By Charles Rotblut

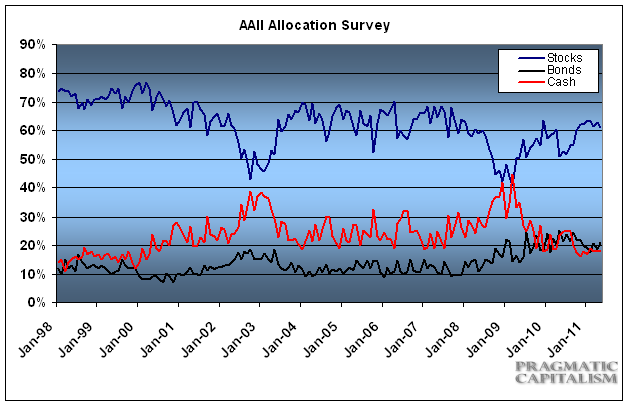

Stock and stock fund allocations fell to a seven-month low according to the May AAII Asset Allocation Survey. Individual investors kept 61.0% of their portfolios in equities last month, a drop of 1.9 percentage points. Even with the decline, May was the eighth consecutive month that stock and stock fund allocations were above their historical average of 60.0%.

Bond and bond fund allocations rose 2.5 percentage points to 21.1%, a six-month high. May was the 24th consecutive month that fixed-income allocations have been above their historical average of 15%.

Cash allocations slipped 0.6 percentage points to 17.9%, a four-month low. May was the 11th consecutive month that cash allocations have been below their historical average of 25%.

The decline in stock and stock fund allocations occurred as optimism about the direction of stock prices fell to its lowest level since last August in our sentiment survey. Ongoing volatility in the stock market reduced some of the cautious optimism that we have been seeing. A rebound in bond prices last month also played a role. It should be noted, however, that last month’s shifts did not impact the trends we have been seeing in our asset allocation survey. Both stock and bond allocations stayed above their historical averages for yet another month.

This month’s special question asked AAII members if they have made any changes to their portfolios because of the ongoing debate over the federal deficit. The majority of respondents said they have not made any changes.

Among those who said they were making changes, many said they were increasing their cash positions. Others said they increased their allocations to commodities, gold and stocks.

Here is a sampling of the responses:

- “The change I’ve made is to avoid any changes. I’m resisting the frantic shifts that uncertainty would call for.”

- “Nothing so far, but I will likely get defensive soon if partisan politics don’t soften up some.”

- “I’m increasing the amount of cash right now. I’m hoping for a correction that will give me a buying opportunity.”

- “I have switched more into cash and foreign funds.”

May Asset Allocation Survey Results:

- Stocks/Stock Funds: 61.0%, down 1.9 percentage points

- Bonds/Bond Funds: 21.1%, up 2.5 percentage points

- Cash: 17.9%, down 0.6 percentage points

Asset Allocation details:

- Stocks: 27.1%, down 0.7 percentage points

- Stock Funds: 34.0%, down 1.1 percentage points

- Bonds: 4.6%, up 1.3 percentage points

- Bond Funds: 16.5%, up 1.2 percentage points

Historical Averages

- Stocks/Stock Funds: 60%

- Bonds/Bond Funds: 15%

- Cash: 25%

No comments:

Post a Comment