by Cullen Roche

I rarely use technical analysis in my work, but there are times when a picture really is worth a thousand words. Sometimes a chart can help an investor to visualize market relationships better than raw data can. In this way, technical analysis can be particularly helpful in gauging risks and potential mean reverting situations. One such potential mean reverting situation is the long-term outlook for commodity prices. This is, in my opinion, particularly important given Wall Street’s recent attempts to push the “commodities are an investment class” theme.

As I’ve previously mentioned, betting on the actual commodities is never an investment. In fact, over the long-term, commodities have very poor real returns. Rather, an investor who is looking to benefit from a commodity bull market or the negative correlation of some commodities, is better off investing in the ingenuity of the corporations that benefit from these markets. In this manner, you are actually buying human ingenuity rather than buying physical commodities which are the equivalent of selling human ingenuity.

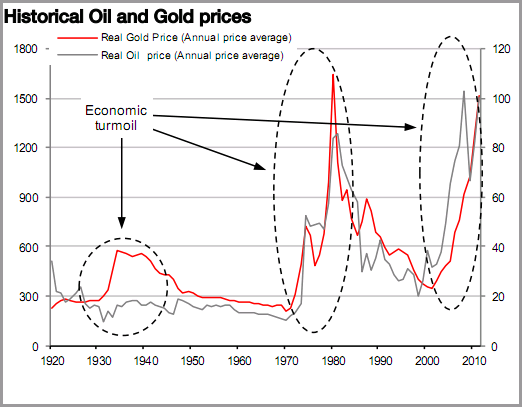

In a recent strategy note, analysts at Societe Generale discussed the long-term surge in some commodity prices and why it could be foreshadowing of a mean reverting event:

“Commodity prices seem much too high as economic growth is slowing. Over the past three years, all commodities have touched historical highs. The most recent high seen for Gold, in August, was sparked by forex fears. Oil prices used to be very sensitive to US growth, but things are different this time, as emerging market demand partly outpaces that of the US, maintaining global oil demand at high levels. But, now the surge in Gold suggests that markets are looking for safe haven investments, as was the case in the 1930s and the 1970s. Hence, financial markets begin to doubt that the current forecast for global growth of 4% pa is sustainable, thus, commodity prices seem much too high at this stage of the economic cycle.”

Now, I don’t like lumping gold into this analysis because I think gold has some intangible components that make it more unique than other commodities, but I am generally skeptical of the idea that broad commodities are going to sustain high real prices in the same manner that other asset classes have historically. As Jeremy Grantham believes, this time would truly have to be different in order for this to persist. Of course, this is not my way of saying that one should go out and short all commodities. Quite the contrary. It just means that you have to recognize that you’re speculating when you buy raw commodities and if you’re trading that might suit your needs perfectly fine. If instead, you are an investor with a long-term diversified focus you would be wise to focus on the underlying ingenuity that benefits from commodity markets by investing in the actual corporations themselves. Don’t fall for Wall Street’s latest sale’s pitch which is trying to push investors into physical commodities of all sorts. History is not on your side.

No comments:

Post a Comment