Once again the Select Sector SPDR funds have many commonalities, and none of them good. Trying to determine where the best place is to look for strength reminds me of when you arrive late to Sunday Brunch. You are excited to see just what is on the buffet and then you notice that they have Egg’s Benedict. For me that is a great thing. But when you get to the chaffing dish there are only 3 left. Well sort of. One at least has all the parts but the sauce is coagulating on top. It was probably good when it first came out of the kitchen an hour ago, just an Old Egg’s Benedict. The second is complete but from the jostling the Egg has fallen off of Ham and English Muffin and you will need to put it back together. Since that Egg has been sitting right on the chaffing dish you know it will be rock solid, an Old Hard Egg’s Benedict. The third one on closer inspection does not have an Egg at all. Just an English Muffin with a little Hollandaise on it. The Disaster. You walk away with the one complete Egg’s Benedict, knowing it is the best of the lot even if it will be disappointing.

From a technical perspective each of the Select Sector SPDR funds, when viewed through the weekly chart, looks disappointing going into this week. They all have Relative Strength Indexes (RSI) and Moving Average Convergence Divergence (MACD) indicators that support further moves lower. The sell off last week happened on big volume for each also suggesting there could be more downside. So how do you decide which are the best, like the Old Egg’s Benedict and which are the Disaster? Let’s take a look.

Old Egg’s Benedict

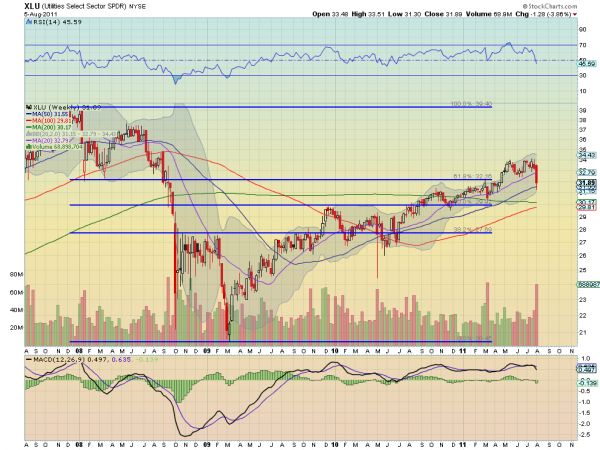

The best looking sectors are the Consumer Staples Select Sector SPDR, $XLP and Utilities Select Sector SPDR, $XLU. These two, as illustrated by the chart of the $XLU below, are the only sectors that were able to close within their Bollinger bands for the week. The $XLU did not break below it intra-week at all while the $XLP did marginally but recovered. They also

continue to have upward sloping Simple Moving Averages (SMA) with price testing the 50 week SMA and holding above it. Finally they have not broken below the March low support. They certainly are not pretty charts though with the RSI steeply declining, but look for these sectors to hold up relatively well in a continued down turn. They would make a good long side of a long short pairs trade.

Old Hard Egg’s Benedict

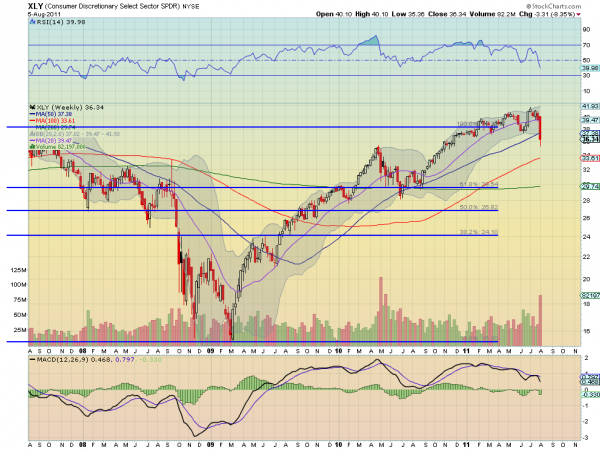

This group, a little worse than the first, dropped significantly below their Bollinger bands and were not able to recover. They are the Technology Select Sector SPDR, $XLK, the Health Care Select Sector SPDR, $XLV and the Consumer Discretionary Select Sector SPDR, $XLY. Using the chart for $XLY to illustrate, you can see that this group is also has rising SMA’s but that they

are below their 50 week SMA and breached their March lows, setting new lows for the year. The outlook for this group is dim as well with the steep RSI and growing MACD and if they continue to move lower see support in the June through early September 2010 area that launched the last move higher.

The Diaster

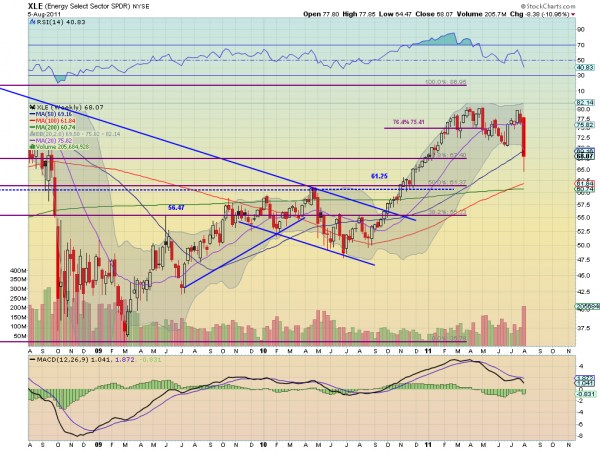

The moves from this group last week made lows that had not been seen since at least November 2010 and one as far back as August. They are the Energy Select Sector SPDR, $XLE, Materials Select Sector SPDR, $XLB, Industrials Select Sector SPDR, $XLI and Financials Select Sector SPDR, $XLF in order of best to worst. I guess English Muffin with Hollandaise to hard, burnt, dry English Muffin. Using the $XLE to illustrate, they are all flirting with or below their 100

week SMA and the shorter SMA’s are rolling over. They have all solidly given up the support of their 50 week SMA and are pulling the Bollinger bands lower. They are the leaders lower and have lots of support from the falling RSI and MACD for more of it. These sectors would be appropriate for the short side of the long short pairs trade.

So as you prepare for the week ahead, remember that like at the buffet, you may be presented with poor choices, but there will always be the distinction between the Old Egg’s Benedict and the hard, burnt, dry English Muffin. Look for those differences and plan accordingly.

No comments:

Post a Comment