By: Paul_Rejczak

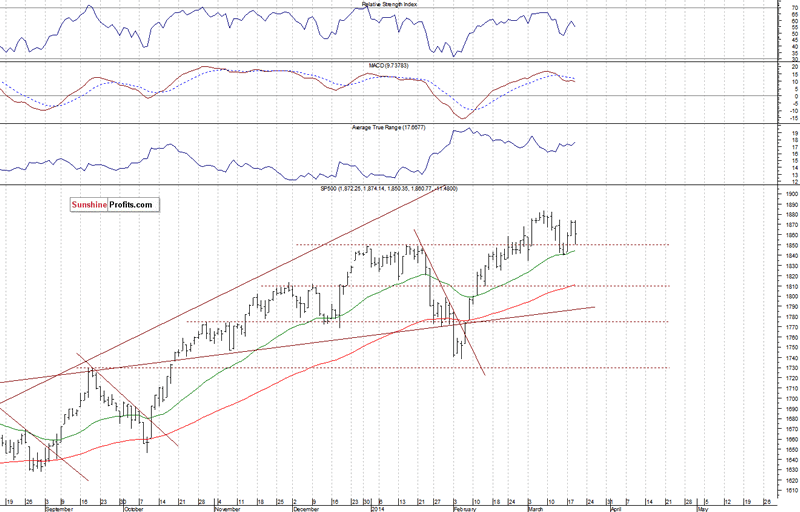

The U.S. stock market indexes lost between 0.6% and 0.7% on Wednesday, as investors reacted to the FOMC statement release. The S&P 500 index moved away from its March 7 all-time high of 1,883.57, extending few week long consolidation. The resistance remains at around 1,880-1,900, and the nearest important support level is at 1,840-1,850, marked by the recent local low, among others. There is no clear short-term direction, as we can see on the daily chart:

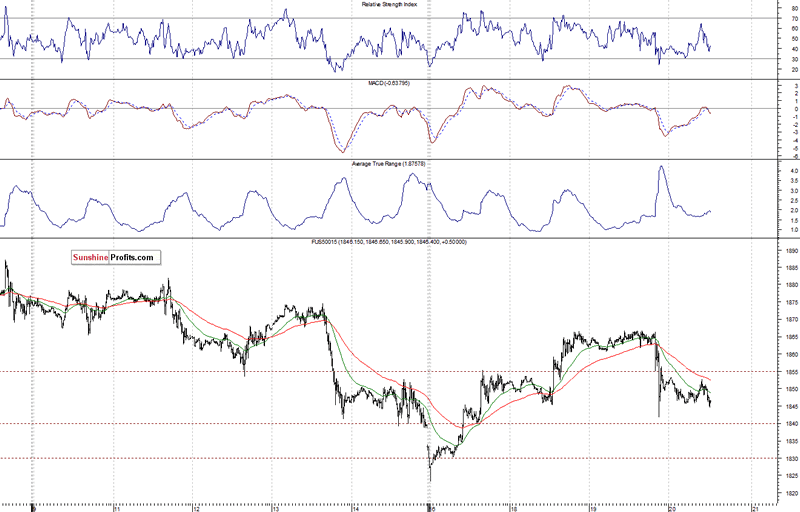

Expectations before the opening of today’s session are negative, with index futures currently down 0.3%. The main European stock market indexes have lost 0.9-1.2% so far. Investors will now wait for some economic data releases: Initial Claims at 8:30 a.m., Existing Home Sales, Philadelphia Fed indicator and the Leading Indicators at 10:00 a.m. The S&P 500 futures contract (CFD) extends its consolidation along the level of 1,850, following a rebound from Monday’s low. The resistance is at 1,865-1,870, and the nearest support is at around 1,840, as the 15-minute chart shows:

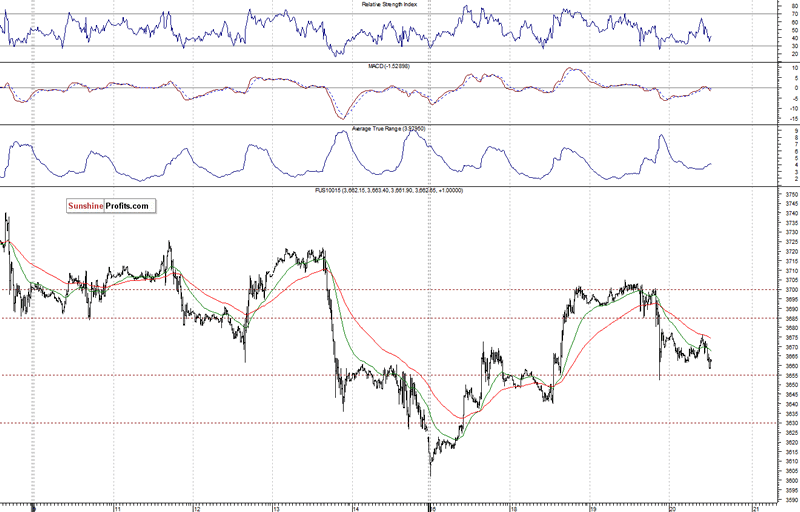

The technology Nasdaq 100 futures contract (CFD) bounced off the psychological resistance at around 3,700, as it trades along the level of 3,660. For now, it looks like a rather flat correction within short-term downtrend:

No comments:

Post a Comment