by Cullen Roche

Tomorrow brings us the beginning of another FOMC meeting with a Wednesday decision. The Fed will announce their decision on rates, release their quarterly forecasts for the economy, provide some details on a potential QE3 and will finish off the big event with the new Q&A by the Chairman.

If you’ll recall last quarter, the Fed hinted at remaining accommodative for what feels like a permanently extended period. Markets loved the news and a speculative frenzy ensued as commodity prices went ballistic. Unfortunately, nothing of any significance was announced with regards to actually impacting the economy and the markets have since responded with their recent swoon. And that’s the conundrum the Fed now finds itself in. Their policy choices are depleted.

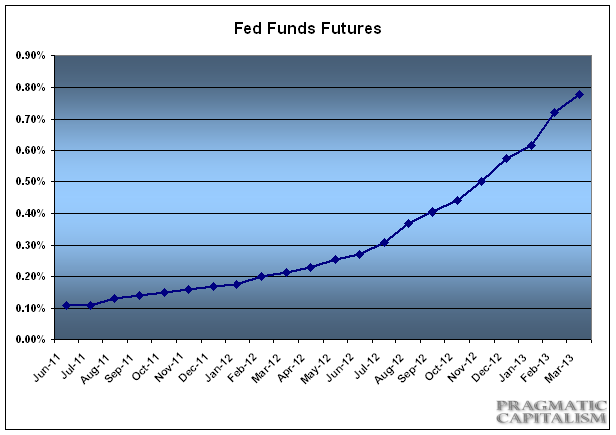

Tomorrow’s meeting is likely to result in no change in the Fed Funds Rate, no hint at QE3, remaining accommodative for an extended period, a marginal downgrade in the economic outlook and a very boring press conference with the Chairman. In other words, the whole thing should be a big snooze fest. Given the Fed Funds futures curve I think it’s safe to say that the markets largely expect this meeting to be no different than the last few. The nearest rate hike is currently projected all the way out to November of 2012! Now that’s accommodation.

No comments:

Post a Comment