by Charles Hugh Smith

The Promises That Cannot Be Kept

The government's promises, for pensions and healthcare and everything else, cannot be kept. We as a nation will eventually have to have a truthful conversation about that reality.

The fact that the Federal government cannot possibly fund the entitlement/ benefit programs that have been promised to the citizenry is well-known, but remarkably unwelcome. I have addressed this difficult reality dozens of times, as have hundreds of other commentators, for example:

To Fix Social Security, First Ask Why It Is Deep in the Red (January 18, 2011)

Is the Recovery "Self-Sustaining"? Here's a Test (March 22, 2011)

If You Want Solutions, First Pin Down Where the Money Is Going (May 23, 2011)

Bruce Krasting recently penned a wonderful evocation of the bitter "I, Me, Mine" rage this reality triggers in Americans: I go to a 4th of July party (Zero Hedge).

The typical reaction is either denial, mixed with wishful thinking--if only we taxed the rich and cut out war spending, everything could easily be funded indefinitely--or rage against anything and everyone that threatens the individual's own share of the swag.

Krasting brilliantly depicts the net result, which I call internecine conflict between protected fiefdoms in Survival+: the constituency of each fiefdom--Social Security, Medicare, Defense, etc.-- will undermine the other fiefdoms to maintain their slice of the dwindling Federal pie. This leads to a profound political disunity which cannot be overcome with compromises, as that would require deep cuts in all government programs.

None of this is new. Richard W. Fisher of the Dallas Federal Reserve laid it all out very succinctly back in May 2008, before the global financial meltdown. Now of course, the situation is much worse: Social Security is already deeply in the red, for example, a condition that wasn't supposed to occur until 2017. If we removed Federal and Federal Reserve stimulus, the economy would immediately contract 11%.

The entire notion of entitlements based on age requires an ever-expanding population of working contributors and an ever-expanding economy. If either condition isn't met, then the programs fail. Fisher's message is clear: our entitlement programs will fail because there is no way to raise $100 trillion in additional taxes in a declining economy.

Storms on the Horizon:

The fact that the Federal government cannot possibly fund the entitlement/ benefit programs that have been promised to the citizenry is well-known, but remarkably unwelcome. I have addressed this difficult reality dozens of times, as have hundreds of other commentators, for example:

To Fix Social Security, First Ask Why It Is Deep in the Red (January 18, 2011)

Is the Recovery "Self-Sustaining"? Here's a Test (March 22, 2011)

If You Want Solutions, First Pin Down Where the Money Is Going (May 23, 2011)

Bruce Krasting recently penned a wonderful evocation of the bitter "I, Me, Mine" rage this reality triggers in Americans: I go to a 4th of July party (Zero Hedge).

The typical reaction is either denial, mixed with wishful thinking--if only we taxed the rich and cut out war spending, everything could easily be funded indefinitely--or rage against anything and everyone that threatens the individual's own share of the swag.

Krasting brilliantly depicts the net result, which I call internecine conflict between protected fiefdoms in Survival+: the constituency of each fiefdom--Social Security, Medicare, Defense, etc.-- will undermine the other fiefdoms to maintain their slice of the dwindling Federal pie. This leads to a profound political disunity which cannot be overcome with compromises, as that would require deep cuts in all government programs.

None of this is new. Richard W. Fisher of the Dallas Federal Reserve laid it all out very succinctly back in May 2008, before the global financial meltdown. Now of course, the situation is much worse: Social Security is already deeply in the red, for example, a condition that wasn't supposed to occur until 2017. If we removed Federal and Federal Reserve stimulus, the economy would immediately contract 11%.

The entire notion of entitlements based on age requires an ever-expanding population of working contributors and an ever-expanding economy. If either condition isn't met, then the programs fail. Fisher's message is clear: our entitlement programs will fail because there is no way to raise $100 trillion in additional taxes in a declining economy.

Storms on the Horizon:

Please sit tight while I walk you through the math of Medicare. As you may know, the program comes in three parts: Medicare Part A, which covers hospital stays; Medicare B, which covers doctor visits; and Medicare D, the drug benefit that went into effect just 29 months ago. The infinite-horizon present discounted value of the unfunded liability for Medicare A is $34.4 trillion. The unfunded liability of Medicare B is an additional $34 trillion. The shortfall for Medicare D adds another $17.2 trillion. The total? If you wanted to cover the unfunded liability of all three programs today, you would be stuck with an $85.6 trillion bill. That is more than six times as large as the bill for Social Security. It is more than six times the annual output of the entire U.S. economy.

I want to remind you that I am only talking about the unfunded portions of Social Security and Medicare. It is what the current payment scheme of Social Security payroll taxes, Medicare payroll taxes, membership fees for Medicare B, copays, deductibles and all other revenue currently channeled to our entitlement system will not cover under current rules. These existing revenue streams must remain in place in perpetuity to handle the “funded” entitlement liabilities. Reduce or eliminate this income and the unfunded liability grows. Increase benefits and the liability grows as well.

To solve the entitlement deficit problem, discretionary spending would have to be reduced by 97 percent not only for our generation, but for our children and their children and every generation of children to come. And similarly on the taxation side, income tax revenue would have to rise 68 percent and remain that high forever. Remember, though, I said tax revenue, not tax rates. Who knows how much individual and corporate tax rates would have to change to increase revenue by 68 percent?

For the existing unfunded liabilities to be covered in the end, someone must pay $99.2 trillion more or receive $99.2 trillion less than they have been currently promised. This is a cold, hard fact.

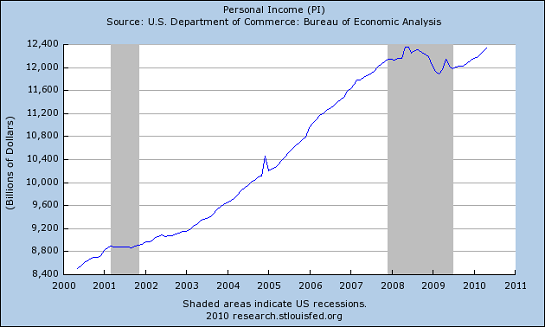

Though I've addressed this many times before, let's walk through it one more time. Let's start with the income side of the ledger, Total Personal Income in the U.S.:

Total personal income is defined by the United States' Bureau of Economic Analysis as income received by persons from all sources. It includes income received from participation in production as well as from government and business transfer payments. It is the sum of compensation of employees (received), supplements to wages and salaries, proprietors' income with inventory valuation adjustment (IVA) and capital consumption adjustment (CCAdj), rental income of persons with CCAdj, personal income receipts on assets, and personal current transfer receipts, less contributions for government social insurance.

In other words, total personal income includes all the entitlement spending and government benefits such as extended unemployment, Section 8 housing, etc. As Mish recently explained, personal transfers now eat up all Federal tax revenues: $2.4 trillion in, $2.4 trillion mailed out.

If we set aside our own fond hopes for Social Security checks being deposited into our personal accounts and Medicare to survive long enough to pay for our own care, we conclude this is a staggering imbalance. The promised programs are already consuming every dollar the government collects, and the Baby Boom has barely begun to retire.

Perhaps a few million of the 76 million Boomer generation has started collecting Social Security, and the first Boomers, born in 1946, are just now qualifying for Medicare. That these programs have already expanded to the point that they consume all revenues should give pause to anyone still in the denial or rage stage of the denial/anger/grief/resignation/acceptance cycle.

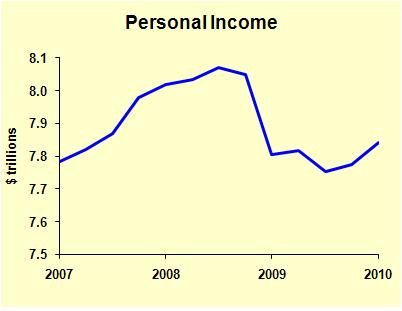

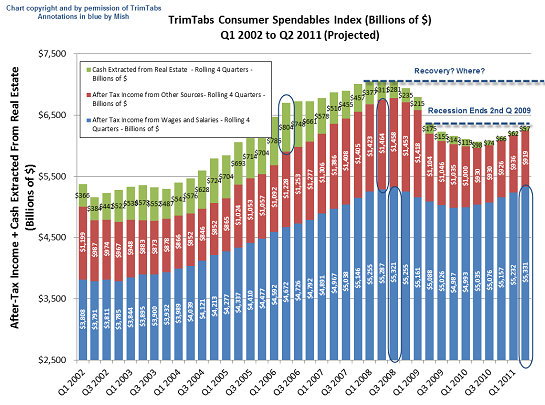

Earned Income is flat to down. Here is a chart of total income:

If we set aside our own fond hopes for Social Security checks being deposited into our personal accounts and Medicare to survive long enough to pay for our own care, we conclude this is a staggering imbalance. The promised programs are already consuming every dollar the government collects, and the Baby Boom has barely begun to retire.

Perhaps a few million of the 76 million Boomer generation has started collecting Social Security, and the first Boomers, born in 1946, are just now qualifying for Medicare. That these programs have already expanded to the point that they consume all revenues should give pause to anyone still in the denial or rage stage of the denial/anger/grief/resignation/acceptance cycle.

Earned Income is flat to down. Here is a chart of total income:

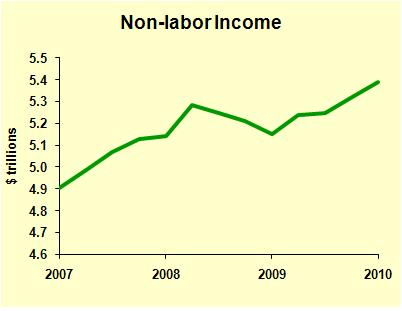

There are two components of income: wages and non-labor, which includes dividends, interest, capital gains, rental income, and other investment income.

Charts: Conerly Consulting

The handsome rebound in Corporate America's profits--roughly 11% of the entire GDP at $1.6 trillion--and the Fed-engineered "permanent rally" in stocks has goosed non-labor income for the top 10% who own these income streams, but it has also bolstered the pension funds that millions of state and local government retirees depend on. (When the stock and bond markets implode, so will all those pension funds' promises.)

Personal income has "recovered" only as a result of greatly increased Federal transfer payments. If we subtract all those government transfer payments, income has cratered:

Government transfers now account for 22% of household income, an unprecedented dependence on Central State checks and benefits:

Click on chart for full-sized chart in a new browser window.

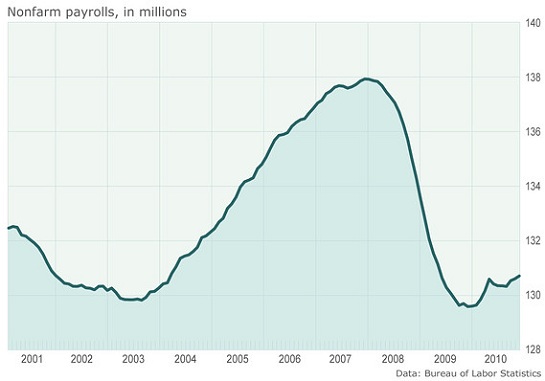

Employment is down and is not recovering. I have addressed why many times, what author Jeremy Rifkin termed "the end of work." So any projections based on a rapidly growing workforce are not reality-based.

All the "growth" of the past decade was simply borrowed, as our private and public debt has soared. If you borrow cash from your credit card and spend it, is that really "income"? No. Here is the national "credit card" account. Does that look sustainable?

Notice how much of the decade's income was equity extraction during the housing bubble. That source of borrow-and-spend is gone.

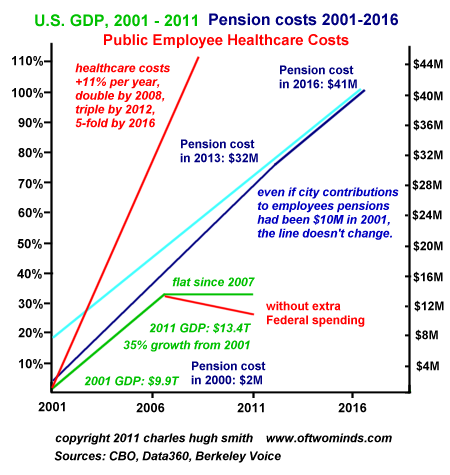

The problem is that the benefit costs are not static; they're constantly moving ever higher because the programs are expanding 3, 4 or 5 times faster than the real economy. Here is a chart of local government healthcare and pension costs. Does this look remotely sustainable?

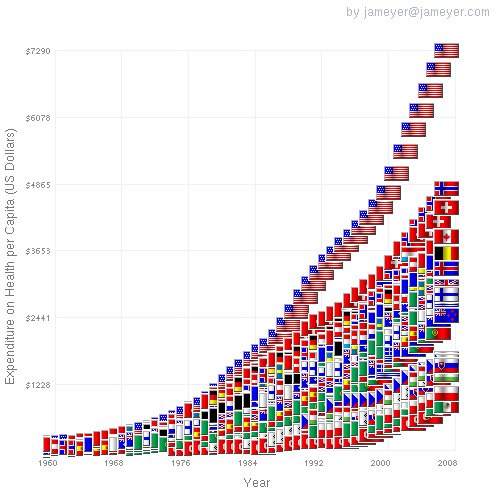

The problem is that the benefit costs are not static; they're constantly moving ever higher because the programs are expanding 3, 4 or 5 times faster than the real economy. Here is a chart of local government healthcare and pension costs. Does this look remotely sustainable? Here is a chart of our national healthcare (a.k.a. sickcare) spending. Compare this rocket-ascent path to the moon with the chart of declining income and the skyrocketing debt.

Here is a chart of our national healthcare (a.k.a. sickcare) spending. Compare this rocket-ascent path to the moon with the chart of declining income and the skyrocketing debt.

Many readers suggest that cutting Defense and raising taxes on the wealthy will preserve these entitlement programs. Unfortunately the math doesn't pencil out, for the reason noted above: when expenses are rising by 6% to 11% a year, every year, and your income remains flat to down, then in a very few years, those expenses will eat up your entire income.

But let's do the math. Let's knock a third out of the Defense budget of around $730 billion, saving $250 billion a year. (Never mind the fierce fight that fiefdom would put up.) Let's increase taxes on the super-wealthy (good luck getting them to pay it) and the plain old wealthy and you might raise $500 billion more a year.

That is questionable for a number of reasons, most saliently that the wealthy already pay most of the Federal income tax, which is quite progressive on earned income: The Problem with "Tax The Rich": It Won't Work (May 28, 2010).

The top 5% earn about 22% of the income, and they pay about 60% of Federal taxes. As many readers have pointed out, the total tax burden, including sales tax, property tax, etc. is heavier on lower-income workers as a percentage of income than it is on the super-wealthy (top 1%), who pay around 17% of income in taxes. But no matter how you slice the data, the fact remains that the top 5% already pay a hefty percentage of earned income in taxes, and they also pony up 60% of all Federal income taxes.

The top 1% could certainly stand to pay more than 17%, but the problem there is that capital is mobile now and anyone paying taxes on their global income in, say, Switzerland, cannot be made to pay taxes elsewhere on that same income. (Income and corporate taxes are low in Switzerland compared to the U.S. and Europe.)

We can rail against this reality, but capital will flow to the highest returns and lowest tax rates. We should impose the same tax rate on non-labor as we do on labor, and that would raise a a few hundred billion more a year. But let's also recall that the Federal government is borrowing $1.6 trillion each and every year, fully 11% of the nation's GDP and 40% of Federal spending, so even $500 billion more simply isn't going to rectify the budget shortfall or long-term situation.

Studies have found that taxes are remarkably stable at about 20% of GDP. It seems that attempts to raise taxes above that share of the economy trigger blowback in the form of tax avoidance, capital flight, voluntary reductions in income, etc.

But let's say you do manage to strip out $250 billion annually from Defense and Homeland Security/War on Global Terror (GWOT), and boost tax revenues by $500 billion a year (a 21% increase in total tax revenues). Together, that would generate $750 billion annually, or $15 trillion over 20 years.

I haven't found any firm estimates of the unfunded liabilities due in the next 20 years, but since 25% of the entire population (the Baby Boomers) will be retired and drawing on Social Security and Medicare within 15 years, I think we can reckon that about half that $106 trillion will come due in the next 20 years--and that is probably absurdly conservative.

$15 trillion down, $35 trillion to go. Do you see how utterly hopeless this exercise is when Federal spending rises by 6.5% every year even as the underlying economy muddles along at 2% in good years and -5% in poor years, if we subtract borrow-and-spend deficit financing?

In other words, $100 trillion in unfunded liabilities is the number now, but if spending continues rising at triple the rate of the real economy, then that number will only grow.

If we're honest about our accounting, then the U.S. economy hasn't grown at all since 2008; it's shrunk by $6 trillion, a sum we have masked by borrowing and spending $6 trillion in Federal debt, money that replaced the decline of private borrowing and spending.

Please look at the charts of healthcare and local government pension and healthcare costs again. Those rocket-launch lines shooting higher cannot be funded by a national income that is flat or declining.

We need a national conversation about reality, not wishful thinking. We need to grasp the nettle and talk about triage, about conserving Social Security for those with no other sources of income, and about devoting our scarce resources for palliative and preventive care. The Status Quo is completely, utterly unsustainable, but that needn't bring the nation to its knees--unless we actively insist that it does so.

No comments:

Post a Comment