by Cullen Roche

A little over a month ago I described the biggest risks to the market currently. It has been my position for several years now that we remain in a balance sheet recession and that growth has been largely salvaged via deficit spending and strong Chinese growth. The risks in such an environment are rather simple. Because the EMU is not helping their periphery brethren the depression on the periphery is certain to continue. It’s only a matter of time before this hurts growth in the core. Europe requires a structural fix. They’re far from achieving that.

In China, they implemented a highly flawed stimulus package (they did not have the banking crisis the USA had, yet they responded with the same medicine) and the result has been a seesaw in inflation. We’re now on the downswing as high inflation naturally causes reduced demand.

In the USA, the recovery is largely due to deficit spending as the private sector remains weak and deleveraging. Thus far we’ve managed to sidestep the global cries for austerity, however, it is beginning to look like spending cuts could come to fruition as the fear mongering over the debt ceiling gives Republicans a bargaining chip.

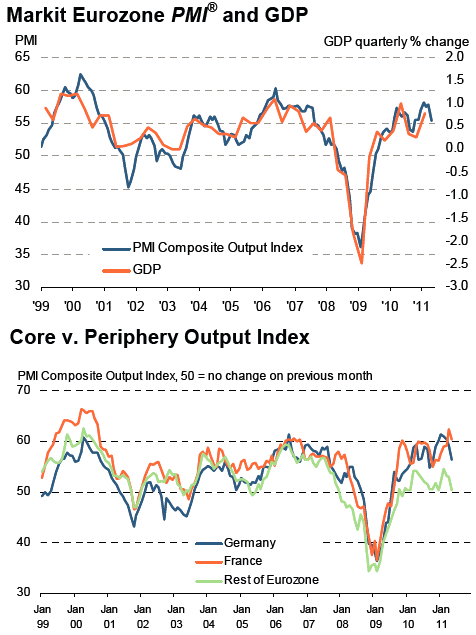

There was a huge amount of global news this morning and unfortunately for equity investors it’s all bad. We hit every corner of the globe with manufacturing news. First up, Europe, where the Flash Output Index from Markit sank to its lowest level since November 2008. Markit elaborates:

“The Markit Flash Eurozone Composite Output Index, based on around 85% of usual monthly replies, fell from 57.8 in April to 55.4 in May to signal ongoing expansion for the twenty-second successive month. However, although in line with the average seen during 2010, the increase was the weakest for seven months and the deceleration in the rate of growth, as measured by the fall in the index, was the largest since November 2008.”

The above chart is important as it shows just how weak the periphery nations are compared to the core. As regular readers know, this highlights the flaw in the single currency system. The core nations, which are trade surplus nations, are the winners in such a system as decades of trade deficits in the periphery nations inevitably led to excessive government spending. The periphery nations find themselves without a floating exchange rate to help balance trade so the situation has devolved into what we see today – several of these nations are bankrupt. Unfortunately, the situation is unsustainable. Real reform MUST happen. I have maintained for over a year now that that will involve defaults/defections and a more unified core Europe as a result. European leaders appear unable to resolve the structural flaws in the Euro so the situation is spiraling out of control. It’s only a matter of time before the citizens become increasingly upset with the depression that is being imposed on them. This situation is highly combustible and nearly impossible to predict.

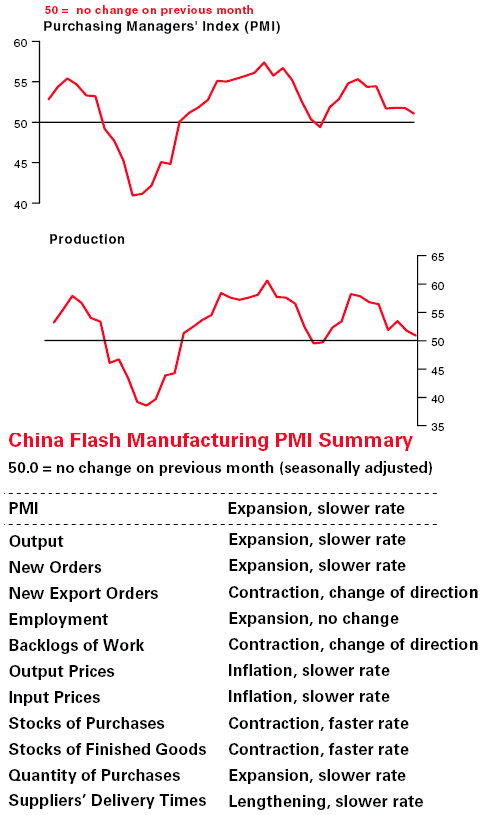

China’s Manufacturing sector appears to be slowing. The monthly flash PMI showed growth slowing to a 10 month low (via Markit):

- Flash China Manufacturing PMI™ at 51.1 (51.8 in April). 10-month low.

- Flash China Manufacturing Output Index at 50.9 (51.8 in April). 10-month low.

Commenting on the Flash China Manufacturing PMI survey, Hongbin Qu, Chief Economist, China & Co-Head of Asian Economic Research at HSBC said:“The Flash manufacturing PMI eased further to 51.1 in May, the lowest level since July 2010. Manufacturers continued to reduce inventories amidst slowing new business flows, leading to slower production growth at a 10-month low. That said, we think that there is no need to worry about a hard landing because the current level of the PMI is still consistent with around 13% IP and 9% GDP growth. Policy focus is still tilted towards taming inflation. We expect Beijing’s tightening policy will continue in the coming months.”

China has been the one strong leg of the global growth story over the last 2 years. It’s my opinion that misguided domestic stimulus programs led to the current mini-boom in the Chinese economy and we’re now experiencing the inevitable downside involved in misguided government intervention as inflation has sapped demand by forcing consumers to reallocate spending. QE2 exacerbated the commodity boom via speculation. The air is now coming out of that bubble. The risk now, is that the Fed has created a highly unstable market in commodities that will result in production concerns and exacerbated economic fears.

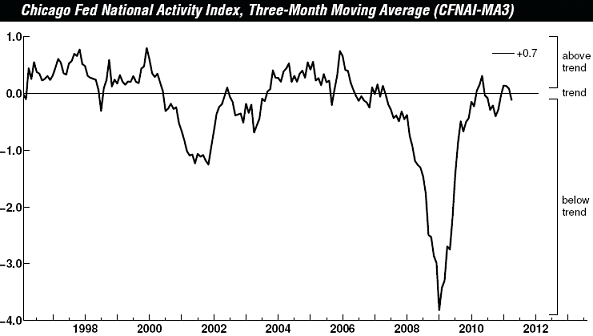

In the USA, we continue to see weakening manufacturing data. This morning’s Chicago Fed Index is consistent with several of the recent regional reports as well as the latest ISM Services data. This month’s decline was the lowest reading since August 2010:

“Led by declines in production-related indicators, the Chicago Fed National Activity Index fell to –0.45 in April from +0.32 in March. April marked the lowest reading of the index since August 2010. Three of the four broad categories of indicators that make up the index deteriorated from March, but two of those three categories made positive contributions to the index in April.”

The risks have certainly increased in recent months as the manufacturing boom appears to be softening around the globe. I believe the highly misguided QE2 program has substantially contributed to the current downturn around the globe as speculators drove many prices well beyond sustainable levels. Real GDP has slowed every quarter since the beginning of QE2. We should all hope that the Fed doesn’t respond to the current downturn with more of the same misguided medicine.

No comments:

Post a Comment