by tony caldaro

REVIEW

The week started with Russia flexing its military muscle in the Ukraine, and the market sold off to SPX 1834 by Monday noon. After the event was temporarily neutralized the market recovered, and made all time new highs every day thereafter. For the week the SPX/DOW were +0.90%, the NDX/NAZ were +0.45, and the DJ World index rose 0.40%. Economic reports for the week finally turned positive, with positive reports outpacing negatives ones 10 to 7. On the uptick: personal income/spending, PCE prices, ISM manufacturing, construction spending, monthly payrolls, the MIS, monetary base, the WLEI, plus weekly jobless claims improved. On the downtick: monthly auto sales, the ADP, ISM services, factory orders, consumer credit, plus the unemployment rate and trade deficit nudged higher. Next week we have Retail sales, Business/Wholesale inventories and the PPI.

LONG TERM: bull market

This liquidity driven Cycle wave [1] bull market continues to exceed expectations. Just as, I would imagine, the liquidity driven 1932-1937 Cycle wave [1] bull market did decades ago. Then, Primary waves I and III were rather simple one year affairs, with an extending Primary V taking three years to unfold. Quite similar to the 2002-2007 bull market. Although the waves in the 2002-2007 bull market were of a lesser Major degree.

This bull market has had a two year Primary I and, currently, a three year Primary III. Primary II, for those that keep count, only lasted five months. Primary I naturally divided into five Major waves, with a subdividing Major wave 1. Primary III is also dividing into five Major waves, but Major waves 1, 3 and 5 are all subdividing. Major waves 1 and 2 completed by mid-2012. Major waves 3 and 4 completed by mid-2013. It would make sense then, to expect Major wave 5 to complete around mid-2014. Especially since the subdividing waves of Major waves 1 and 2, Primary I, also completed in mid-year.

MEDIUM TERM: uptrend

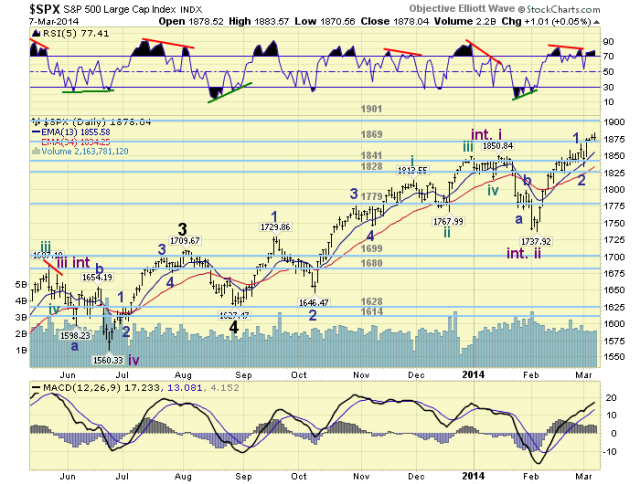

During this Major wave 5, Intermediate wave one completed in mid-January and Intermediate two in early-February. Intermediate wave three is only a month old and has already exceeded the old all time high by nearly 2%. The initial advance off the Int. two SPX 1738 low was quite strong and very implusive. The market rose to SPX 1848 (110 points) in just two weeks. After that it became quite choppy until this week. As it has risen just 36 points in over two weeks. This choppiness has left a short term pattern that has many potential counts.

During this bull market third wave trends, which this is one, and there have been four, have lasted between 4 and 7 months in duration. This would suggest an Int. wave three high some time by around June, maybe longer. If this one is anything like Int. wave three of Major wave 1 (Nov11 to Mar12), when the SPX rose 263 points. Then we are looking at potentially an Int. iii high near June around SPX 2000. Actually our target for this uptrend is the OEW 1974 pivot, and the pivot after that is 2019. Medium term support is at the 1869 and 1841 pivots, with resistance at the 1901 and 1962 pivots.

SHORT TERM

Short term support is at the 1869 pivot an SPX 1859, with resistance at SPX 1884 and the 1901 pivot. Short term momentum ended the week just above neutral. The short term OEW charts are positive with the reversal level now SPX 1871.

The uptrend can best be counted as five Minute waves up to complete Minor 1 at SPX 1868. The five Minutes waves are: 1827-1809-1848-1841 (triangle)-1868. Minor wave 2 then completed at SPX 1834 on Monday. From that low the market rallied to SPX 1884 early Friday, completing Minute one. Then pulled back to SPX 1871, also on Friday, possibly completing Minute wave two. As soon as the market rallies above SPX 1880 we will label that low, or the next low, as Minute wave two. Best to your trading!

FOREIGN MARKETS

Asian markets were mostly higher for a net gain of 1.2%.

European markets were mostly lower for a net loss of 0.6%.

The Commodity equity group was also mostly lower for a net loss of 3.3% - mostly Russia.

The DJ World index is uptrending and gained 0.4% on the week.

COMMODITIES

Bonds entered a downtrend and lost 0.8% on the week.

Crude was quite choppy losing just 0.1% on the week.

Gold continues to have negative divergences, but gained 0.8% on the week.

The USD remains in a downtrend and lost 0.1% on the week.

NEXT WEEK

Tuesday: Wholesale inventories. Wednesday: the Budget deficit. Thursday: weekly Jobless claims, Retail sales, Export/Import prices, and Business inventories. Friday: the PPI and Consumer sentiment. On Thursday FED governor Powell will give Senate testimony. Best to your weekend and week!

No comments:

Post a Comment