The SPX moves may appear disappointing at first glance. However, there is a lot of coiled up energy stored in these moves. All of these waves are impulsive and no matter how much they are being fought against, the waves are grinding down the opposition.

I have found that, when estimating the length of Wave threes, they are often a multiple of the cumulative wave ones. In this case, the cumulative value is 65 points, so the next wave down (assuming it’s a three) may have a minimum length of 130 points.

That may give SPX enough downside energy to break through both Intermediate-term support at 1618.21 and the 50-day moving average at 1601.54.

The downside target may be in the range of 1499.00 to 1510.00, below the smaller Orthodox Broadening Top. The bounce from that low may be contained by the Weekly Diagonal trendline, just below 1575.00. Remember, the SPX is still in throw-over territory in the weekly Ending Diagonal.

Once below the 50-day moving average, the speed of the decline may pick up. Those that are still bullish (there are many of them) may have a change of heart at that point.

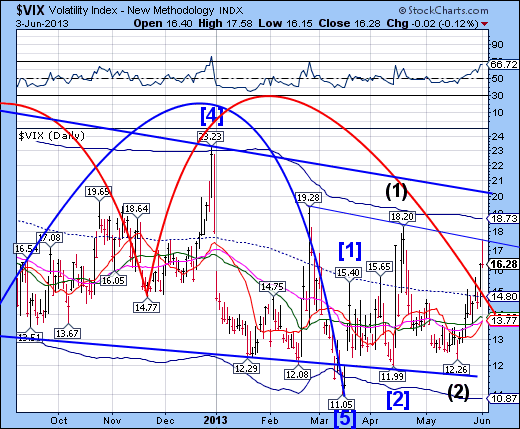

VIX has nearly made its Head & Shoulders target and it has not completed its pattern yet.

What seems to be holding the VIX from going higher at the moment is a small Diagonal formation that must be broken through. Once accomplished, the larger Diagonal formation must also be dealt with. The coiled up energy in the VIX may just do that very soon.

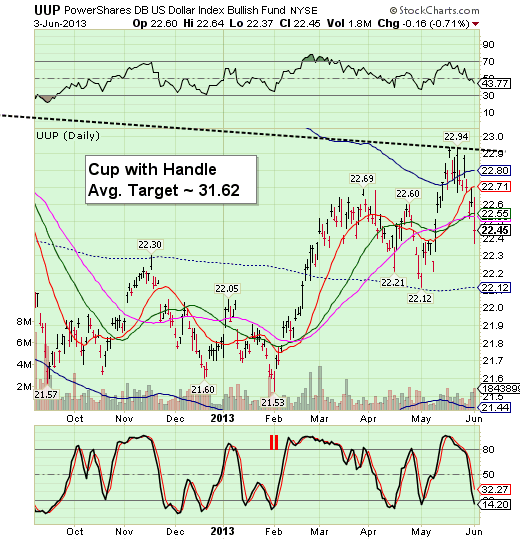

UUP is just completing a Trading Cycle low. The turn date for the new rally is tomorrow. There is a high correlation between the USD/UUP and the VIX. It appears that UUP/USD may have a breakout above the Lip of its Cup with Handle, which portends to be a very powerful move.

It just occurred to me that this may be the catalyst for the breakout in VIX and breakdown in SPX.

Good luck and happy trading!

No comments:

Post a Comment