by Greg Harmon

The Chinese stock market had a long steady plunge from late 2009, but seemed to be on its way to a strong recovery this past winter. This all changed in February as it peaked. And since March there has been a Head and Shoulders Top that we have been monitoring. That carries a price objective down to at least 2144. Turns out that level was hit in local trading Thursday. So the worst is over right? Not exactly. But that is good news. If it continues you should be happy as an American. Let me explain. The chart below of the Shanghai Composite ($SSEC) shows the price action over the last year.

The Head and Shoulders Top mentioned is the one with the red Shoulders. But there is another Head and Shoulders Top with blue shoulders. This one remains valid and has a Price Objective to at least 2026. There may continue to be a bounce and eventually a closing of the gap created, but the downside pressure in the chart remains. And that second Head and Shoulders may not be the end either. The Composite is also in a Bullish Crab Harmonic. That is good news far down the road, but the current leg carries a Potential Reversal Zone at 1644. That is a long way lower.

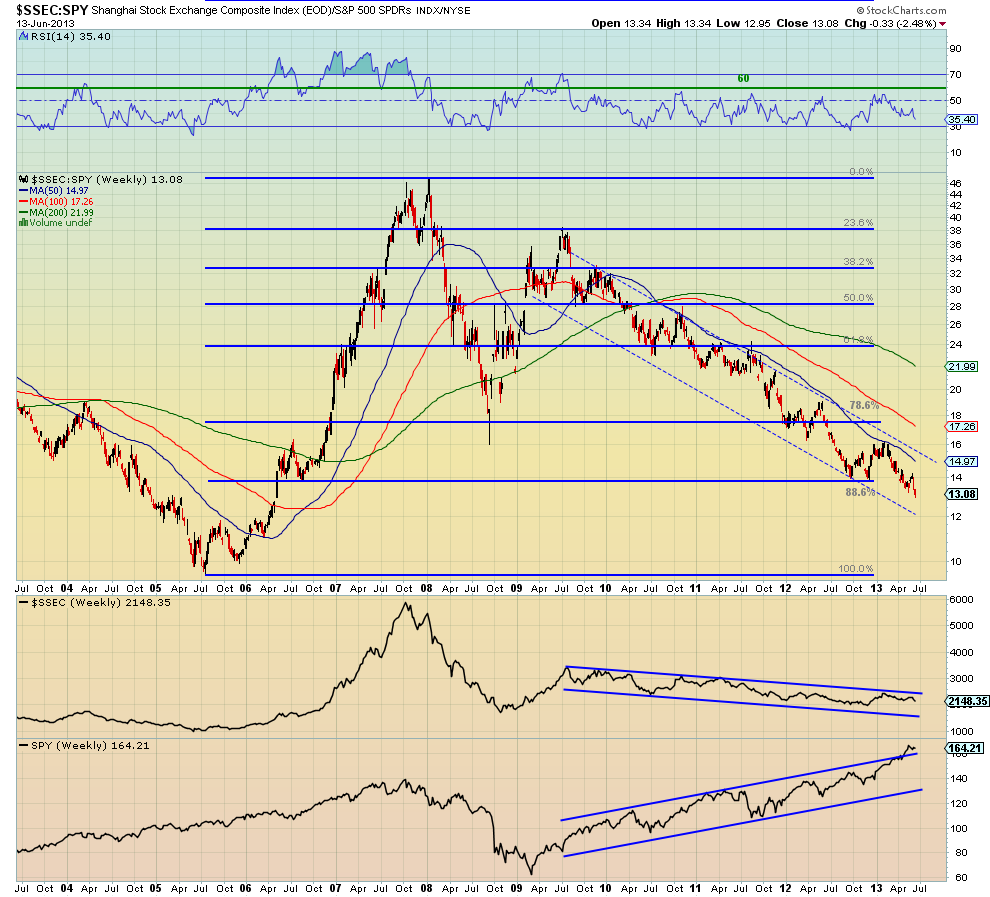

We have seen recently the crash in the Japanese Market causing a drag on global markets, but this is not the case with the Chinese market. The ratio chart of the Shanghai Composite to the S&P 500 SPDRs ($SPY) above shows that as the Shanghai Composite has been falling over the the last 4 years the S&P 500 has been rising. A weak Chinese market is good for US stocks. Go USA, boo China!

No comments:

Post a Comment