By Keith Jurow

I’ve asserted in previous writings that buyers paying all-cash for properties have been keeping some of the worst bubble markets from collapsing. Inside Mortgage Finance, which surveys roughly 3,000 brokers each month and issues a monthly report, revealed at the end of March that a record 33.7% of property purchases nationwide were all-cash.

The National Association of Realtors (NAR) conducts an Investment and Vacation Home Buyers Survey annually. The latest survey covering 2010 found that a record 59% of investors paid all-cash for their property. That figure was only 32% in 2006 and a mere 17% in 2004 according to previous NAR surveys.

For Broward County on the Florida east coast, the Southeast Florida MLS reported that a record 69% of all February property sales were all-cash purchases. Zillow.com revealed at the end of February that 54% of all sales in the three south Florida counties of Dade, Broward, and Palm Beach were purchased with cash in the fourth quarter of 2010. In California, 30% of all 2010 sales were cash purchases. According to the highly-regarded California blog, drhousingbubble.com, the average in that state over the last 10 years was a mere 12.9%.

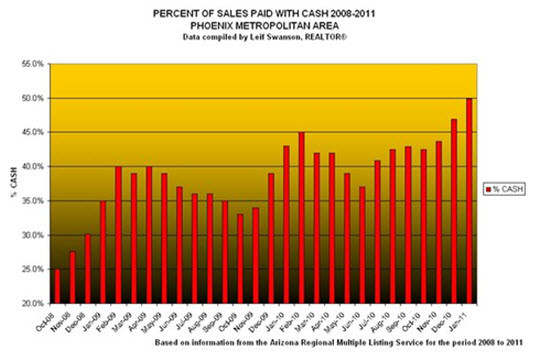

Take a look at this amazing chart showing cash sales in Phoenix.

Notice that while cash purchases have been a substantial portion of Phoenix sales since early 2009, it reached a record 50% in January of this year.

Who are these all-cash buyers? Leif Swanson, the creator of this chart and an active Phoenix broker, explained to me that many were over 50 with plenty of liquid assets who could not stand the interest rates they were getting. This was also told to me by Jim McClelland, Sr., a major property “redeveloper” in Chicago who resold many of his foreclosure purchases to all-cash investors. Most were cash buyers who were 50+ years old and were tired of earning interest rates of 1% or less.

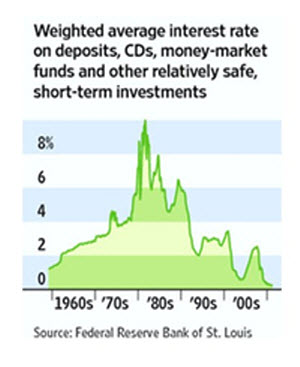

Can you blame these 50+ savers, especially those nearing retirement? Take at look at what has happened to their interest income because of the Fed’s policies.

A substantial number of these savers are what I consider to be reluctant real estate investors. They are being pulled into this arena by the plunge in their interest return. I strongly suspect that many have little sense of how much risk they are taking with their capital.

Consider this example from a March 1 article in the online Palm Beach Post about all-cash investors. One retired couple decided to buy a three-bedroom home for $149,000 in cash because they believed a home would bring a better return on their money than a CD or other investment. The wife said that “any kind of interest income is so low right now, we might as well put it into a house.” She went on to predict that “If prices go down any more, they’re not likely to go down appreciably.” Had she read the second issue of my Housing Market Report and its focus on Miami-Dade County, they might have reconsidered their decision to buy.

Or take this example from an early February article in the Wall Street Journal. A 62-year-old piano teacher saw a three-bedroom bungalow that was listed as a short sale last summer in Georgia. The desperate sellers had dropped the original asking price of $159,000 to $129,000 and then to $79,900. Sensing that the market was awful, she offered $50,000. The sellers accepted $52,000 in cash.

While these purchases may make good sense, they aren’t necessarily smart investments. On April 25, I spoke again to noted real estate writer, San Diego State University lecturer and investor Leonard Baron about purchasing investment properties with cash. He reiterated that these investors must do a careful due diligence analysis to see if the property makes financial sense. Link to his terrific 7-page due diligence checklist on his website for the tool to enable you to do this – professorbaron.com. On the right side of his homepage, you will see the table of contents for his book. Link to Chapter One and it will take you to the checklist. Just scroll down a little until you see it. You can print it out and then use it for your analysis. You’ll be glad you did.

Would most of these older, all-cash buyers be searching for investment properties now if interest rates had not been pushed down so dramatically by the Fed? Think about it. If you were either close to retirement or actually retired, would you be plunking down anywhere from $50,000 to $1 million or more in cash on a house or condo if the interest rates on your Treasury securities, CDs, bonds, or money market funds were at historical norms?

The vast majority of these cash buyers (excluding perhaps some foreign investors) are not speculators. If they can land a decent tenant, the investment might make good sense. Yet do they really have a good idea about the state of the housing market where they are investing their hard-earned savings? If I thought they did, I would not have launched my Housing Market Report.

On the basis of my in-depth research, it’s quite clear to me that the “normal” housing market in most major metropolitan areas is shrinking. The percentage of sales in these markets which are distressed properties – either foreclosures or short sales – is climbing steadily. Conversely, the percentage of homeowners wanting to sell who still have equity left in their property is declining. My goal is to inform readers why this will not turn around anytime soon.

No comments:

Post a Comment