SPX broke its 50-day moving average at 1605.00 a short while ago. It is now retesting its 50-day and may rise above it to the hourly Cycle Bottom at 1613.00. The SPX now has permission to Flash Crash once it loses its grip on the 50-day.

Just a month ago we broke above the magical 1,600 level on the S&P 500... today we broke back below, with the index now down over 5% from its 5/22 highs. From a technical perspective, the Nikkei 225 is below its 100DMA, and the Dow and S&P 500 just broke below the 50DMA. VIX has risen, now back above 18% (highest in over 3 months). No Hindenburg Omen signal (yet). What we worry about is that everyone is focused on tomorrow's NFP print as some panacea for "Taper." This is incorrect. The "Taper" jawboning from the Fed is because they are increasingly fearful of the bubbles they have created…

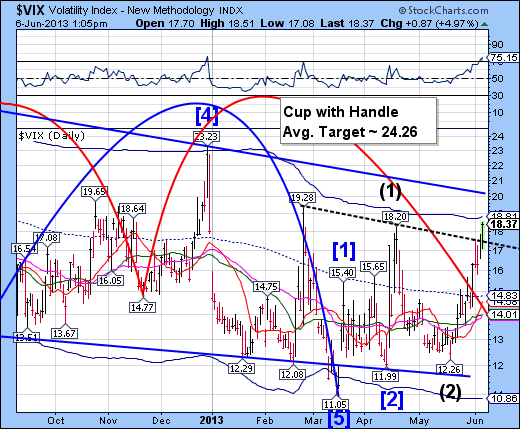

The VIX has now triggered its Cup with Handle formation with a target of 24.26.

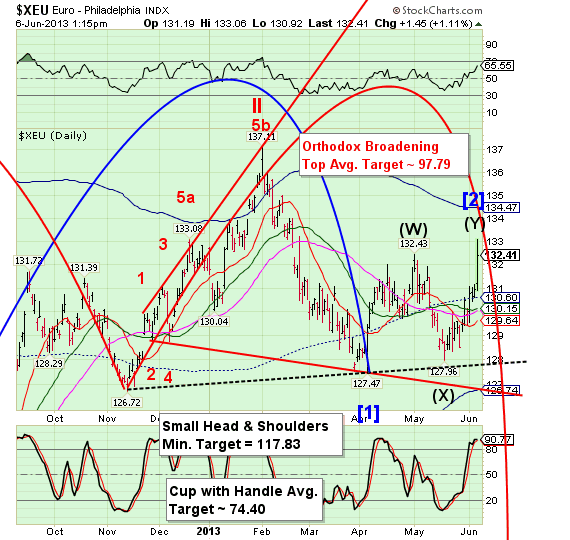

XEU has completed a complex rally to run the shorts. The Euro is within 24 hours of a turn and may have already begun it. This appears to be a Trading Cycle high. That may be a set-up for a Primary Cycle “Panic Decline” through the end of June.

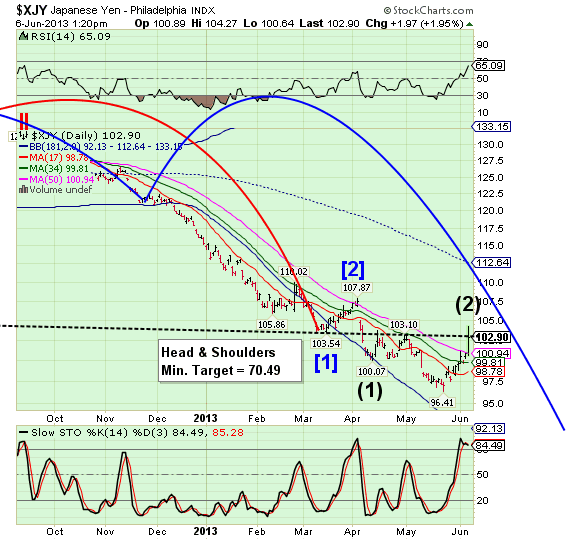

XJY is also running the shorts today. It has revisited its Head & Shoulders neckline and is likely now to reverse hard down. If it Flash Crashes, we may see the low as early as Wednesday.

JPY's biggest daily gain in 3 years!!

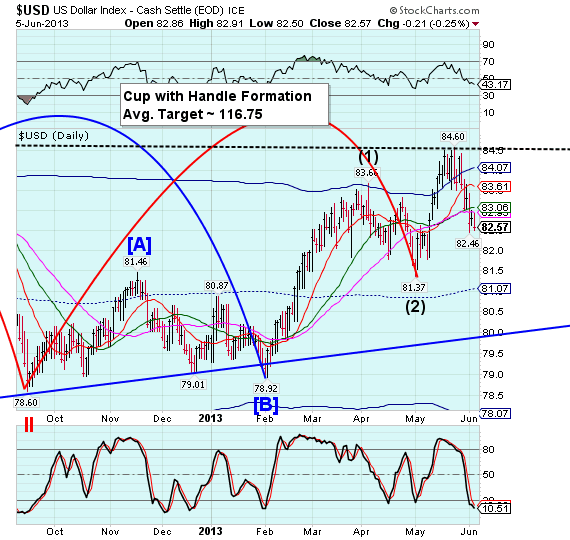

US Dollar futures declined to 81.08 and reversed higher as the PTB are running the stops on the longs. This market is not for the weak of heart. By the way, this move just extended the Master Cycle low to today.

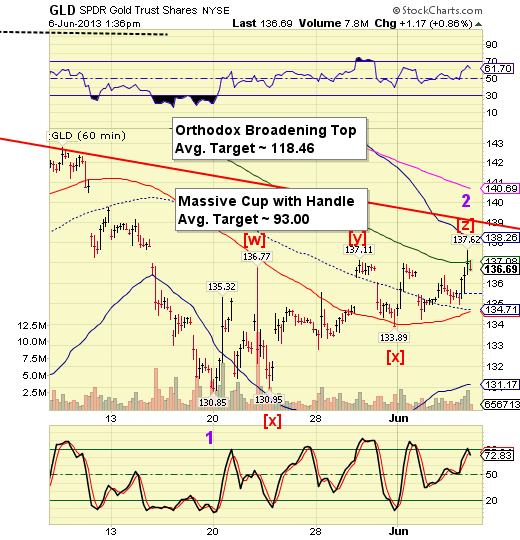

GLD has made a very complex correction to discourage the shorts.

No comments:

Post a Comment