By JJ Abodeely

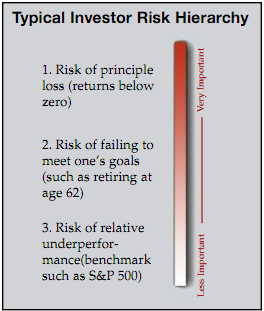

In the paper Vincent argues that the flawed foundation of Modern Portfolio Theory (MPT) that risk=volatility has allowed MPT advocates to control the language of the debate and set the stage for the obvious conclusion that passive index-based investing is inherently superior. And don’t think for a second that this debate is simply theoretical, academic, or unimportant– the basic tenets of MPT shape the decisions of nearly every institutional money manager, wealth management firm, investment counselor/consultant, and financial planner in profound and often disturbing ways. YOUR money is almost certainly being managed with these ideas at the core. The traditional approach to asset allocation is built on false axioms.

While Vincent’s direct assault seems to be focused on highlighting the mistreatment of active, concentrated equity or fixed income asset managers vs. holding a passive equity or fixed income index, his arguments hold sway over the much larger and dangerous consequences of MPT on asset allocation. My assertion is that most damage to investors portfolios from the traditional approach to investing comes from the foundation of static, backward looking assumptions informing broad asset allocation decisions.

Vincent’s Case

In the piece, the author does a fantastic job of summarizing the history of Modern Portfolio Theory and it’s building block components:

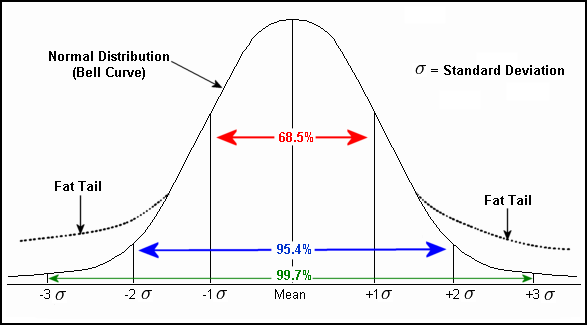

- Harry Markowitz’s work on “Portfolio Selection” (which informs the chart above) proved mathematically that diversification could reduce volatility which he equated with risk

- William Sharpe’s Capital Asset Pricing Model (CAPM) which mathematically defines an asset’s return into two parts:

- systemic risk or “beta” which describes how an asset has historically behaved relative to “the market” or a broad index

- idiosyncratic (stock specific) risk which can and should be diversified away

- Eugene Fama’s Efficient Market Hypothesis (EMH) which asserts that the market is ultimately efficient at pricing all available information

Vincent notes that most advocates for passive investing and MPT start with a compelling statement:

Active managers in general have been shown to underperform passive funds, especially when taking into account their higher management fees, taxes, sales charges, and trading costs. If you can make more money in index funds then why bother with the hassle of trying to find a good manager?

On the surface, that’s hard to argue with. I’ve seen studies that indicate after taxes, 80% of active long-only equity managers underperform their benchmarks over long time periods. Here’s the problem: Most “active” managers aren’t active at all. They are closet indexers:

While diversification has always been a selling point for actively managed mutual funds, the average number of holdings in a fund have increased dramatically since MPT made the scene. The average number of stocks held in actively managed funds is up roughly one hundred percent since 1980… the average fund holdings had risen to approximately 140 positions by 2000. The actual number of holdings in a given year could easily surpass 200 because portfolio turnover exceeds 100 percent per year on average…Investors in actively managed funds suffer – they receive quasi-active management at full active management prices.

MPT and the quantification of investing has further (mis)informed the debate by seeking a easy way to label and quantify “risk.” In 1952, Harry Markowitz chose variance or volatility of prices or returns to define risk. He did so because it was mathematically elegant and computationally simple. However, this idea has serious limitations (most of which Markowitz has since acknowledged).

On the individual stock level, Vincent notes

Risk is often in the eye of the beholder. While “quants” (who rely heavily on MPT) might view a stock that has fallen in value by 50 percent over a short period of time as quite risky (i.e. it has a high beta), others might view the investment as extremely safe, offering an almost guaranteed return. Perhaps the stock trades well below the cash on its books and the company is likely to generate cash going forward. This latter group of investors might even view volatility as a positive; not something that they need to be paid more to accept. On the other hand, a stock that has climbed slowly and steadily for years and accordingly has a relatively low beta might sell at an astronomical multiple to revenue or earnings. A risk-averse, beta-focused investor is happy to add the stock to his diversified portfolio, while demanding relatively small expected upside, because of the stock’s consistent track record and low volatility. But a fundamentally-inclined investor might consider the stock a high risk investment, even in a diversified portfolio, due to its valuation. There’s a tradeoff between risk and return, but volatility and return shouldn’t necessarily have this same relationship.

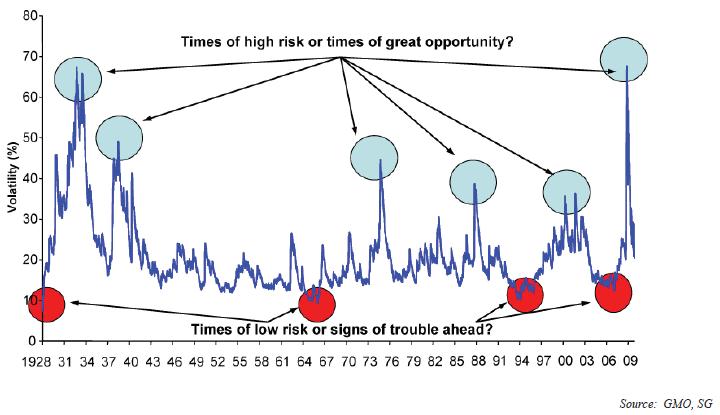

I would add to this sentiment, particularly for equities as an asset class; there is actually more risk (chance of loss) when volatility is low, and less likelihood of loss when volatility is high.

Additionally, not all volatility or standard deviation is created equal. Most investors, for example, do not think that the prospect of achieving returns that are 2 standard deviations ABOVE average is risky, where the opposite is clearly so. So MPT’s cornerstone– its definition of risk– is incomplete at best and at worst, completely misleading.

Vincent continues

Regardless of MPT’s shortcomings on both a theoretical and empirical level, its dominating influence will not easily be dislodged. MPT is deeply woven into the fabric of our financial system, its mathematical grounding and precise answers inspire confidence. Further, its application is crucial in bringing increased scale and profitability to the financial services industry. Few want to see change. As such, common sense and judgment will continue to diminish in importance as top-down, quantitative strategies and blind diversification gain investment dollars.

And this is the part the ticks me off the most. The ideas behind MPT are so self-serving for our industry that despite their shortcomings, we can’t seem to move past them. Of course fear of embracing Maverick Risk (see my recent post) help keep the status quo alive and well

There’s a feeling of safety that accompanies index investing; neither the advisor nor the investor risks losing face or losing a job over putting money to work in a broad index. We enjoy the mathematical certainty of MPT, it’s reassuring that we can fix a value to assets, and that we can quantify risk in a non-subjective manner – free from human error…When defending an entrenched system that furthers the economic interests of powerful entities, the rationale doesn’t need to be sound, it just has to be somewhat convincing.

Vincent’s Prescription

The author contends that smart investors should welcome the dumb money move to highly diversified, passive strategies, while acknowledging if you ARE the dumb money or are forced on some level into limited choices (like 401(k) plan participants or beneficiaries of trusts with bank trustees– at least don’t pay active management fees for closet indexers.

An informed investor should welcome this shift. As highly-diversified strategies gain assets, inefficiencies become more prevalent because share prices are increasingly driven by factors other than fundamentals… there is compelling empirical research that shows active managers who are truly “active,” do persistently outperform indexes. The astute individual investor can seize the opportunity that blind, passive index investing provides in the form of increased market inefficiencies by hiring active managers who have shown the ability to exploit and profit from these inefficiencies.

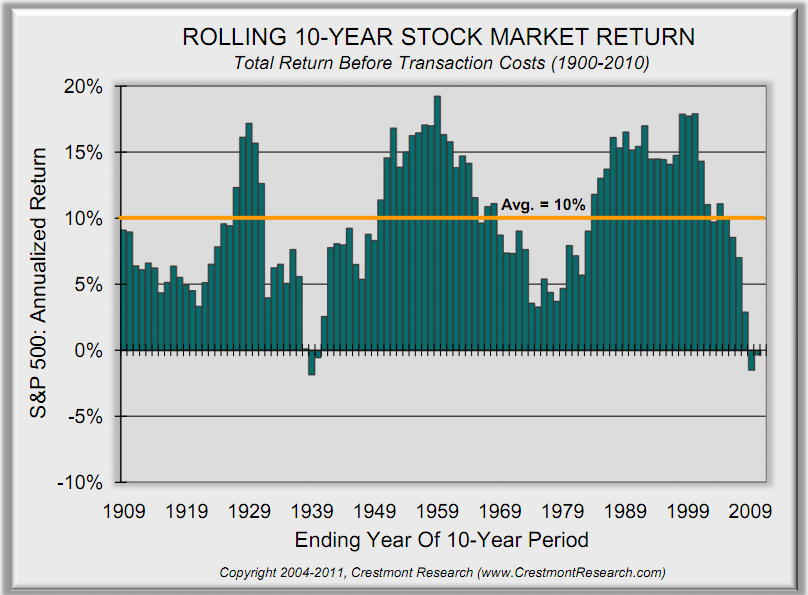

Take advantage of the fact that your neighbors are leaving for passive funds, as their passive investments could provide the inefficiency your manager seeks to exploit. But, by all means, avoid investing in highly diversified active funds whose returns closely match an index. If index returns are what you seek, then pull your money and invest in efficient passive index funds or ETFs (emphasis mine).This is where many investors stop thinking about their portfolio. They say, Yes! index returns is what I seek. After all, if you buy and hold the market you can earn the long-term returns right? Unfortunately, the answer to that is no. The long-term “average” returns are rarely available. In fact, depending on where you are standing, the returns are either much higher, or much lower. Consider this chart fromCrestmont Research which shows that even for periods as long as 10 years, average rarely occurs:

MPT & Asset Allocation

Scott Vincent seems to be focused on encouraging investors to choose the correct managers (truly active, relatively concentrated, fundamentally-focused) WITHIN asset classes like stocks or bonds. And he is certainly compelling. However, as I alluded to earlier, his argument holds sway over the much larger and dangerous consequences of asset allocation.

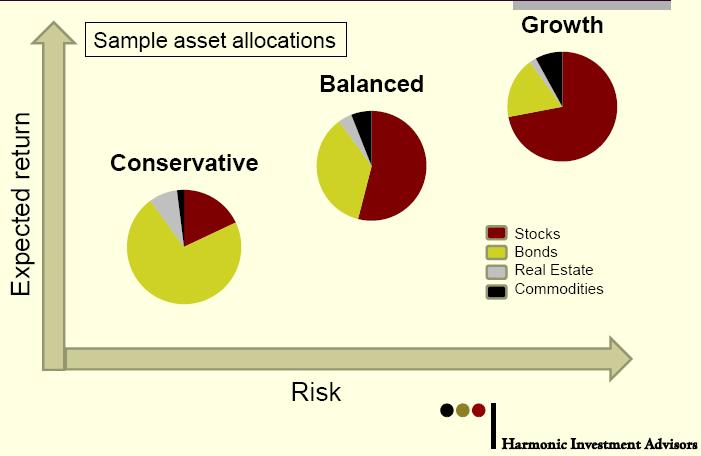

Consider this chart which you’ve probably seen in one form or another. It shows expected risk and return of various mixes of asset classes and the typical approach to asset allocation which Modern Portfolio Theory has spawned:

So what’s wrong with this picture? Lots of things.

The first is the inputs– namely expected returns and volatilities of various asset classes– most investment programs are built on logic like this:

- Bonds will return 5% on average over the long-term but be between 0-10% in any given year

- Stocks will return 10% on average over the long-term but be between -10% and +20% in any given year

- Some might include other nuance regarding different types of bonds like High Yield or different types of stocks like Emerging Markets

- Some might include different types of assets like real estate, commodities, or “alternatives”

The problem of course is this is an incomplete description of investment returns:

- The math contends that returns are randomly and unpredictably distributed around the average

- This “normal distribution” of returns contends that larger market movements outside of the ranges above will be relatively rare

- “Average” returns ignore the role of valuation and the importance of when you start investing (buy) and when you finish (sell) even over multi-decade time horizons

The traditional approach to asset allocation is built on false axioms. The phenomenal secular bull market in stocks and bonds from 1982-1999 created the perfect conditions for the nearly religious acceptance of MPT. In a recent post, Expensive Markets Mean Low (or Negative) Prospective Returns, I made the case that valuation matters greatly and currently portend disappointing returns for both stocks and bonds. Traditional asset allocation has no way of dealing with this in a way that successfully protects portfolios from experiencing meaningful and unnecessary drawdowns.

As colleague Brian McAuley penned in Sitka Pacific’s March 2010 client letter

Whether or not these themes are presented directly, they underpin the advice that most investment advisors give their clients. At its core, the message is usually something similar to this: “The markets are random and unpredictable, so the best way to invest is to properly diversify and wait for the averages to play out.”

However, what most investors seem to be unaware of is that this whole theory of random movement of market prices was proven false over 50 years ago by one of the most influential mathematicians of the 20th century, Benoit Mandelbrot. The random motion of market prices was a very nice theory, but it just doesn’t match what actually happens in the real world.

In a completely random world, a large movement in prices would be a relatively rare event. But we know from market history that large movements in prices happen far more frequently than they should if prices moved completely randomly. In fact, if we look at annual market returns, there are 50% more extreme events than there should be… It’s clear that there are other forces influencing the markets that aren’t taken into account by the statistics of purely random movements—and they have to do with human behavior.

Since the movement of market prices is not random, most investment advice given today that is based on Modern Portfolio Theory is simply wrong. Particularly, the assumption that market risk can be reduced by diversification has led to frequent catastrophic results throughout market history—most recently in 2008.

Although the theory of random market movements was proven false more than 50 years ago for those fluent in mathematics, with multiple bubbles and busts in the last decade it has become painfully obvious to everyone that there is more to market movements besides a Brownian-like random motion. Markets are subject to the rational and irrational decisions made by millions of people, and as such they are prone to cycles of extremes in sentiment and valuation—booms and busts.

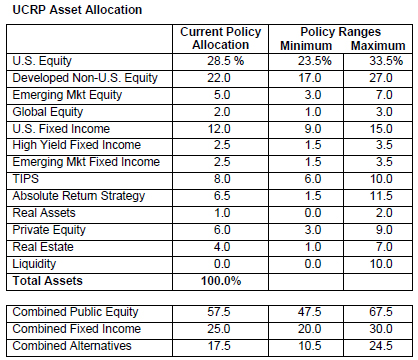

Even those who bill themselves as “active” asset allocators typically only move within a small range of acceptable allocations such as 40-60%. Consider even this progressive asset allocation policy:

My Prescriptions

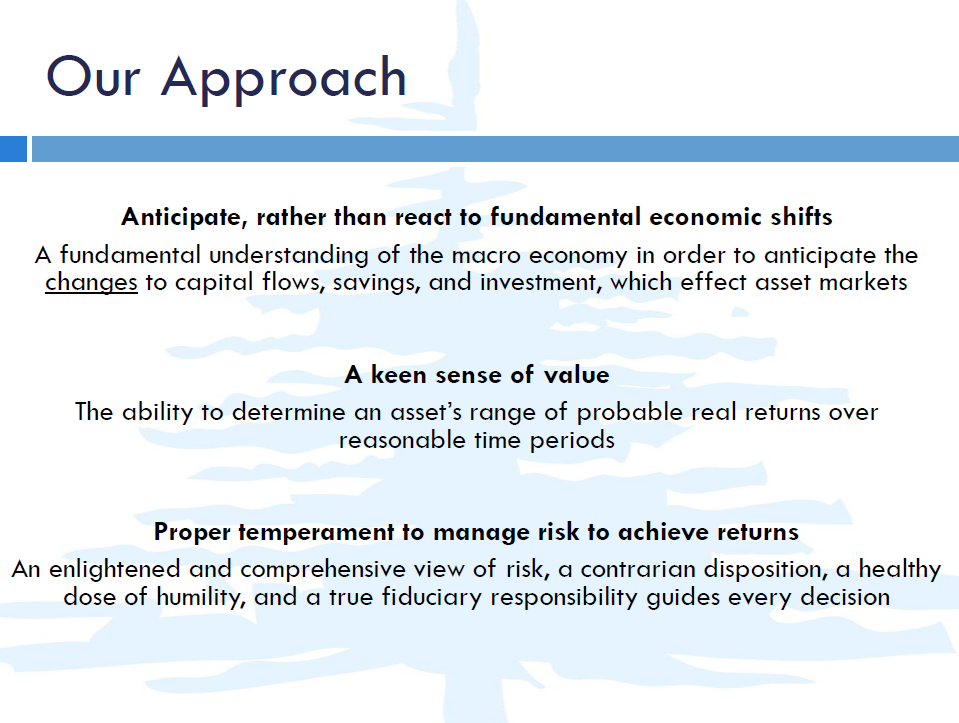

Obviously, I think investors can do better. Just as Scott Vincent highlights the cadre of truly active, relatively concentrated investment managers who have “beaten the market” consistently– there are asset allocation strategies which aim to improve upon the traditional approach. At Sitka Pacific, we’ve taken an “Absolute Return” approach to the markets. From our 2006 Annual Review

We have the flexibility to take more meaningful actions to preserve capital, manage risk and volatility, and invest where the best opportunities are. Our goals are simple: to preserve capital first and generate an absolute positive returns second. In order to achieve those goals we look at the market as a means to generate a return, not something that should be blindly followed. We use the market when it can be useful to us, and can look elsewhere (even to cash) when there is more risk than potential reward in the market. The flexibility to manage risk may prove critical over the next several years.

Lots of managers aim to do the same thing. I’d recommend finding one who not only has demonstrated a successful approach in various market environments, but also whose process seems repeatable and makes sense to you. Take Mebane Faber at Cambria and his GTAA ETF. It’s a pretty straightforward process that using long-term momentum indicators to decide when and when not to be invested in various markets. It’s an improvement on a static approach, but might leave a little something to be desired for folks who wish to have a fundamental approach to their portfolio. John Hussman’s approachat the Hussman Funds is worth a look as well. For Do-it-Yourselfers, I’d recommend this post by David Merkel: The Impossible Dream Project for a good look at how to build your own process. For our approach to be successful, we need 3 Key Traits:

When one is trying to be dynamic and active in their approach, flexibility is hugely important. Whether it’s the inherent inflexibility of an investment committee, the curse of success (overconfidence), ingrained cultural constraints, or simply the challenge of moving around and effectively deploying a large chunk of assets, large, well established firms often lack flexibility.

Folks in this position, MPT devotees, and folks who don’t want to rock the boat too much would be wise to consider several emerging theoretical frameworks which aim to improve upon the status quo.

- Post-Modern Portfolio Theory (PMPT) is compellingly described in this FPA Journal article by Pete Swisher and Gregory Kasten.

- Allocating based on Downside Risk (versus Mean Variance) seems like a no-brainer and should be evaluated by anybody trying to “optimize” portfolio allocations. Here is a good primer.

- Fundamental Indexing: Research Affiliates is a good source.

- Risk Parity, which Bridgewater, PanAgora, and AQR are all pursuing in various forms, takes a different view of targeting acceptable levels of risk as opposed to returns

These approaches all have their own limitations and should be evaluated critically (like anything involving your or your client’s money). Ironically, one can make the argument that “Absolute Return” or GTAA or Fundamental Indexing can be considered as distinct asset classes, with their own projected risk and return characteristics and lower correlations to traditional benchmarks. In this case, MPT would suggest that “efficient” portfolios should have an allocation to them, just as many traditional investors have embraced alternatives to varying degrees.

Regardless of how you are currently invested, the shortcomings of MPT and its pervasiveness in portfolios is becoming increasingly clear. The last two years have given MPT-based investors a reprieve from the secular bear market underway since 2000. The next two years may not be so friendly. Investors should take the leap into truly active investing and asset allocation, even if it just means “trying it” with one or more managers or funds.

No comments:

Post a Comment