by Graham Summers

Japan’s bond market is officially losing control.

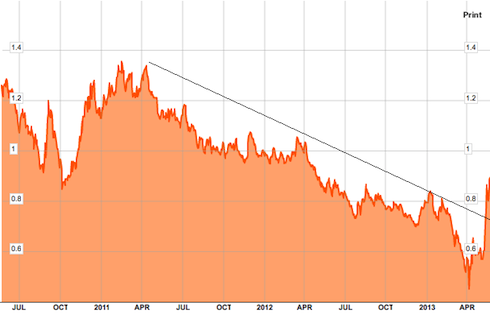

We have definitely taken out the multi-year trendline here, making a new high higher after a higher low. This is BAD news as it indicates that Japan’s bond market could be entering a cyclical downturn.

If this happens then the great global bond market rig of the last five years is coming to an end. Most analysts have been ignoring bonds because stocks are at record highs.

BIG MISTAKE.

As Japan has indicated, when bonds start to plunge, it’s not good for stocks. Today the Japanese Bond market fell and the Nikkei plunged 7%. The entire market down 7%… despite the Bank of Japan funneling $19 billion into it to hold things together.

This is what it looks like when a Central Bank begins to lose control. And what’s happening in Japan today will be coming to the US in the not so distant future.

If you think the Fed is not terrified of this, think again. The Fed has pumped over $1 trillion into foreign banks, hoping to stop the mess from getting to the US. As Japan is showing us, the Fed will fail.

Investors, take note… the financial system is sending us major warnings…

No comments:

Post a Comment