By Global Macro Monitor

The U.S. is suffering from insufficient aggregate demand the result of the bursting of the 2004-07 credit bubble. The consumer led economy financed by borrowing, much of it backed by home equity, has given way to massive private sector deleveraging as reflected in the charts below. To cushion the blow, the federal government stepped up deficit spending in an effort to replace the decline in demand. This is clearly illustrated in the charts below.

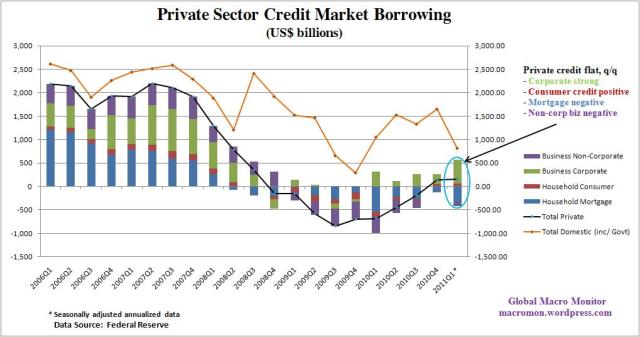

The latest data from the Federal Reserve’s Flow of Funds Accounts show that private domestic credit borrowing of the non-financial sector is still at very anemic levels (see middle chart) . Though total private non-financial credit growth was flat in Q1, corporate continued to strengthen and consumer credit was positive for the second straight quarter. This was offset, however, by continued deleveraging in the mortgage and non-corporate business sector. The negative borrowing is likely both supply and demand constrained.

The charts are revealing as they also illustrate the sharp Q1 drop in public sector borrowing with state and local government turning negative. Unless private credit significantly improves — net mortgage lending turning positive, for example – to help finance the expansion of domestic demand, the economy will likely remain sluggish as the crunch in public spending continues. After all, President Obama did say that “the flow of credit is the lifeblood of our economy.”

Corporate spending and the export sector will have to do the heavy lifting as the U.S. works its way through the credit mess. The President needs a positive Black Swan event, such as the explosion of the internet, which drove high levels of investment spending during the Clinton Administration, for example.

Policies to free up financing for small and non-corporate businesses and renewed efforts to clean up mortgage sector, which also allow housing prices to bottom, could help strengthen the recovery. Stay tuned, we’ll be back with more analysis of the Flow of Funds.

~~~

~~~

See the original article >>

No comments:

Post a Comment