By Barry Ritholtz

I have a ton of errands to do before heading to the airport, but I wanted to get a few thoughts out beforehand:

On the back of ECB chief Jean-Claude Trichet’s comment about Greek debt rollovers, markets around the globe have turned positive rallied. The euro hit a one-month high versus the US dollar.

Stocks in Europe gained about 0.2%, while US SPX futures climbed 0.6 %. The 10-year Treasury is a mere 3 bips above 3% mark at 3.03%

Last week’s big sell off was a 90/90 day, meaning 90% of the trading breadth and 90% of the share volume were to the downside. The playbook favors a 5 -7 day bounce, and then a resumption of the move downwards.

Here is what Lowry’s Paul Desmond, the creator of the 90/90 indicator, has said about these days:

With the evidence currently available from our measures of Supply and Demand, the probabilities favor a limited recovery rally. The 74 year history of the Lowry Analysis shows that such rallies are usually best used to sell into strength and build defensive positions. However, it is important to recognize that exceptions to the probabilities are always possible.”

We are off the recent peak by less than 6%. My best guess as to the extent of the pullback is a 7-12% move lover from the highs. As we get more data, I’ll try to update that projection.

Be back shortly . . .

>

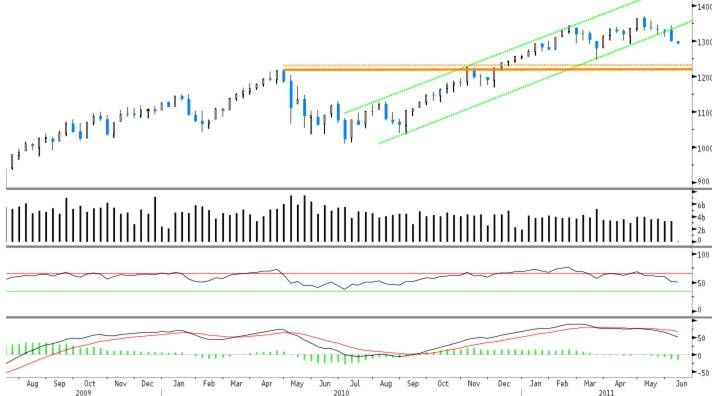

SPX Breaks its 1 year Up Channel

Chart courtesy of FusionIQ

No comments:

Post a Comment