by Greg Harmon

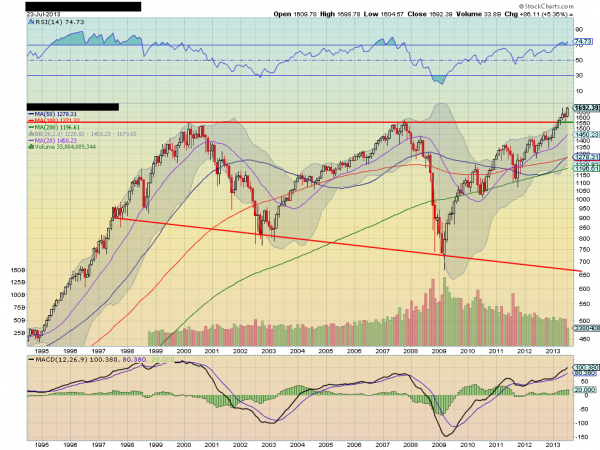

Long term break outs are a fact in the market. They just happen. Unless they happen in the S&P 500. Targets and forecasts on the S&P 500 are only met with less controversy than those on the price of Apple stock. Every one has an opinion and a rationalization. But what if you looked at the long term chart of the S&P 500 and did not know that it was the S&P 500. I have taken the label off of the chart below to make it easier for you. To a technician this now becomes a routine expanding wedge break higher. Without the labels to cloud your judgement, this break of this wedge to the upside, gives a target of 2390. That is only incredible if you do not try to put it in context. Otherwise there is no reason that a stock

could not break a wedge of consolidation over 20 years and move 50% higher. Many technology stocks did it this year. Why do we need to doubt it just because it is the S&P 500? If you are a market pundit, TV talking head or some kind of financial analyst then by all means toss in some justification for why this cannot possibly happen or why it is correct. If you are a technical analyst however, remove your barriers and look at the possibility. Clear your mind for a minute. It is not so far fetched.

No comments:

Post a Comment