by Dirk Ehnts

Paul Krugman wonders why Italian government bond yields are much higher than Japanese bond yields:

A question (to which I don’t have the full answer): why are the interest rates on Italian and Japanese debt so different? As of right now, 10-year Japanese bonds are yielding 1.09%; 10-year Italian bonds 5.76%.

I ask this because in a number of ways the two countries look similar. Both have high debt levels, although Japan’s is higher. Both have awful demography. In other respects, the numbers if anything favor Italy, which has a much smaller current deficit as a percentage of GDP.

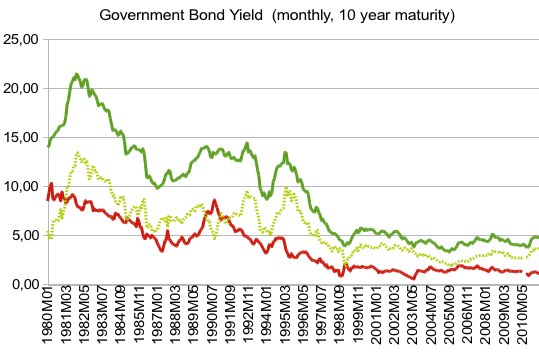

Let us take a look at some historical data, taken from Eurostat (why is this series abandoned in mid-2007, when the financial crisis hit?) and ECB (because apparently that is where they now have the data). The green line represents data points of Bella Italia, the red line those of Japan, a lighter green marks the spread (ITA-JPN):

So, the spread is quite persistent. For decades Italian government bonds delivered a higher yield than Japanese ones. What does theory say about this?

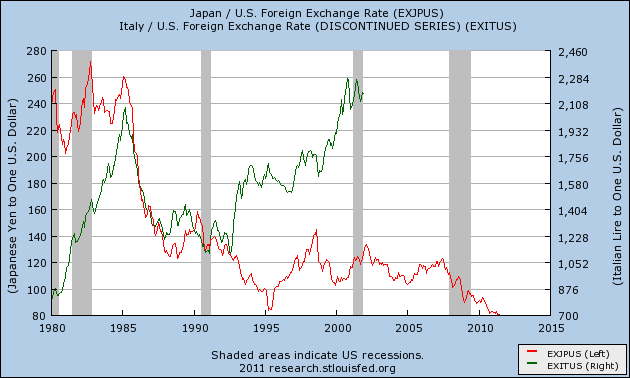

The relevant piece of theory, I believe, is the uncovered interest rate parity. The nominal interest rates plus the expected change in the exchange rate should be equalized all over the world (or at least where financial markets are free). This translates into the case of Japan (low yields) and Italy (high yields) as expectations of the Italian Lira to depreciate against an anchor currency, like the US-dollar, whereas the Japanese Yen is expected to appreciate. Here is a back of the envelope calculation: From 1980-2000, the Italian government bond yield averages 12.4 percent, the Japanese bond yield 5.2 percent. Here are the exchange rates for that time:

So, investing $1,000 in Italian government bonds in 1980 will give you about L800,000. This will increase about 10-fold in 20 years at an average yield of 12.4%, returning you L8,000,000 in 2000. Since a dollar is now worth L2.250 this translates into $3,555. Now for Japanese bonds. Y250 to the dollar would have given you Y250,000. With a yield of 5.2% the return will be about 2.75, which gives you about Y687,500, which in 2,000 at an exchange rate of Y105 to the dollar would have been $6,547. In seems that the Japanese government debt would have been the better investment in hindsight (assuming that there is no risk of default, of course).

Now in 2,000 the euro was already introduced, since a year before the exchange rates were fixed. Now people expected the euro to appreciate over the long-run against the dollar, and Italian yields came down towards German levels. Japan, having been in a slump since 1990, had low yields since inflation was no problem and the Yen expected to gain further. The recent experience of higher Italian yields is a euro zone problem, I’d say. While Japan can print its way out of its government debt if it needs to, Italy cannot. Also, Japan is very competitive in world markets and therefore the risk of a prolonged slump (in order to regain competitiveness) is unlikely, especially since the Bank of Japan oversees the exchange rate and does intervene from time to time.

In Italy, control over the instrument of monetary policy has been lost, and there is no exchange rate to manipulate either. Decreasing prices would kick-start exports, but at the same time increase the burden of real debt for the borrowers, which would harm domestic consumption. Doubts might arise whether Italy can repay at all.

To sum up, I would argue that higher yields of Italian debt from 1980 to 2000 was mostly driven by expectations of exchange rate changes, and that now with the euro these still determine the spread between the government bond yields of Japan and Italy. Yes, Italy might look better from the debt mechanics, with debt/GDP not as high as in Japan (but more insecurity on where growth should be coming from), but Japan looks better from the international perspective, being a net exporter with a currency that historically has gained against the dollar.

No comments:

Post a Comment