Investors seeking more robust returns in a lower-interest-rate environment often look to high-yield bonds for answers. But it’s critical that they don’t reach too far down the credit spectrum in search of higher yields—as tempting as it may be.

High Yield’s Slippery Slope

We’re currently in the stable phase of the credit cycle—characterized by companies’ solid financial health—and we anticipate that we’re still years away from increasing defaults becoming an issue. But that doesn’t give investors the green light to begin stretching for higher yields by investing in lower-rated credits.

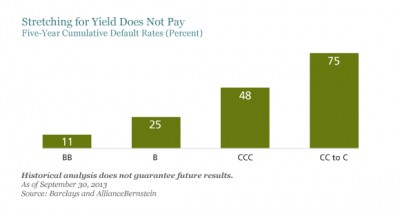

The display below shows cumulative five-year default rates, which worsen the further one slides down the credit scale. Even reaching for CCC-rated debt can put an investor in hot water and often isn’t worth the pain, as the compensation isn’t commensurate with the risk level. The extra premium investors receive is low relative to history—on top of default risk—and CCC debt is unattractively priced above par. Bottom line: avoid the yield stretch.

How Roll Can Help

During a steep-yield-curve environment in which interest rates are expected to rise, yield-curve “roll,” or a bond’s price increase as it moves closer to maturity, can act as a cushion against rising rates and declining prices. Over time, a bond’s yield progresses—or rolls—down the yield curve as its price ticks upward. Bondholders can especially benefit if interest rates rise by less than anticipated, as their bonds will likely be valued at a higher level than new issues of a comparable time frame.

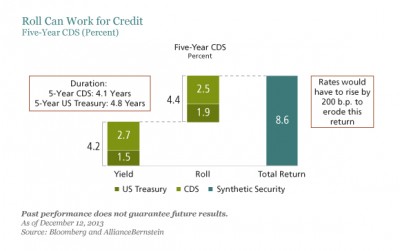

Many credit curves are particularly steep today, creating opportunities for roll. The display below shows how roll can work for a five-year corporate credit default swap (CDS). For the bond’s total return (its income and capital appreciation) to be eroded, interest rates would have to rise by 200 basis points, which is unlikely.

Given the current environment, we expect high yield to continue its journey for the next couple of years, and as long as investors remain wary of yield stretch, and remember that roll is on their side, they’ll have a better chance of successfully navigating the road ahead—no matter what interest rates do.

No comments:

Post a Comment