by

Last week’s review of the macro market indicators looked to bring more red to Gold and Crude Oil, although likely at a slower pace in Crude. The US Dollar Index was headed to a test with the 3 year trend line while US Treasuries looked to continue to consolidate, but with an upward bias. The Shanghai Composite looked higher if only to retest the weekly breakdown level while Emerging Markets consolidate, with a chance of more downside. Volatility looks to continue to drift higher with a spike a possible signal of a further downside move in the Equity Index ETF’s. Otherwise they look to continue to consolidate but with the SPY and QQQ biased to the downside while the IWM is biased higher.

The week played out at as the charts foretold for Gold, and Crude did consolidate and move slightly higher. The US Dollar Index hit resistance and bounced lower while US Treasuries broke their consolidation to the downside. The Shanghai Composite consolidated slightly higher but Emerging Markets broke their consolidation higher. The Volatility Index started higher but then drifted lower as the Equity Indexes SPY, IWM and QQQ rocketed higher out of their descending wedges for the week. The same correlations between Treasuries, Equities and the Dollar, but the opposite direction, with the US Dollar being the driver. What does this mean for the coming week? Let’s look at some charts.

As always you can see details of individual charts and more on my StockTwits feed and on chartly.)

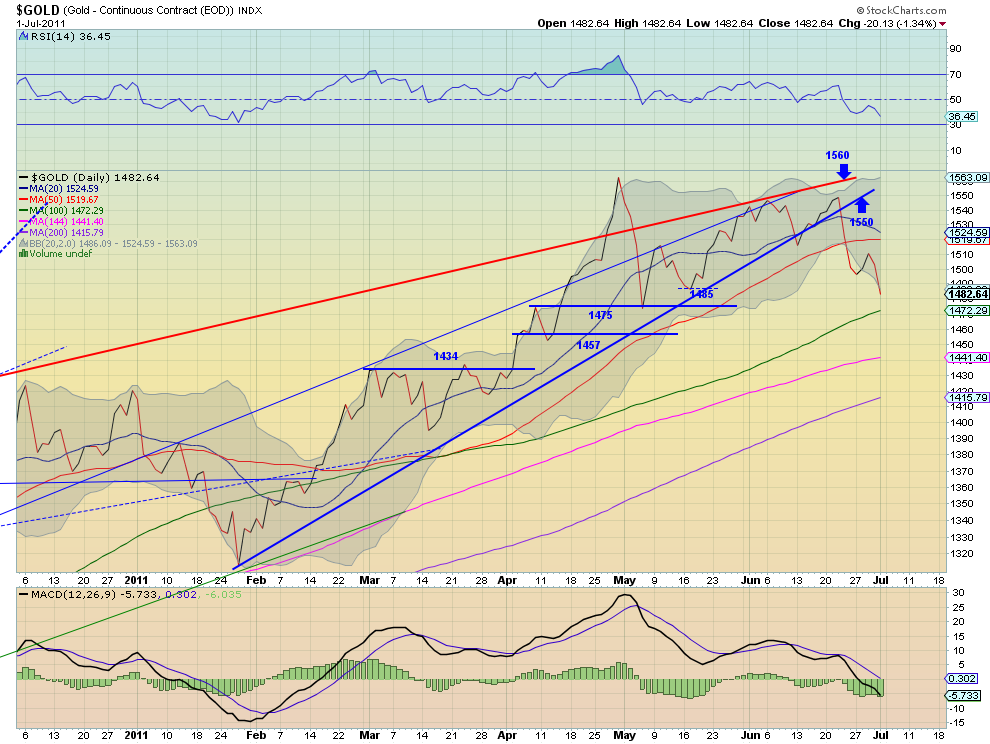

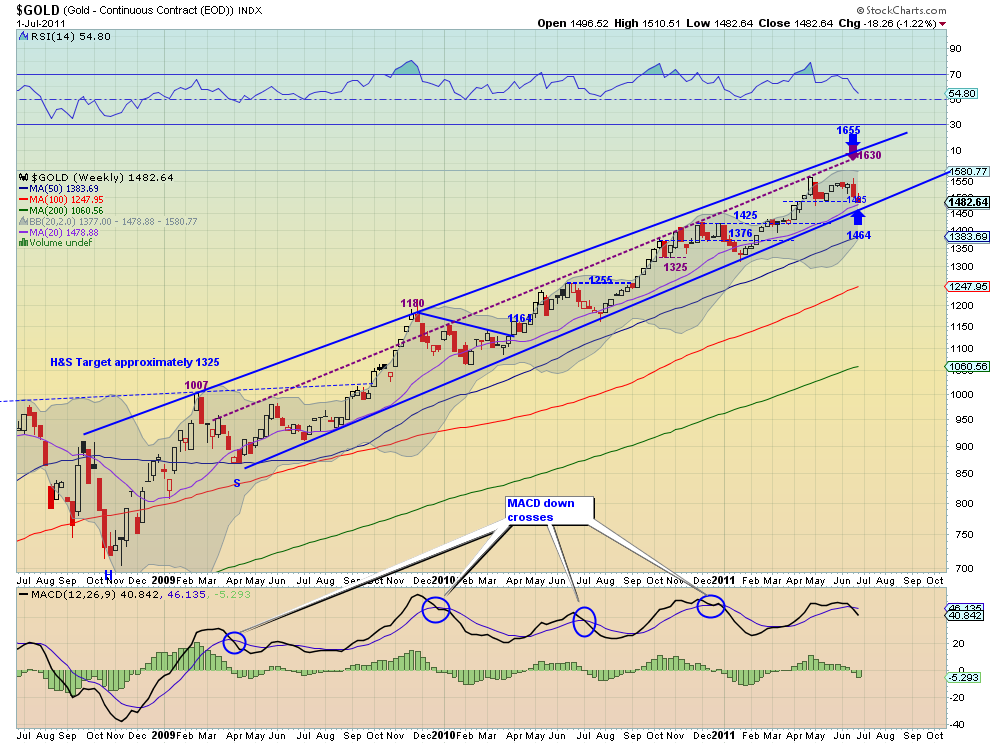

Gold Weekly, $GC_F

Gold started the week lower, looked like it might consolidate and then plummeted to finish the week. It now sits below support at 1485 on the daily chart with Relative Strength Index (RSI) that is still heading lower and a Moving Average Convergence Divergence (MACD) that is again gaining to the downside. The shorter Simple Moving Averages (SMA), the 20 and 50 day, have rolled lower and the 100 day SMA is just below near the next resistance at 1475. The weekly chart shows that the multi-year uptrend is still in tact with support of the rising channel below at 1464. But the RSI is moving south steeply and the MACD has just crossed negative. Look for more downside to Gold next week and likely a test at the 100 day SMA with a failure there falling to the 144 SMA which has historically been a buy level.

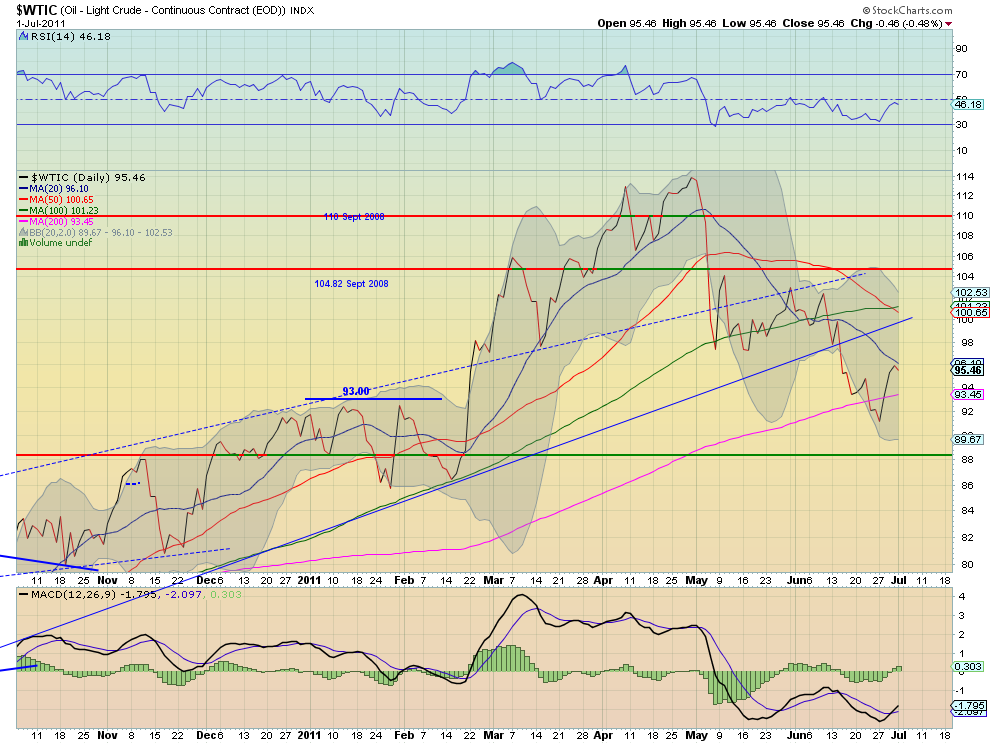

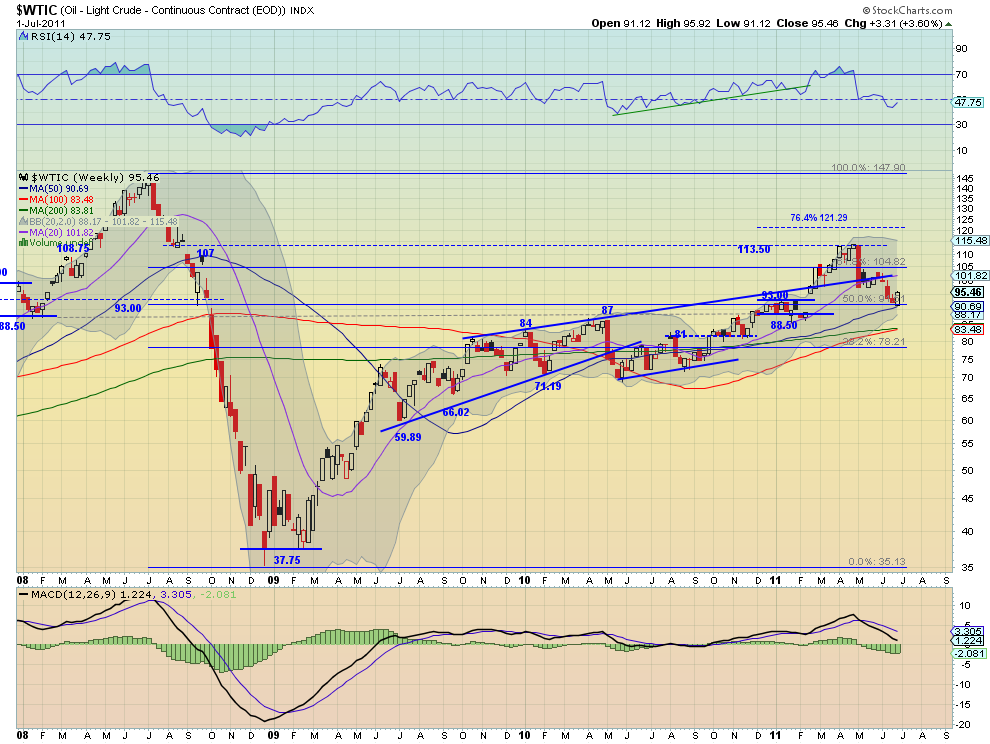

West Texas Intermediate Crude Weekly, $CL_F

Crude Oil caught a bid in the previous channel between 88.50 and 93 and bounced higher, only to fail at the falling 20 day SMA. The RSI on the daily chart hit the mid line and rejected at the same time, but the MACD having just crossed positive suggests there may still be some upside. The weekly chart shows that the bounce happened near the 91.51 Fibonacci level, midway of the 2008 move lower. The RSI is curling higher and the MACD is leveling. Mixed signals in the short term downtrend. If the move lower Friday continues look for support at 88 and if it proves to be just a consolidation, my bias, then a test of the rising trend line at 102.

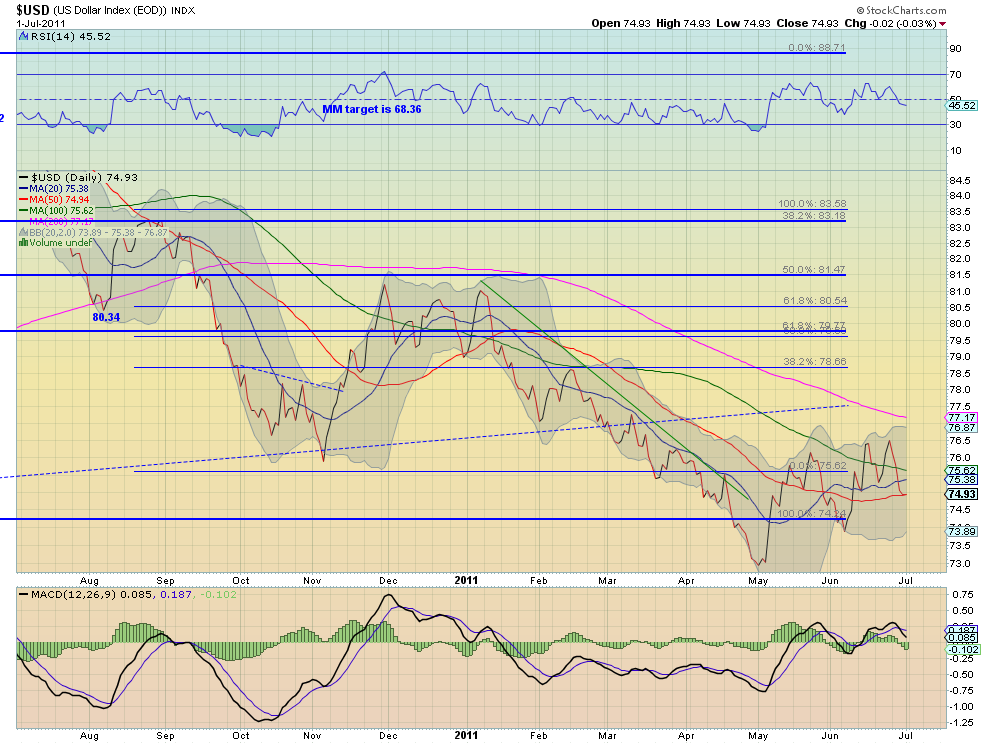

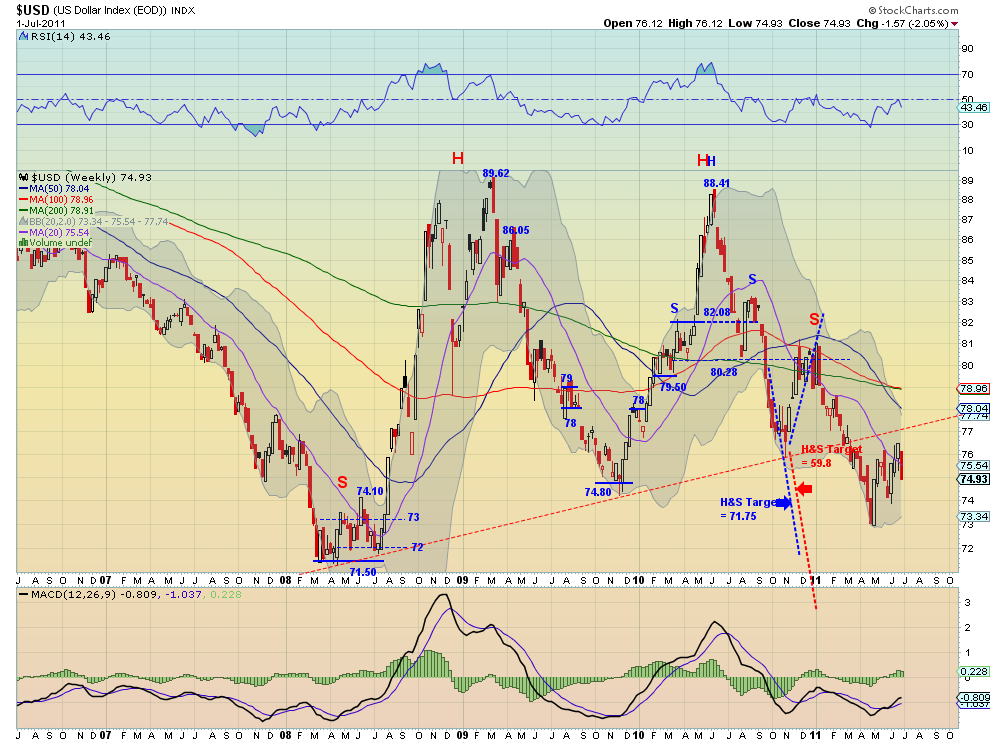

US Dollar Index Weekly, $DX_F

The US Dollar Index found resistance again at 76.50 and kicked lower. On the daily chart it is building a bear flag with the RSI making a lower low and through the mid line pointing lower. The MACD on that chart is also pointing lower. The weekly chart shows that flag more clearly. It also shows the RSI rejecting off of the mid line and the MACD starting to fade. The bear flag could continue to test the 77.20 trendline break without impacting the long term trend and this still looks likely, unless it breaks below 74. In that case prepare for a test of 73 and the previous low at 71.50.

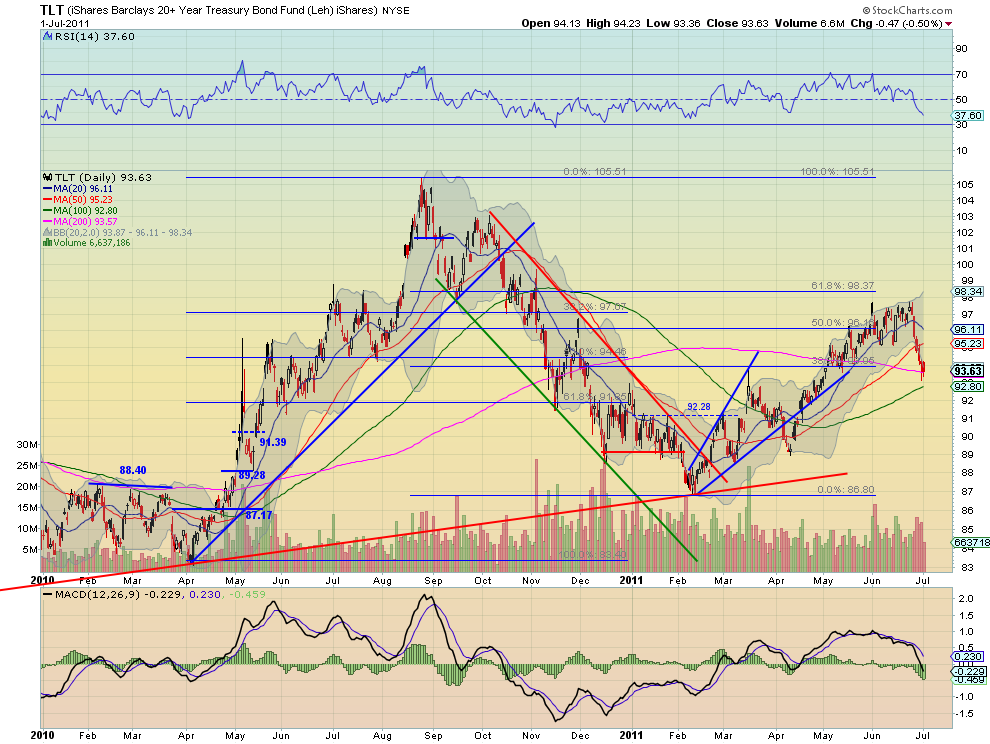

iShares Barclays 20+ Yr Treasury Bond Fund Weekly, $TLT

US Treasuries, measured by the ETF TLT, crashed out of the resistance at the 97.30 area and began to build a bear flag at the end of the week on the 200 day SMA. The daily chart shows the RSI and MACD suggesting more downside. The weekly chart shows the rejection area was the middle of the symmetrical triangle formed between the 8 year rising support trendline and the two and a half year falling resistance trend line. With rising volume, a RSI pointing sharply lower and a MACD fading to a negative cross quickly, it looks like more downside. Look for the TLT to continue lower next week with support at 93 and the rising trend line near 90.

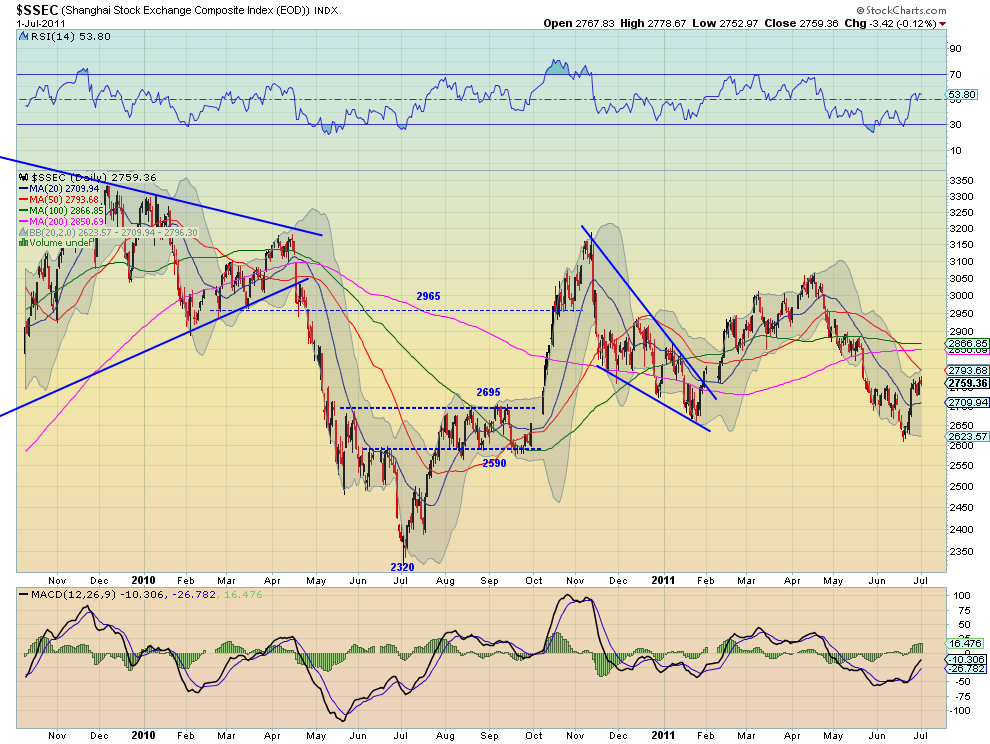

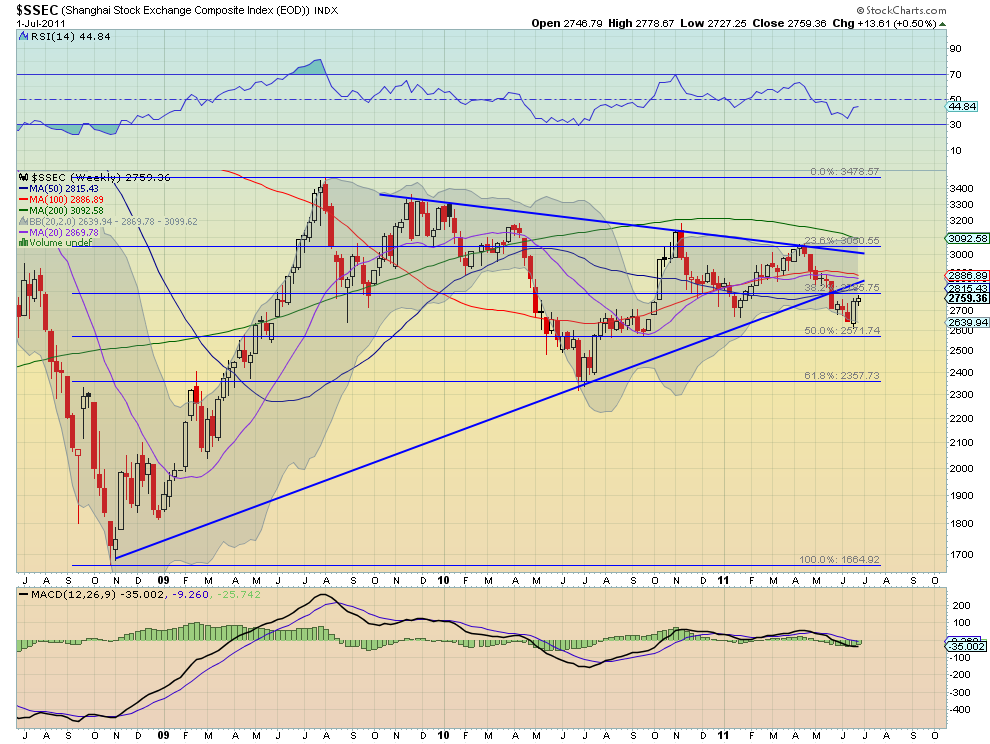

Shanghai Stock Exchange Composite Weekly, $SSEC

The Shanghai Composite consolidated higher this week with a drift above the early June highs. The daily chart shows that the RSI tested the mid line from above, held and reversed higher. The MACD crossed positive and has been increasing. Both are bullish. The weekly chart shows the consolidation occurring just below the Fibonacci level at 2795, with a rising RSI and a MACD that is moving north towards zero. But the SMA’s are rolling lower suggesting a top is near. Look for more upside in the Shanghai Composite next week with resistance in the 2795-2800 area.

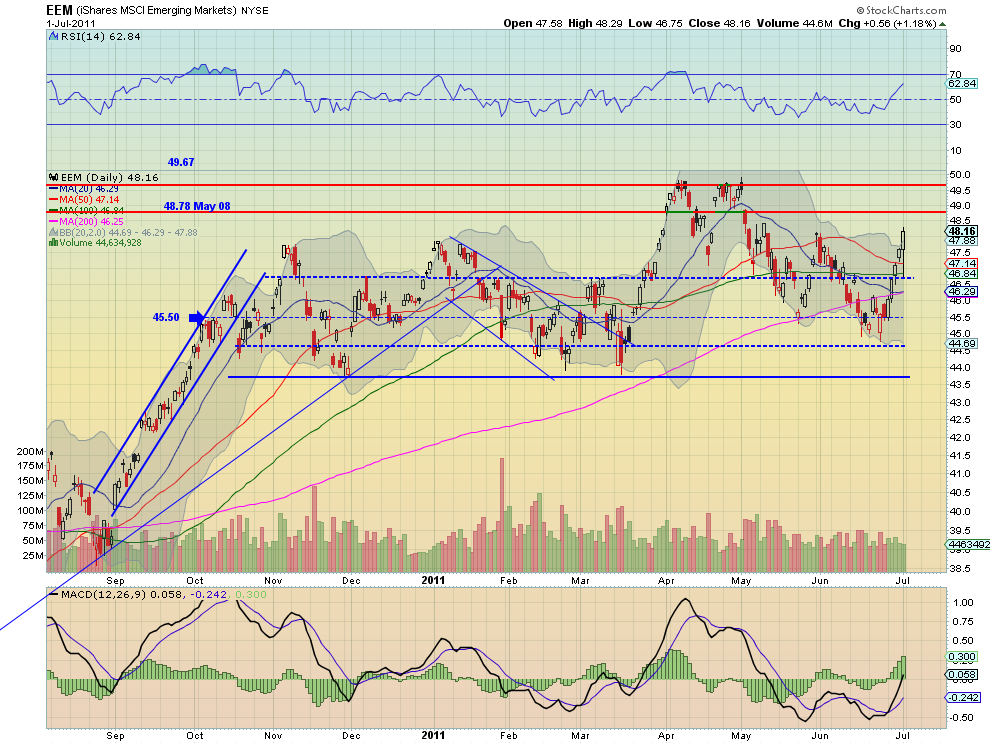

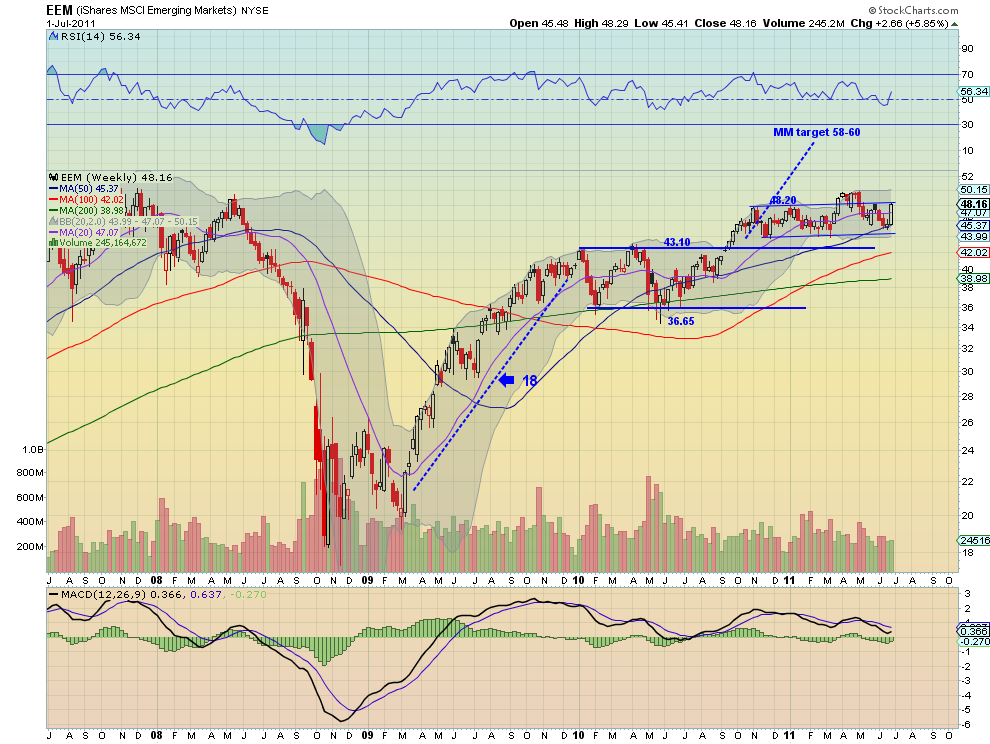

iShares MSCI Emerging Markets Index Weekly, $EEM

Emerging Markets, measured by the ETF EEM, rocketed higher this week. The daily chart shows the RSI is rising rapidly and the MACD growing quickly as well. Strong. The weekly chart shows that strength ended right at channel resistance. The RSI and MACD on the weekly suggest that it has more upside left in it. Look for a continued move higher next week with resistance at 48.78 and then 49.67-50 above that.

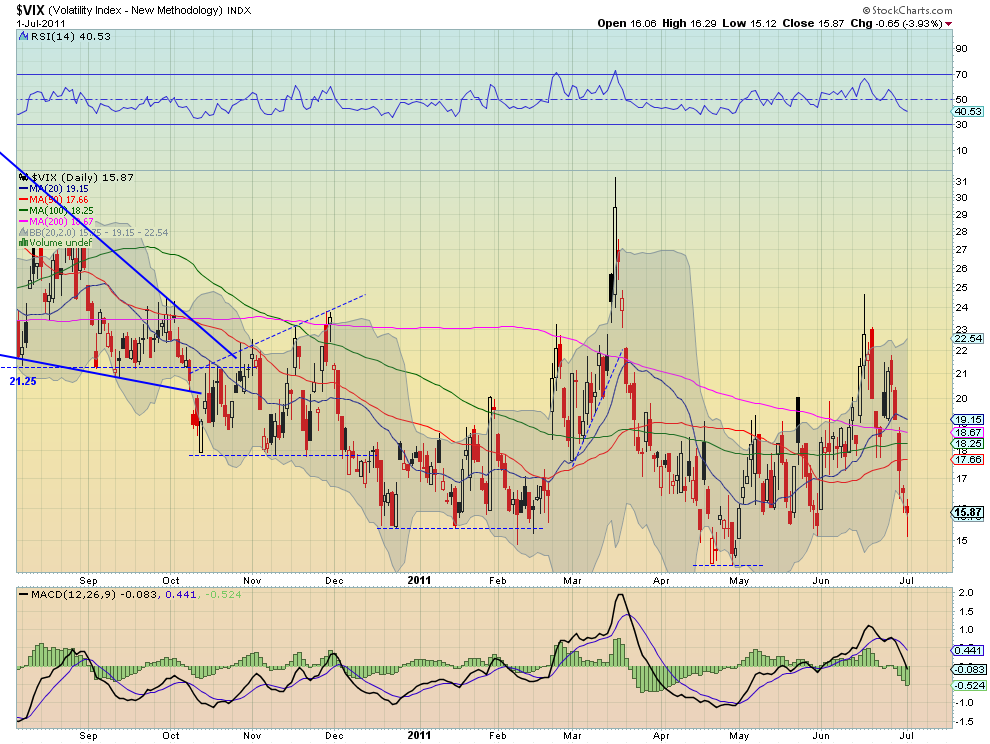

VIX Weekly, $VIX

The Volatility Index teased that it was going higher and then trended lower all week, finishing at the lowest level in a month. The RSI is back below the mid line after spending most of June above it hinting of a bullish move, and the MACD now pointing to more downside. The weekly chart shows an expanding wedge which could mean a bottoming, but it is following two previous expanding wedges that did not mark bottoms. The weekly RSI is also running lower with the MACD flat but hinting at a cross lower. All this means to look for continued stability in the Volatility Index in the coning week, with a range between 15.50 and 23.

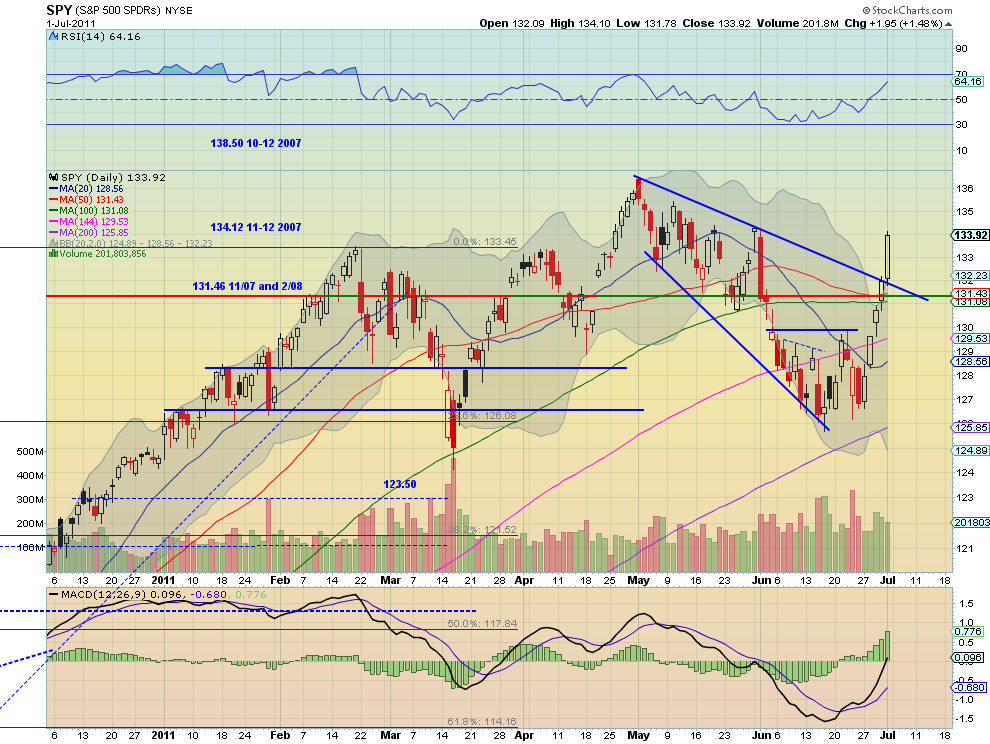

SPY Weekly, $SPY

The SPY broke the descending wedge to the upside Friday and ran big to the high from the end of May. The RSI is rising sharply on the daily chart and the MACD increasing, boding for more upside. But the volume has been decreasing on the run higher and it is now well outside of the upper Bollinger band. The weekly chart shows the RSI turned sharply higher with the MACD moving back toward zero, but also highlighting the light volume. It is also still below the rising trend line resistance from the March 2009 lows. The strength of the bullish weekly Marubozu candle trumps all at the moment. Look for more upside in the coming week with resistance higher at 134.20 followed by 135.4 and finally 136.50 before a new leg higher can be expected. Any pullback should find support at 131.46 or 130 else the move higher comes into question.

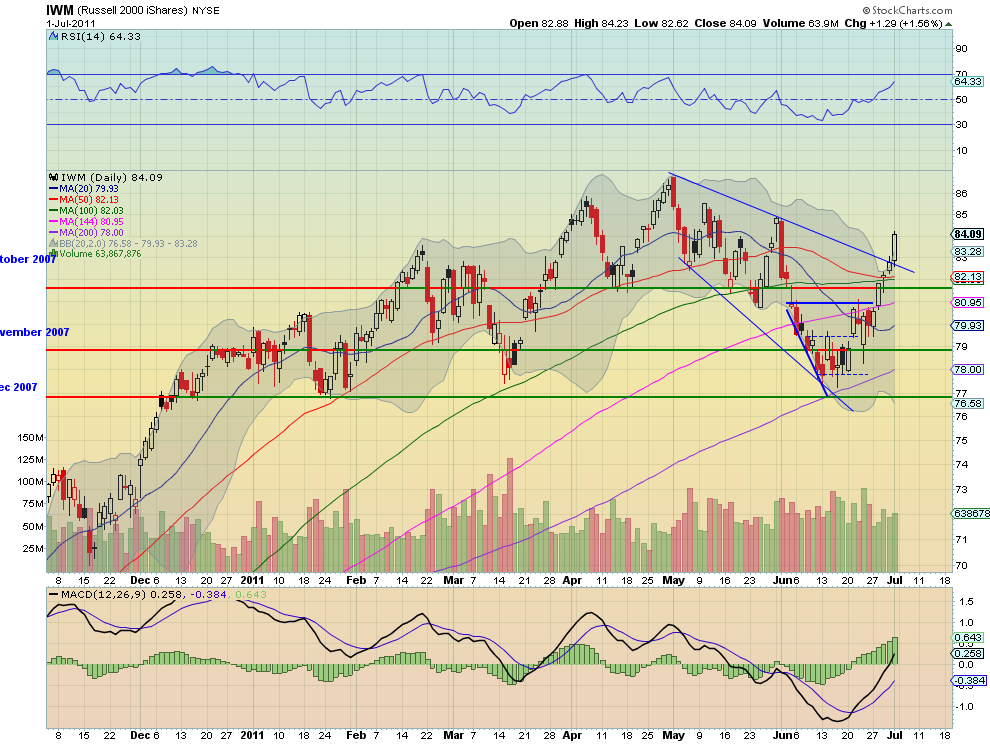

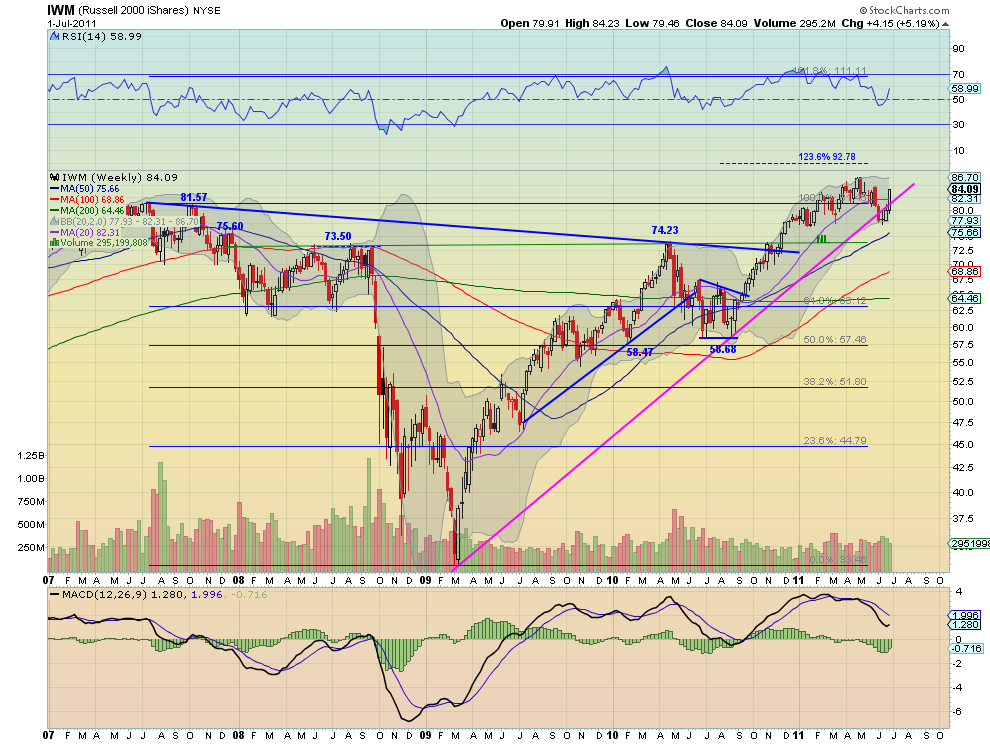

IWM Weekly, $IWM

The IWM also broke the descending wedge to the upside Friday and ran big to just under the high from the end of May. The RSI is rising sharply on the daily chart and the MACD increasing, boding for more upside. Unlike the SPY the volume has been increasing on the run higher, but it is also well outside of the upper Bollinger band. The weekly chart shows the RSI turned sharply higher with the MACD moving back toward zero. It has moved above the rising trend line resistance from the March 2009 lows. The strength of the bullish weekly Marubozu candle is reinforced by the other indicators. Look for more upside in the coming week with resistance higher at 85 followed by 85.60 and finally 86.80 before a new leg higher can be expected. Any pullback should find support at 81.57 or 81 else the move higher comes into question.

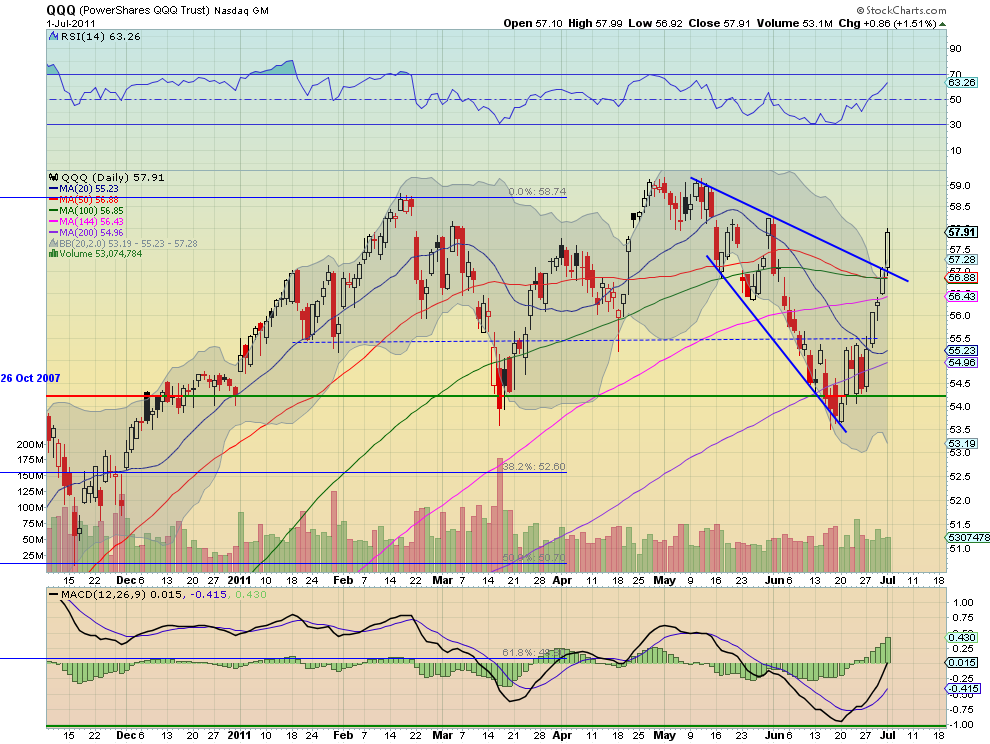

QQQ Weekly, $QQQ

The QQQ broke the descending wedge to the upside Friday and ran big to just under the high from the end of May. The RSI is rising sharply on the daily chart and the MACD increasing, boding for more upside. But the volume has been decreasing toward the end of the run higher and it is now well outside of the upper Bollinger band. The weekly chart shows the RSI turned sharply higher with the MACD moving back toward zero. It is also at resistance of the rising trend line from the March 2009 lows. The strength of the bullish weekly Marubozu candle trumps yet again. Look for more upside in the coming week with resistance higher at 58 followed by 58.74 and finally 59.21 before a new leg higher can be expected. Any pullback should find support at 56.40 or 55.50 else the move higher comes into question.

The coming week looks for Gold to continue lower with Crude Oil biased to the upside but defined by the range between 88 and 102, I know that is big stay away from the middle. The US Dollar Index still looks headed higher to test the trend break in a bear flag, while US Treasuries continue lower. The Shanghai Composite is headed higher towards a test of the breakdown while Emerging Markets continue higher to resistance. The Volatility Index looks to remain stable allowing a run higher by the Equity Indexes toward previous highs from April. Remain cautious on any move lower that does not hold support from near Tuesday’s highs as this could trigger a major down move and a Head and Shoulders top. Use this information to understand the major trend and how it may be influenced as you prepare for the coming week ahead. Trade’m well.

No comments:

Post a Comment