th 2014 newsletter. The charts below are from the Feb 17th 2014 newsletter illustrating the expected relationship and topping action. DOW - Feb 17th Forecast

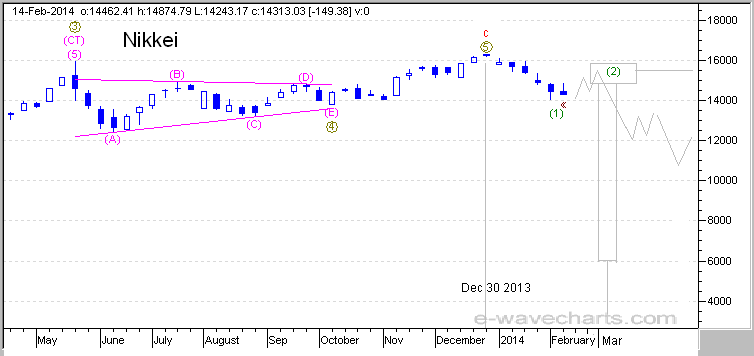

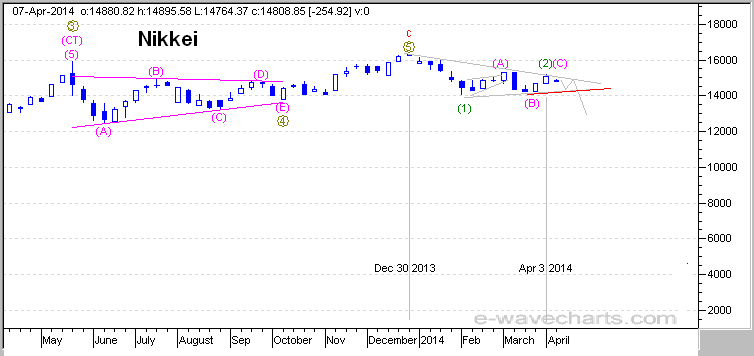

Nikkei - Feb 17th Forecast

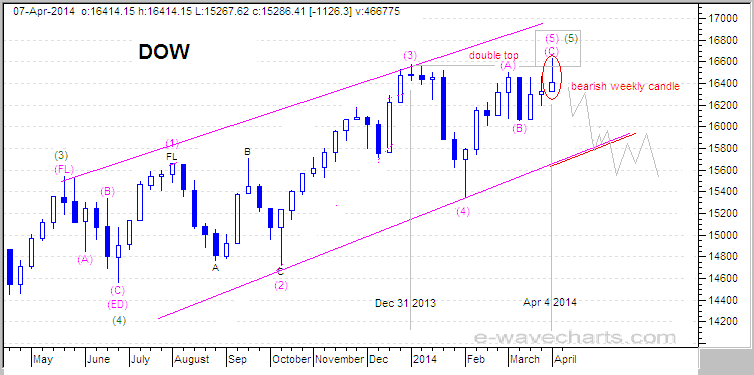

The charts below illustrate the completion of the expected relationship. DOW - Apr 7th Forecast

Nikkei - Apr 7th Forecast

The DOW made a brief new high as a double top, while the Nikkei appears to have complete wave (2) up. This is similar to the brief new high for the DOW in 2007 while the Nikkei completed wave (2) up. We still need to see further action on the Nikkei to confirm that wave (2) up is complete, since wave (C) fell a little short of the wave (A) high for wave (2) up. Wave (C) was in the target area for completion before the downside today, but we need to see it move lower to negate further upside for wave (C) up. A break below the lower trendlines marked in red will support the count that the rally is complete. A move above the Apr 3rd high would indicate further upside in wave (2)(C). |

No comments:

Post a Comment