Friday marked not only the end of the week but the end of the month so it seemed a good time to step back and look at the big picture for a while. Identifying major trends can save even the short term trader a lot of grief and help avoid stepping in front of an oncoming train that may have just been stopping at the station to pick up passengers. There were three many similarities in the SPDR Sector ETF monthly charts but they could also be readily split into 3 groups.

Inverse Head and Shoulders

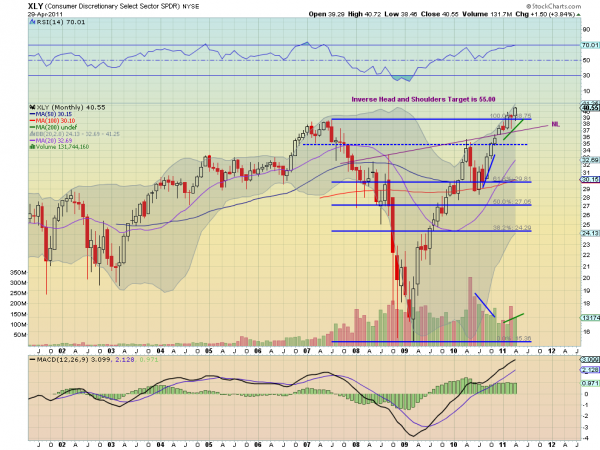

There are five sector funds that fit into this group: Industrials Select Sector SPDR,$XLI, Technology Select Sector SPDR,$XLK, Consumer Staples Select Sector SPDR,$XLP, Health Care Select Sector SPDR,$XLV and Consumer Discretionary Select Sector SPDR,$XLY. Using the chart for XLY below to illustrate,

there are some interesting points to note. Most prominent is that each chart clearly shows an Inverse Head and Shoulders pattern. The XLY has the furthest yet to run to attain its target of at least 55.00, 35% higher, but the closest one XLP still has over 16% higher to move. Also, all of these sectors are either at or just above a full retracement of their moves from the 2007 highs to the March 2009 lows. Next, for all except the XLK, the volume on current leg higher diverged until the price passed the neckline, when it began to increase again. Almost as if the neckline break confirmed the move higher to investors. Finally for their moves off of the lows all have Measured Move targets that will be reached before the Inverse Head and Shoulders target is achieved so they may pause on the way higher. Speaking of Measured Moves.

Measured Moves

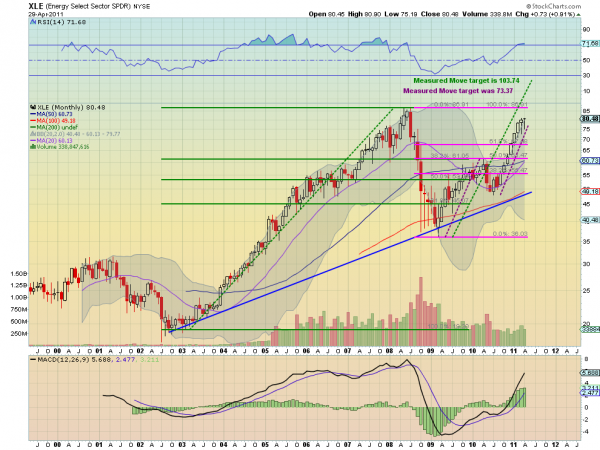

The 5 sector funds mentioned above are working on a Measured Move higher but three other sector funds, Materials Select Sector SPDR,$XLB, Energy Select Sector SPDR,$XLE and Utilities Select Sector SPDR,$XLU, fit into this space better. Using the chart below for the XLE to illustrate,

there are two Measured Moves that these sector funds are working on. XLE has already achieved the first target and is showing signs of a consolidation or pullback, printing a Hanging man candle for April. The other two are yet to achieve the first Measured Move. It is also worth noting that none of these sector funds have reached the full retracement of their highs, which was in 2008 for each, not 2007 as for the first 5 funds, they were still rising in 2007. These three sectors have been correlated over the past 3 1/2 years and look to be heading higher together with the being the weight on the group. Ah, the Weight.

Dead Wait

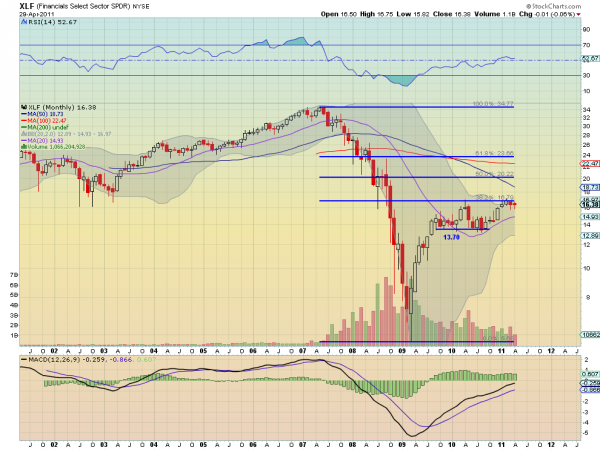

The one remaining sector fund, Financials Select Sector SPDR,$XLF continues to be the Dead Wait (or Weight, you choose) on the market. It lags in many categories. It has only retraced 38.2% of the move from 2007 highs to the 2009 lows, while the worst other sector fund XLU, has cleared a 61.8% retracement. The Relative Strength Index is languishing in the low 50s, undecided between bullish and bearish, while all the others are above 64, firmly in bullish territory. The volume has continued a slow decline since April 2010 while the other sectors have seen a bump up recently. And it is the only sector that is still trading below its 50 and 100 month Simple Moving Averages, which by the way are sloping downward.

It has been said by many that XLF needs to move higher to confirm the rally. The evidence suggests that is not the case but should the Dead Wait start to move then even these prognosticators could join in bullish. One potential catalyst for a move could come from the squeezing Bollinger bands which have moved from a range of 14 to a range of just over 4 since the beginning of 2010. it has been a boring sector but keep an eye on those Bollinger bands and the 16.79 Fibonacci level. Moves higher from there could add rocket fuel to the already hot fire.

No comments:

Post a Comment