“The nation’s unnerving descent into debt began a decade ago with a choice, not a crisis.

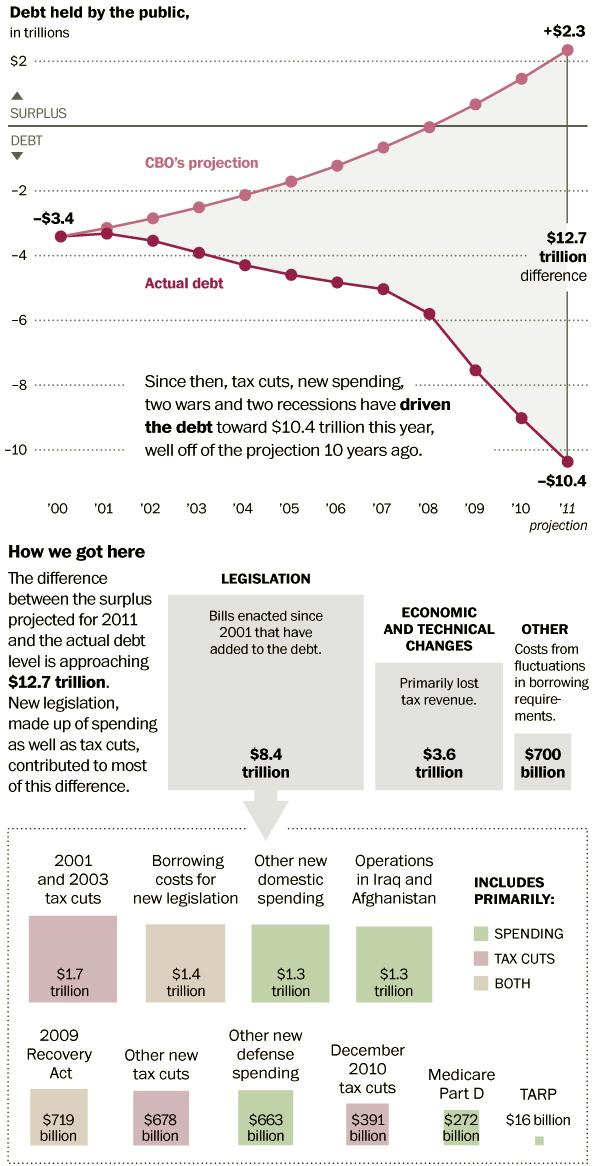

In January 2001, with the budget balanced and clear sailing ahead, the Congressional Budget Office forecast ever-larger annual surpluses indefinitely. The outlook was so rosy, the CBO said, that Washington would have enough money by the end of the decade to pay off everything it owed.

Voices of caution were swept aside in the rush to take advantage of the apparent bounty. Political leaders chose to cut taxes, jack up spending and, for the first time in U.S. history, wage two wars solely with borrowed funds. “In the end, the floodgates opened,” said former senator Pete Domenici (R-N.M.), who chaired the Senate Budget Committee when the first tax-cut bill hit Capitol Hill in early 2001.

Now, instead of tending a nest egg of more than $2 trillion, the federal government expects to owe more than $10 trillion to outside investors by the end of this year. The national debt is larger, as a percentage of the economy, than at any time in U.S. history except for the period shortly after World War II.”

Click for ginormous chart porn:

>

No comments:

Post a Comment